(Bloomberg) — The stress on Gautam Adani to swiftly handle issues over his conglomerate’s monetary well being intensified as a brutal rout worn out greater than half the worth of his firms following a report by short-seller Hindenburg Analysis.

Most Learn from Bloomberg

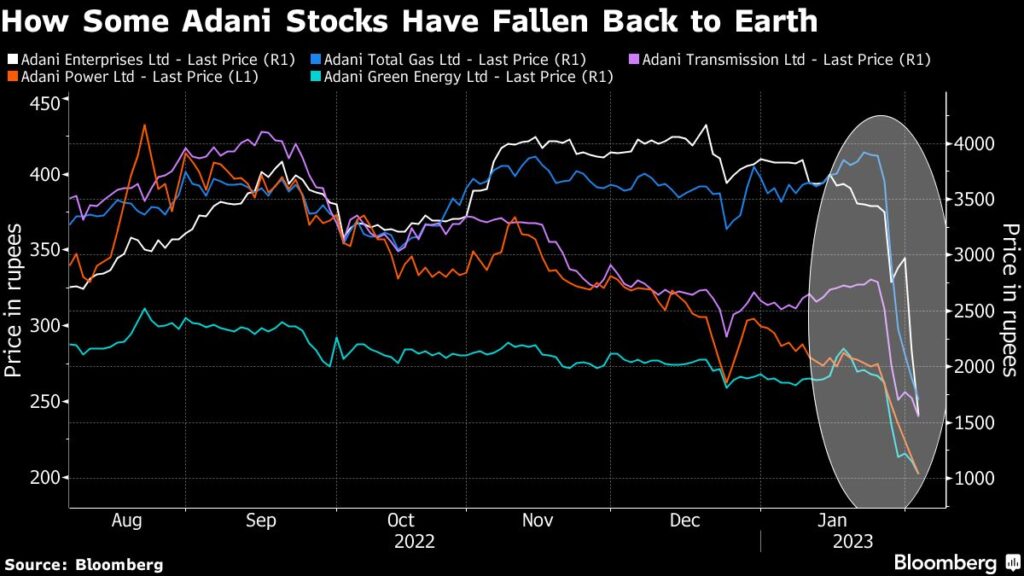

Greater than $118 billion was erased from the market capitalization of his 10 shares since US-based Hindenburg claimed final week that offshore shell entities had been used to inflate revenues and manipulate inventory costs. Flagship Adani Enterprises Ltd. sank a report 35% intraday, earlier than losses narrowed amid a sequence of massive trades.

The continued stoop displays worries about Adani’s entry to funding after the tycoon scrapped a key inventory providing this week, and as long-held issues concerning the group’s debt had been propelled onto the worldwide stage by Hindenburg. The embattled tycoon is in talks with collectors to prepay some loans backed by pledged shares, as some banks stopped accepting the securities of the group that spans from ports to vitality as collateral in consumer trades.

“Traders should not simply concerned with clearing pledges, they need concrete plans and actions,” stated Sameer Kalra, founding father of Goal Investing in Mumbai. “The usage of each rupee on steadiness sheet is important now. There are quite a lot of stakeholders.”

The disaster of confidence in Adani has turn out to be a nationwide concern with lawmakers disrupting parliament for 2 days to demand solutions from Prime Minister Narendra Modi’s authorities, given how intently his pursuits are intertwined with the nation’s development plans. Authorities officers have sought to downplay the affect, even because the opposition Congress Social gathering plans nationwide protests to focus on the dangers to small buyers.

Hindenburg Analysis final week accused the group of “brazen” market manipulation and accounting fraud, claiming that an internet of Adani-family managed offshore shell entities in tax havens had been used to facilitate corruption, cash laundering and taxpayer theft.

The conglomerate has repeatedly denied the allegations, referred to as the report “bogus,” and threatened authorized motion. Adani gave a video speech on Thursday stating that the group’s steadiness sheet is wholesome.

Fitch Rankings stated Friday that there’s no rapid affect on the credit score profile of the Adani firms it charges following the Hindenburg report. It additionally doesn’t count on materials adjustments to the forecast money circulation.

In a reprieve for Adani, the group’s bonds rallied Friday after Goldman Sachs Group Inc. and JPMorgan Chase & Co. advised some purchasers that the debt can provide worth as a result of energy of sure belongings. All 15 greenback debt securities, a few of which had fallen into distressed pricing, superior.

At the least 200 monetary establishments have had publicity to Adani Group’s $8 billion in greenback bonds, in keeping with knowledge compiled by Bloomberg primarily based on the corporate’s most up-to-date filings. BlackRock Inc, New Jersey-based Lord Abbett & Co. and New York-based Lecturers Insurance coverage & Annuity Affiliation of America had been among the many massive holders.

“There may be distressed worth on such investments however they’re dangerous, they deserve such excessive yields,” stated Rakhi Prasad, an funding supervisor with Alder Capital. “I received’t suggest both shares or bonds in a falling-knife market.”

Losses in Adani Enterprises narrowed to 14% as of 12:41 pm in Mumbai as at the very least 11 trades of greater than 100,000 shares every modified fingers. Such volatility is ready to persist, with merchants leaping to guess on potential outcomes.

The combination choices quantity has surged, with report highs seen within the open curiosity of each places and calls.

Banks have been tightening scrutiny on Adani firms’ securities. Items of Credit score Suisse Group AG and Citigroup Inc. earlier this week stopped accepting some securities issued by Adani’s firms as collateral for margin loans to rich purchasers.

The fallout has already led to the elimination of Adani Enterprises from the Dow Jones Sustainability Indices. Lord Jo Johnson, a former Conservative minister and brother of former UK prime minister Boris Johnson, has resigned as a director of Elara Capital, which was one of many bookrunners for the canceled Adani inventory share, the Monetary Occasions reported.

Adani’s proposed mortgage prepayment would see lenders launch among the inventory within the group’s firms that was pledged as collateral, Bloomberg Information reported, citing an individual with information of the matter. The Indian group hasn’t confronted margin calls on these pledges and is searching for the prepayment proactively, the particular person added.

The billionarie’s backers embrace Citigroup Inc., Credit score Suisse Group AG and Barclays Plc. They’re amongst banks pursuing a spread of choices to curb the chance of losses.

“Contagion issues are widening, however are nonetheless restricted to the banking sector,” stated Charu Chanana, a strategist at Saxo Capital Markets. “The main focus stays on additional dangers of index exclusions, whereas a coherent response on the fraud allegations from the Adani Group remains to be awaited.”

–With help from Harry Suhartono.

(Updates with Fitch report in eighth paragraph, and worth of greenback bonds in ninth paragraph)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.