AI-generated responses have gotten extra frequent, whether or not vacationers know or not.

Westend61 | Getty Photos

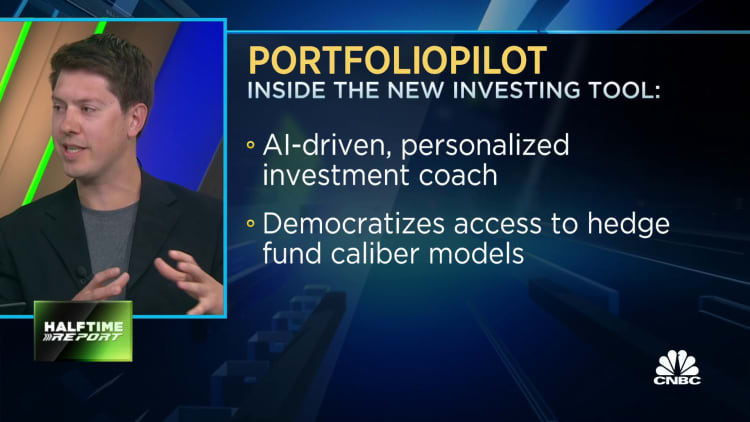

An automatic monetary advisor known as PortfolioPilot has shortly gained $20 billion in property in a doable preview of how disruptive synthetic intelligence could possibly be for the wealth administration trade.

The service has added greater than 22,000 customers since its launch two years in the past, in keeping with Alexander Harmsen, co-founder of International Predictions, which launched the product.

The San Francisco-based startup raised $2 million this month from buyers together with Morado Ventures and the NEA Angel Fund to fund its development, CNBC has realized.

The world’s largest wealth administration corporations have rushed to implement generative AI after the arrival of OpenAI’s ChatGPT, rolling out companies that increase human monetary advisors with assembly assistants and chatbots. However the wealth administration trade has lengthy feared a future the place human advisors are not vital, and that chance appears nearer with generative AI, which makes use of giant language fashions to create human-sounding responses to questions.

Nonetheless, the advisor-led wealth administration area, with giants together with Morgan Stanley and Financial institution of America, has grown over the previous decade even amid the appearance of robo-advisors like Betterment and Wealthfront. At Morgan Stanley, as an illustration, advisors handle $4.4 trillion in property, way over the $1.2 trillion managed in its self-directed channel.

Many suppliers, whether or not human or robo-advisor, find yourself placing shoppers into comparable portfolios, stated Harmsen, 32, who beforehand cofounded an autonomous drone software program firm known as Iris Automation.

“Persons are fed up with cookie-cutter portfolios,” Harmsen advised CNBC. “They really need opinionated insights; they need personalised suggestions. If we take into consideration next-generation recommendation, I feel it is actually personalised, and also you get to manage how concerned you might be.”

AI-generated report playing cards

The startup makes use of generative AI fashions from OpenAI, Anthropic and Meta’s Llama, meshing it with machine studying algorithms and conventional finance fashions for greater than a dozen functions all through the product, together with for forecasting and assessing consumer portfolios, Harmsen stated.

In relation to evaluating portfolios, International Predictions focuses on three major elements: whether or not funding danger ranges match the consumer’s tolerance; risk-adjusted returns; and resilience in opposition to sharp declines, he stated.

Customers can get a report card-style grade of their portfolio by connecting their funding accounts or manually inputting their stakes into the service, which is free; a $29 per 30 days “Gold” account provides personalised funding suggestions and an AI assistant.

“We will provide you with very particular monetary recommendation, we’ll inform you to purchase this inventory, or ‘Here is a mutual fund that you simply’re paying an excessive amount of in charges for, substitute it with this,'” Harmsen stated.

“It could possibly be easy stuff like that, or it could possibly be far more difficult recommendation, like, ‘You are overexposed to altering inflation situations, perhaps you must think about including some commodities publicity,'” he added.

International Predictions targets folks with between $100,000 and $5 million in property — in different phrases, folks with sufficient cash to start worrying about diversification and portfolio administration, Harmsen stated.

The median PortfolioPilot consumer has a $450,000 internet value, he stated.

The startup does not but take custody of consumer funds; as a substitute it provides paying clients detailed instructions on the best way to greatest tailor their portfolios. Whereas that has lowered the hurdle for customers to become involved with the software program, a future model may give the corporate extra management over shopper cash, Harmsen stated.

“It is doubtless that over the subsequent 12 months or two, we’ll construct increasingly more automation and deeper integrations into these establishments, and perhaps even a Gen 2 robo-advisor system that permits you to custody funds with us, and we’ll simply execute the trades for you.”

‘Large shake up’

Harmsen stated he created the primary model of PortfolioPilot just a few years in the past to handle his personal newfound wealth after promoting his first firm.

He’d grown annoyed after assembly greater than a dozen monetary advisors and realizing that they had been “mainly simply salespeople attempting to provide entry to this pretty normal” strategy, he stated.

“It felt like a really actual drawback for me, as a result of the one different I noticed in the marketplace was, you realize, mainly turning into a day dealer and turning into my very own portfolio supervisor,” Harmsen stated.

“I needed hedge fund-quality instruments and methods to consider danger and draw back safety, and portfolio administration throughout all of my completely different accounts and the buckets of cash in crypto and actual property,” he stated.

So across the time he was beginning a household and shopping for a house in San Francisco, he started coding a program that might handle his investments.

After realizing it may have a broader use, Harmsen started constructing a group for International Predictions, together with three former workers of Bridgewater Associates, the world’s largest hedge fund.

The corporate’s rise has attracted regulatory scrutiny; in March, the Securities and Change Fee accused International Predictions of creating deceptive claims in 2023 on its web site, together with that it was the “first regulated AI monetary advisor.” International Predictions paid a $175,000 superb and altered its tagline in consequence.

Whereas immediately’s dominant suppliers have been speeding to implement AI, many might be left behind by the transition to totally automated recommendation, Harmsen predicted.

“The actual secret’s you could discover a approach to make use of AI and financial fashions and portfolio administration fashions to generate recommendation robotically,” he stated.

“I feel that’s such an enormous soar for the normal trade; it isn’t incremental, it is very black or white,” he stated. “I do not know what is going on to occur over the subsequent 10 years, however I think there might be an enormous shake up for conventional human monetary advisors.”