Nvidia (NASDAQ: NVDA) has most likely been probably the most watched inventory on the planet over the previous a number of months. It is because the corporate dominates the factitious intelligence (AI) chip market, and its hovering income has prompted the inventory to skyrocket. Within the first half, the shares soared greater than 150% — and that is after already gaining greater than 1,300% within the earlier 5 years.

In reality, this momentum pushed Nvidia inventory previous the brink of $1,000, a stage that could be a psychological barrier for some buyers — and in different instances makes it troublesome for small buyers to purchase with out counting on fractional shares. So Nvidia launched a inventory break up just lately to convey down the value of every particular person share. Buyers welcomed the information, and the inventory rallied practically 30% from the break up announcement by way of the precise operation.

Now, although, the massive query is whether or not Nvidia’s momentum will proceed post-split and whether or not this high chip designer will soar within the second half. Let’s look to historical past for some solutions.

historic patterns

First, it is vital to notice that simply because a sure sample occurred prior to now would not assure the identical sample will proceed sooner or later. So, any conclusions we draw might information us — however they are not set in stone. The market or a selected inventory might shock us.

That mentioned, patterns do replicate incessantly sufficient to make them value our consideration. They might supply us an concept of what typically occurs after a sure occasion, making us conscious of probably prospects.

Let’s transfer on to the concept of inventory splits and what historical past reveals. A inventory break up, by way of the issuance of latest shares to present holders, lowers the value of every particular person share — however with out altering the market worth of the corporate or the valuation of the inventory. So, the operation hasn’t modified something basic in regards to the specific firm or inventory.

However the break up accomplishes one main factor: It opens the funding alternative as much as a broader vary of buyers. That is optimistic for you and me as a result of it makes it simpler for us to put money into an organization like Nvidia, and it is optimistic for the corporate as a result of it presents it a complete new viewers of potential buyers. So it is a win-win state of affairs. Nvidia’s 10-for-1 inventory break up introduced the inventory value down from greater than $1,000 to about $125.

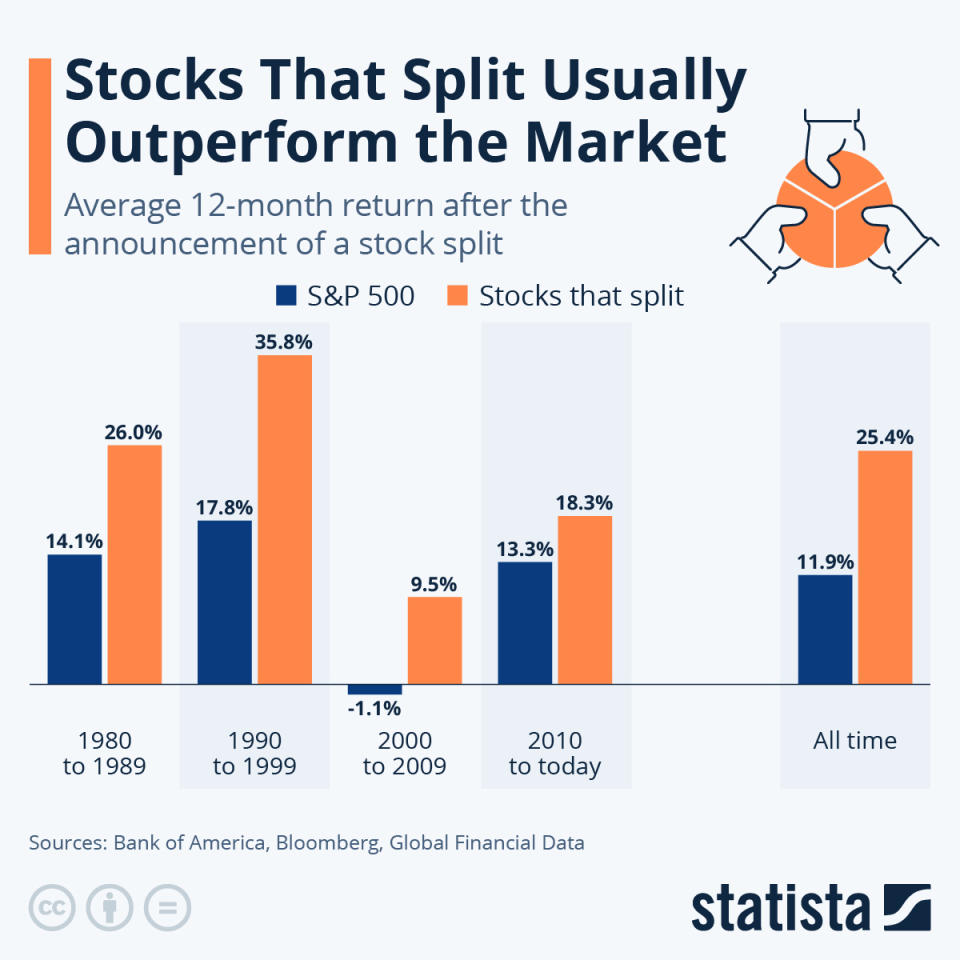

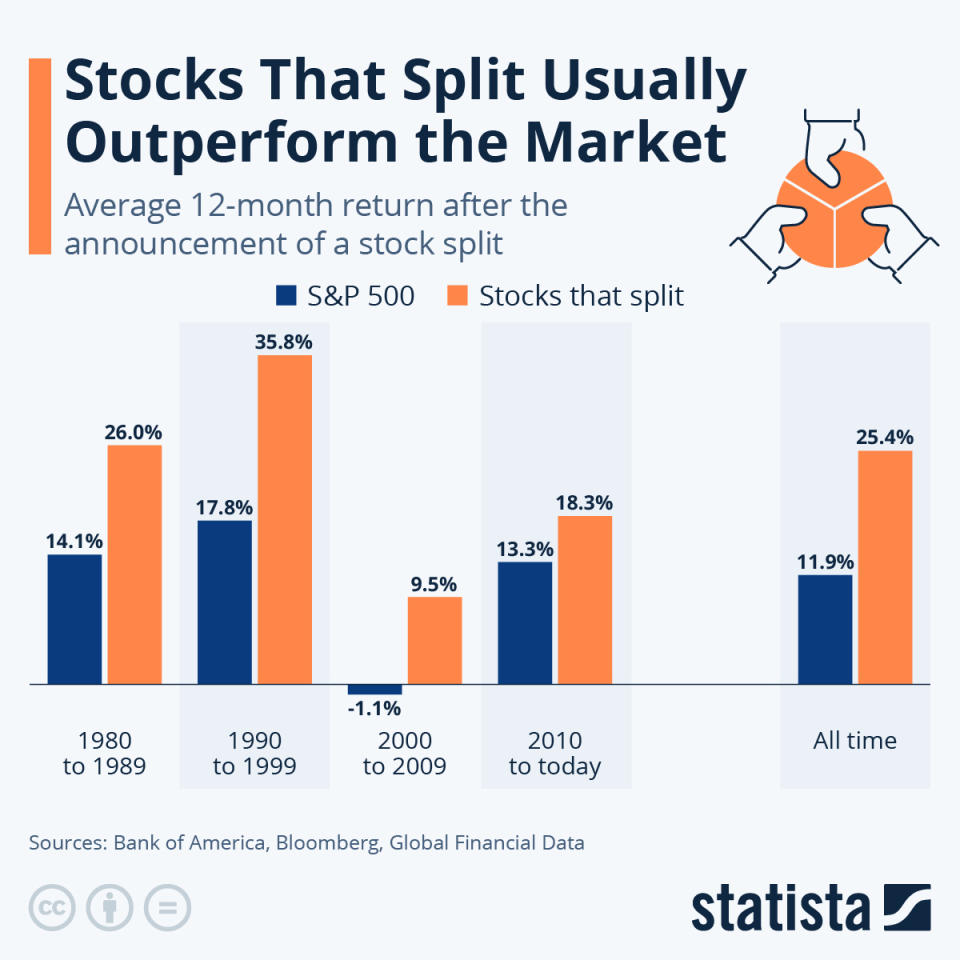

Inventory splits in and of themselves, since they’re simply mechanical operations, aren’t catalysts for inventory efficiency — you would not purchase a inventory simply because the corporate launched a break up. However, as you’ll be able to see within the chart, beneath, historical past reveals that inventory break up gamers are inclined to outperform the S&P 500 within the 12 months following the inventory break up announcement.

The chart reveals that inventory break up firms have generated a mean whole return of greater than 25% in that 12-month interval. That is in comparison with lower than 12% for the S&P 500 as a complete. That is based mostly on Financial institution of America‘s Analysis Funding Committee information from 1980 by way of in the present day.

Nvidia’s previous inventory splits

Now we will dig deeper by taking a look at Nvidia itself after its previous two inventory splits, in 2007 and 2021. After each, the inventory declined within the 12 months that adopted — however first, the shares superior within the two to 5 months after the operation. Nvidia inventory climbed greater than 60% within the 5 months following the 2021 break up and added about 17% within the six-week interval following the 2007 break up.

So, what does all of this inform us about what might occur in the present day? It is vital to needless to say Nvidia’s enterprise has tremendously developed because the previous inventory splits. Then, it primarily served the video gaming trade and progressively was shifting into different areas, resembling AI. As we speak, the high-growth subject of AI is the corporate’s foremost enterprise, making the inventory considerably extra enticing to buyers. So Nvidia might have stronger momentum in the present day than it did after earlier splits — and which may make a long-lasting rally doable.

This could occur if Nvidia continues to report spectacular earnings progress and ship on product launch objectives. And issues look promising. Nvidia has reported quarter after quarter of document income and says demand for its soon-to-launch Blackwell structure and chip surpasses provide. And talking of Blackwell, this launch, too, could possibly be a optimistic catalyst for the inventory.

All of this implies it’s extremely doable Nvidia inventory will soar within the second half, due to the corporate’s management in a high-growth market and stable income prospects. And the most effective information is that this: Even when historical past is unsuitable and Nvidia would not rally within the coming months, this high inventory nonetheless has what it takes to ship huge returns to buyers over the long run.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $774,526!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 24, 2024

Financial institution of America is an promoting companion of The Ascent, a Motley Idiot firm. Adria Cimino has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Financial institution of America and Nvidia. The Motley Idiot has a disclosure coverage.

After Nvidia’s Inventory Break up and 150% First-Half Achieve, Will It Soar within the Second Half? This is What Historical past Says. was initially revealed by The Motley Idiot