Superior Micro Units, Inc (NASDAQ:AMD) CEO Lisa Su emphasised the chip designer’s progress towards its 30×25 objective, aiming for a 30x enhance in compute node energy effectivity by 2025 and now foreseeing a possible 100x enchancment by 2026-2027 at a latest occasion.

Su highlighted AMD’s foresight in addressing AI’s energy consumption points since 2021, specializing in bettering knowledge middle energy effectivity. She famous that the explosion of generative AI fashions like ChatGPT had intensified issues about AI’s energy urge for food, Tom’s {Hardware} stories.

Additionally Learn: Nvidia’s Main Place Challenged as Trade Giants Assist OpenAI’s New Developer Software program

AMD set its 30×25 objective to enhance knowledge middle effectivity, particularly concentrating on AI and HPC energy consumption as crucial challenges.

Su defined that the fast growth of knowledge facilities, pushed by AI developments, is straining public energy grids.

Su identified that the computing necessities for AI mannequin coaching are growing at an unprecedented charge, outpacing developments in computing and reminiscence expertise.

To deal with these challenges, AMD employs a multi-pronged technique that features silicon developments, AI-specific architectures, system-level tuning, and hardware-software co-design initiatives.

Su highlighted the function of 3nm Gate All Round (GAA) transistors in bettering energy effectivity and efficiency, together with superior packaging strategies to maximise compute-per-watt effectivity.

Su additionally emphasised the significance of knowledge locality in decreasing energy consumption, citing AMD’s MI300X chip for instance of environment friendly design.

Furthermore, Su confused the advantages of {hardware} and software program co-optimization, considerably boosting energy effectivity and efficiency.

Latest stories indicated that Microsoft Corp (NASDAQ:MSFT) is contemplating integrating AMD’s MI300X AI chips into Azure.

Latest stories additionally flagged AMD gaining market share within the x86 processor marketplace for consumer and server classes.

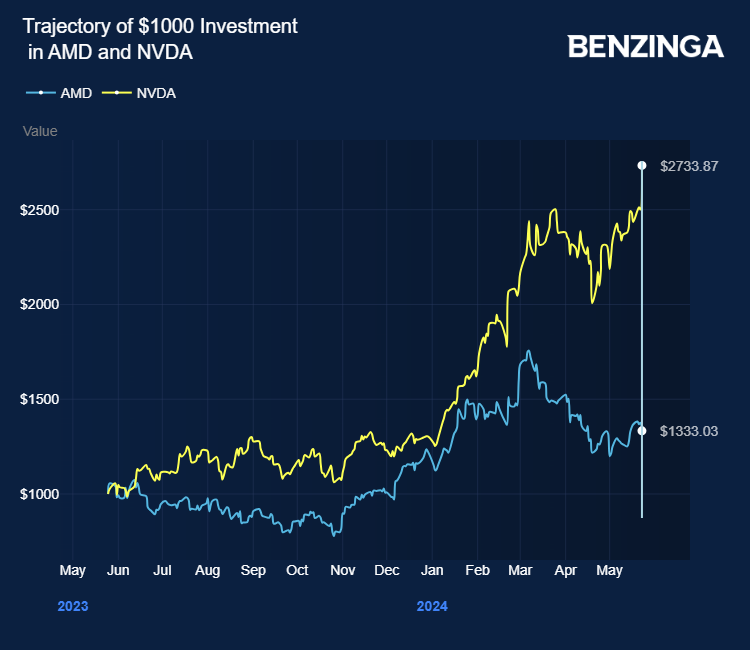

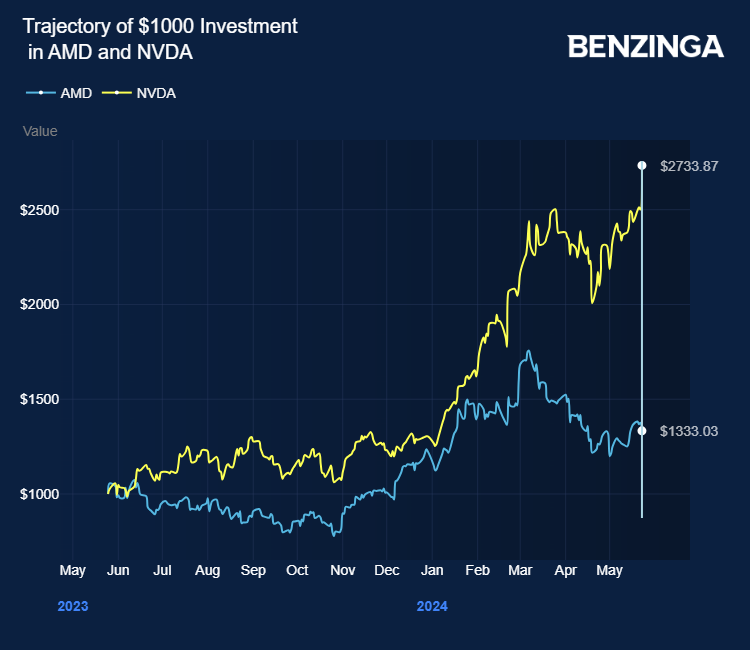

Analysts highlighted AMD’s, the following most significant AI beneficiary after Nvidia Corp (NASDAQ:NVDA) positive aspects within the server CPU market and its profitable seize of market share within the service provider accelerator sector.

AMD inventory gained over 48% within the final 12 months. Traders can achieve publicity to the inventory by way of Advisor Managed Portfolios Trenchless Fund ETF (NYSE:RVER) and REX FANG & Innovation Fairness Premium Earnings ETF (NASDAQ:FEPI).

Worth Actions: AMD shares traded larger by 3.18% at $165.53 on the final verify on Friday.

Additionally Learn: Nvidia Set For Regular Beneficial properties With Software program-Centric Shift And Blackwell Transition, Analysts Say

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Picture by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & every little thing else” buying and selling software: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the most recent inventory evaluation from Benzinga?

This text AMD Chief Lisa Su Foresees Huge Beneficial properties in AI and Knowledge Heart Effectivity initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.