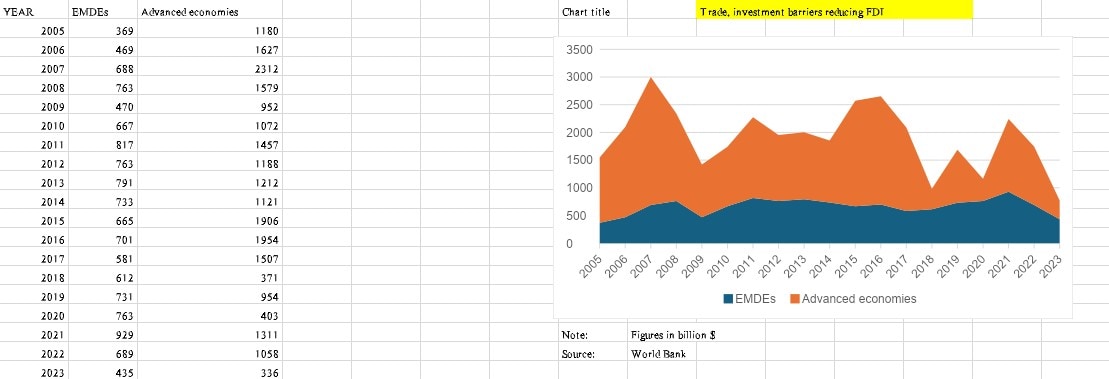

Overseas Direct Funding (FDI) into creating nations fell to $435 billion in 2023, the bottom in practically 20 years, the World Financial institution mentioned Monday, warning that rising commerce and funding obstacles posed a “important risk to world efforts to mobilise financing for improvement”.

In keeping with the Financial institution, the autumn in FDI into creating nations was a part of a worldwide pattern that noticed related flows into superior economies declining to $336 billion in 2023, the bottom degree since 1996. “What we’re seeing is a results of public coverage,” Indermit Gill, the World Financial institution Group’s Chief Economist, mentioned. “It’s not a coincidence that FDI is plumbing new lows on the similar time that public debt is reaching document highs. Non-public funding will now must energy financial progress, and FDI occurs to be probably the most productive types of personal funding. But, lately governments have been busy erecting obstacles to funding and commerce when they need to be intentionally taking them down. They must ditch that dangerous behavior.”

In keeping with M. Ayhan Kose, the World Financial institution Group’s Deputy Chief Economist, the sharp drop in FDI for creating nations “ought to sound alarm bells”. Reversing the pattern, Kose mentioned, was not simply an “financial crucial” but additionally “important for job creation, sustained progress, and reaching broader improvement targets”.

“It is going to require daring home reforms to enhance the enterprise local weather and decisive world cooperation to revive cross-border funding,” Kose mentioned.

In 2022, FDI into rising market and creating economies (EMDEs) stood at $690 billion.

FDI chart

FDI chart

Whereas knowledge for the 2023 calendar 12 months is the most recent out there at a worldwide degree, FDI into India as per Reserve Financial institution of India (RBI) knowledge elevated to $81.04 billion in 2024-25 from $71.28 billion in 2023-24. Nonetheless, web FDI into India – which adjusts the gross FDI quantity by deducting the funds repatriated by overseas traders and the investments made by Indian entities overseas – fell to only $353 million within the final fiscal from $10.13 billion in 2023-24.

China largest receiver

Amongst EMDEs, China has been the most important receiver of FDI from 2012 to 2023, accounting for practically one-third of those inflows. Brazil was second at 10 per cent and India third at 6 per cent, the World Financial institution mentioned.

Story continues under this advert

In keeping with the Financial institution, overseas investments are more and more “decoupling alongside geopolitical fault strains”, with the US lowering its ties from China even because it elevated commerce and FDI hyperlinks with India, Mexico, and Vietnam. “Russia’s invasion of Ukraine in 2022 was adopted by fast divestment by overseas corporations from Russia,” the World Financial institution mentioned in its report ‘Overseas Direct Funding in Retreat’.

The discharge of the report on Monday comes forward of the 4th Worldwide Convention on Financing for Improvement in Spain from June 30 to July 3. On the convention, representatives from governments, worldwide establishments, civil society organisations, and the personal sector are anticipated to debate mobilise funds to attain key world and nationwide improvement targets at a time when world progress is slowing down, public debt is at document highs, and overseas assist budgets have been minimize. Final week, the World Financial institution minimize its world progress forecast for 2025 by 40 foundation factors to 2.3 per cent – the bottom since 2008 exterior of outright world recessions – with Indermit Gill warning that exterior of Asia, the creating world was turning into a “development-free zone”.

Coverage priorities

In keeping with the World Financial institution, creating economies should redouble their efforts to draw FDI, beginning with enjoyable restrictions from the final decade and quickly bettering the funding local weather.

As well as, amplifying the financial advantages of FDI and advancing world cooperation have been additionally recognized as coverage priorities. “All nations ought to work collectively to speed up coverage initiatives that may assist direct FDI flows to creating economies with the biggest funding gaps,” the Financial institution mentioned.

© The Indian Categorical Pvt Ltd