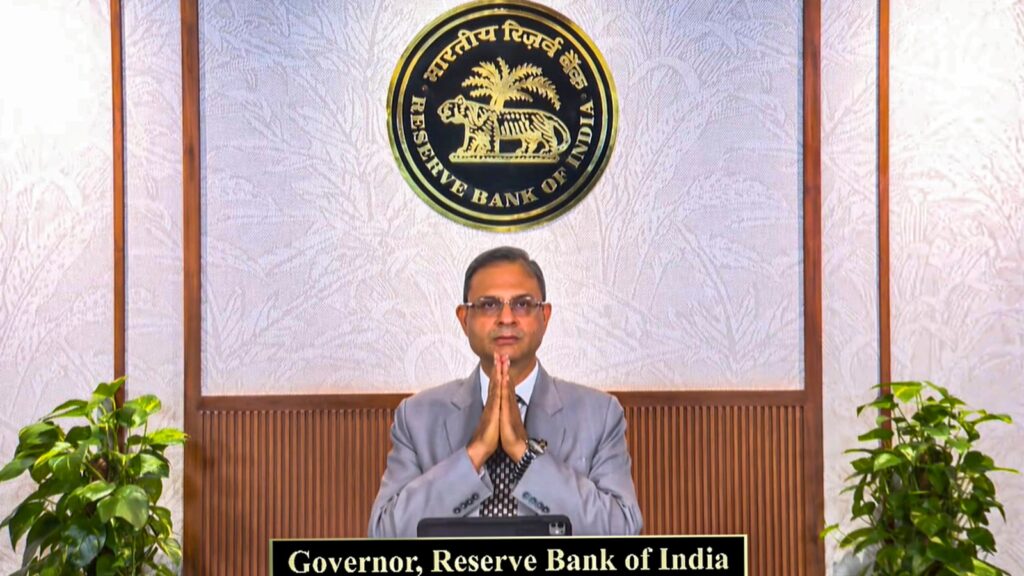

After slashing Repo fee by 50 foundation factors to five.50 per cent on Friday, Reserve Financial institution Governor Sanjay Malhotra indicated that extra fee cuts will depend upon incoming knowledge on inflation and development parameters, hinting on the uncertainty on the rate of interest entrance.

“After having lowered the coverage repo fee by 100 bps in fast succession since February 2025, beneath the present circumstances, financial coverage is left with very restricted house to assist development,” Malhotra mentioned whereas unveiling the financial coverage. The 50 bps Repo fee reduce is anticipated to carry down rates of interest and increase funding and development.

“From right here onwards, the MPC shall be rigorously assessing the incoming knowledge and the evolving outlook to chart out the longer term course of financial coverage with a view to strike the proper growth-inflation steadiness,” he mentioned. The fast-changing world financial state of affairs too necessitates steady monitoring and evaluation of the evolving macroeconomic outlook, Governor mentioned.

Malhotra mentioned world backdrop stays fragile and extremely fluid. The uncertainty across the world financial outlook has considerably ebbed because the MPC meet in April within the wake of momentary aid and the optimism round commerce negotiations. “Nonetheless, it’s nonetheless excessive to weaken sentiment and decrease world development prospects. Accordingly, world development in addition to commerce projections have been revised downwards by multilateral businesses,” he mentioned.

Economic system progressing nicely: Governor

On each inflation and development fronts, the Indian economic system is progressing nicely and it’s broadly on anticipated traces, and this regardless of the worldwide uncertainty that we have now. “Sturdy macroeconomic fundamentals and benign inflation outlook offers house to financial coverage to assist development, whereas remaining in line with the aim of worth stability,” Malhotra mentioned.

“As the worldwide setting stays unsure, it has change into much more vital to concentrate on home development amidst sustained worth stability. Accordingly, at present’s financial coverage motion must be seen as a step in direction of propelling development to the next aspirational trajectory,” he mentioned. The RBI has retained the FY26 development estimate at 6.5 per cent.

Furthermore, the final mile of disinflation is popping out to be a bit of extra protracted, he mentioned. As growth-inflation trade-off is changing into more difficult, financial authorities are charting out extra cautious and thoroughly calibrated coverage trajectory. “Trying past the close to time period, rising financial and monetary fragmentation is reshaping the worldwide economic system. In addition to, complicated interconnections with the monetary system, elevated debt ranges and rising affect of frontier applied sciences like AI are elevating monetary stability issues,” Malhotra mentioned

Story continues beneath this advert

Amidst heighted volatility in capital flows and trade charges, coupled with coverage constraints, central banks of rising market economies have a more durable process to stabilize their economies towards world spillovers, he mentioned.

“Within the world milieu, the Indian economic system presents an image of energy, stability and alternative. First energy comes from the sturdy steadiness sheets of the 5 main sectors – corporates, banks, households, authorities and the exterior sector,” he mentioned.

There may be stability on all three fronts — worth, monetary and political — offering coverage and financial certainty on this dynamically evolving world financial order, he mentioned.

The Indian economic system gives immense alternatives to buyers, each home and international, via three Ds – demographic, digitization and home demand, he mentioned. These fundamentals present the required core energy to cushion the Indian economic system towards the worldwide spillovers and propel it to develop at a quicker tempo, Governor mentioned.