Superior Micro Units (NASDAQ: AMD) inventory worth hit a 52-week excessive on March 8, however shares of the chipmaker have pulled again greater than 15% since then, regardless that there was no notable company-specific growth within the interim.

In fact, experiences that China is reportedly planning to interchange chips made by AMD and Intel from Chinese language authorities servers and private computer systems (PCs) did weigh briefly on the inventory worth, however even that should not be an enormous drawback for AMD in the long term. Here is why.

Sanctions in China should not be a lot of a bother for AMD

AMD reportedly will get 15% of its complete income from promoting its chips to China. So, any sanctions on gross sales of its chips in that nation might have an effect on AMD’s financials. Nonetheless, the dynamics of the semiconductor market are such that even when AMD is unable to promote its chips in China, it can produce other avenues to promote them.

For example, gross sales of each servers and PCs are anticipated to develop strongly throughout the globe because of the adoption of synthetic intelligence (AI). Gross sales of PCs fell simply 2.7% yr over yr within the fourth quarter of 2023 as in comparison with the 14% drop for your complete yr. The market is ready to witness a turnaround in 2024, pushed by a brand new refresh cycle within the enterprise and schooling markets, in addition to the arrival of AI-enabled PCs.

Market analysis agency Canalys estimates that 48 million AI PCs might be shipped this yr, accounting for 18% of the general market. What’s extra, shipments of AI PCs may develop at an annual charge of 44% by way of 2028 and account for 70% of the general market. Canalys additionally factors out that AI PCs are more likely to command a ten% to fifteen% premium as in comparison with conventional machines.

AMD, due to this fact, has a chance to spice up each its volumes and common promoting worth (ASP) of central processing items (CPUs). It is usually value noting that AMD has been taking share from Intel within the PC market. The corporate managed 20.2% of the consumer CPU market within the fourth quarter of 2023, up from 17.1% within the year-ago interval, as per Mercury Analysis.

Mercury Analysis attributed the share positive aspects to AMD’s early transfer into the marketplace for AI PCs with its Ryzen 7040 processor. In the meantime, AMD claims that its CPUs are powering over 90% of AI PCs presently out there. So, the stronger demand for AI PCs goes to provide AMD’s consumer processor enterprise a pleasant shot within the arm.

One thing related is more likely to unfold within the server CPU and GPU (graphics processing unit) markets. AMD completed 2023 with 23% of the server CPU market underneath its management, up from 17.6% within the year-ago interval. AMD CEO Lisa Su remarked on the most recent earnings convention name that the corporate is witnessing “strong demand for EPYC server CPUs throughout cloud, enterprise, and AI prospects.”

AMD additionally added that “a rising variety of prospects are adopting EPYC CPUs for inferencing workloads.” The great half is that AMD’s server CPU momentum is right here to remain, as the marketplace for AI servers is predicted to clock 26% annual progress by way of 2029. Then again, AMD noticed stronger-than-expected demand for its AI GPUs as nicely.

AMD elevated its full-year income forecast from knowledge heart GPUs to $3.5 billion from the sooner estimate of $2 billion. Nonetheless, administration made it clear on the earnings name that it may very nicely exceed that mark due to an bettering provide chain that may assist it meet further demand. All this means that AMD is well-placed to trump analysts’ expectations within the coming quarters.

AMD may shock traders with stronger-than-expected progress

When AMD launched fourth-quarter 2023 outcomes on Jan. 30, 2024, the corporate guided for $5.4 billion in income for the primary quarter of 2024 on the midpoint. That may be almost flat from the prior-year interval’s income of $5.35 billion. Moreover, AMD’s non-GAAP (usually accepted accounting rules) gross margin steering of 52% for the present quarter can be a slight enchancment over the year-ago quarter’s studying of fifty%.

AMD’s income and earnings, due to this fact, may improve barely in Q1. Analysts, nevertheless, count on AMD to publish $5 billion in quarterly income, which is decrease than what the corporate has guided for. Moreover, consensus estimates forecast a decline in AMD’s earnings to $0.55 per share from $0.60 per share within the year-ago interval.

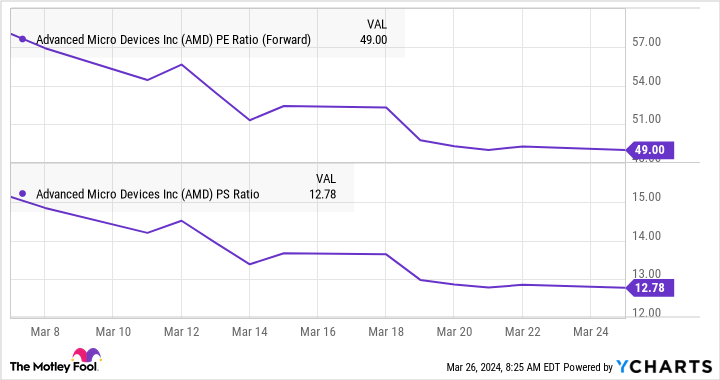

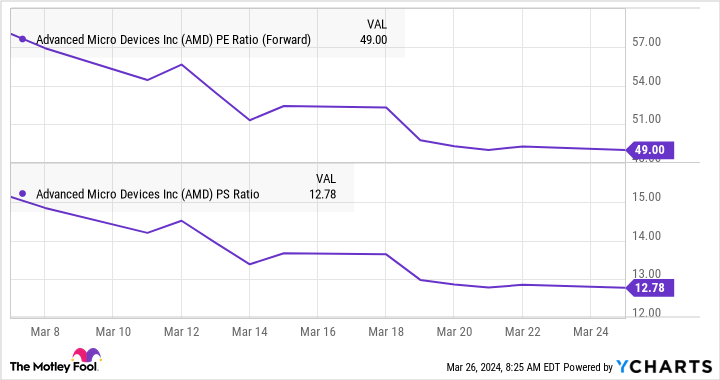

Nonetheless, there’s a stable likelihood that AMD may beat the market’s expectations by an enormous margin due to the a number of AI-related tailwinds mentioned above. The great half is that AMD’s pullback has made the inventory cheaper than earlier than. That is evident from the chart:

AMD is now buying and selling at 49 occasions ahead earnings and has a price-to-sales ratio of lower than 13. It was buying and selling at greater than 57 occasions ahead earnings and 15 occasions gross sales earlier this month. Savvy traders can think about using this drop to build up AMD inventory because the above-mentioned progress drivers may assist it regain its mojo, and the turnaround may start as quickly as subsequent month when it releases its first-quarter 2024 outcomes.

Do you have to make investments $1,000 in Superior Micro Units proper now?

Before you purchase inventory in Superior Micro Units, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Superior Micro Units wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2023 $57.50 calls on Intel, lengthy January 2025 $45 calls on Intel, and brief Could 2024 $47 calls on Intel. The Motley Idiot has a disclosure coverage.

AMD Inventory Is Down 15% From Its 52-Week Highs, and Here is Why You Ought to Purchase It was initially revealed by The Motley Idiot