Over the previous couple of years traders have not been in a position to purchase semiconductor shares quick sufficient. An enormous motive for it is because subtle chips often known as graphics processing models (GPUs) are one of many core energy sources of synthetic intelligence (AI) functions comparable to machine studying and even autonomous driving.

Because the AI narrative continues to push the markets greater, chip shares will doubtless stay in excessive demand. Because it stands as we speak, Nvidia is extensively thought-about to be the market chief amongst AI-powered chip firms. Nonetheless, Nvidia simply advised traders that the corporate’s new Blackwell collection GPUs are going to be delayed resulting from a design flaw.

Whereas I am no supporter of schadenfreude, I see this setback at Nvidia as a once-in-a-lifetime second for the corporate’s largest competitor, Superior Micro Units (NASDAQ: AMD). Let’s study the complete scenario at hand and assess how AMD may reap the benefits of Nvidia’s hiccup.

A story of two chip firms

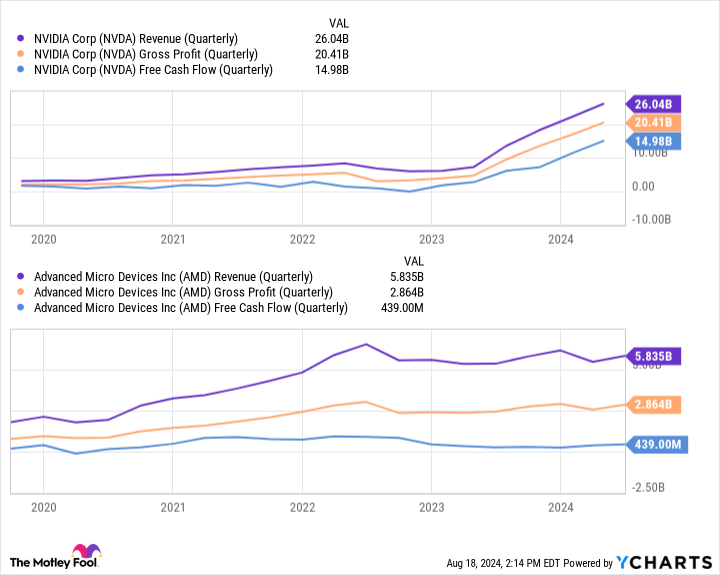

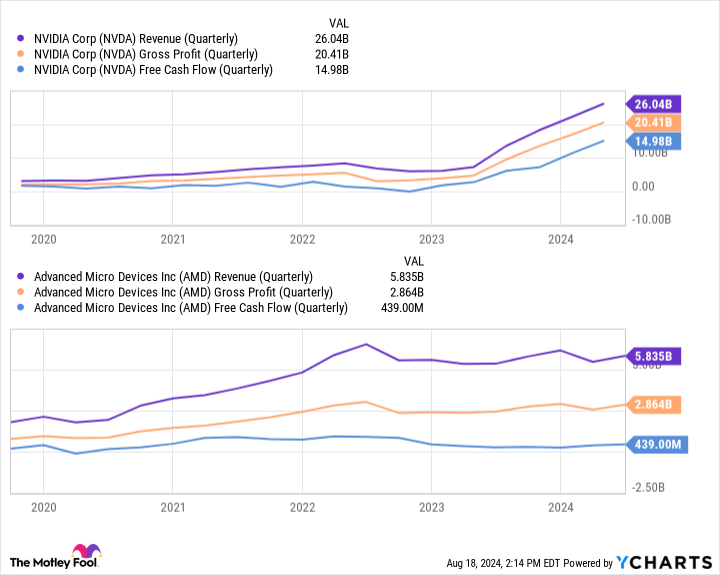

The charts under illustrate a variety of necessary monetary metrics for Nvidia and AMD.

On one facet of the equation, Nvidia’s gross sales and earnings are constantly hovering — resulting in an more and more steeper slope among the many coloured traces depicted under. But on the opposite facet, Nvidia’s chief rival is demonstrating noticeable inconsistencies in its operation.

The dynamics illustrated above clearly point out that chip consumers not solely favor Nvidia, however are additionally keen to pay high greenback. Though Nvidia has remained the supreme semiconductor firm for the reason that inception of the AI revolution, AMD has an unimaginable alternative to leapfrog Nvidia proper now.

Why this could be AMD’s defining second

Wall Road analysts estimate that Nvidia has practically 80% of the AI-powered chip market. Whereas AMD has performed what it will possibly to compete with Nvidia’s beautiful tempo of innovation, I believe the corporate has largely tried to distract traders from Nvidia’s overwhelming lead by way of a collection of questionable acquisitions.

To me, AMD’s time is near operating out and it will possibly’t afford to depend on acquisitions as a supply of product growth and inorganic development. One silver lining for AMD proper now could be that the corporate’s MI300X accelerator GPU is the quickest product to succeed in $1 billion in gross sales over the corporate’s historical past.

Clearly, there’s loads of demand for AMD’s GPUs, however it’s simply not even in the identical breadth as Nvidia’s demand. Now with Blackwell shipments delayed till presumably someday subsequent yr, AMD has an opportunity to grab the second.

It is necessary to remain grounded

Whereas the Blackwell delays are in no way excellent news, traders should be actual right here. I surmise some firms will go for various options to Blackwell within the interim, however I do not assume Nvidia could have a tough time promoting these chips as soon as it lastly repairs its design flaw.

So though AMD doubtless is not going to all of a sudden seize an awesome quantity of market share and outright dethrone Nvidia, I believe the corporate has an opportunity to reinforce its profile by disrupting Nvidia’s momentum.

For now, it’s going to be nearly unattainable for traders to know if AMD is penetrating the market whereas Nvidia focuses on righting the Blackwell ship. I believe some prudent actions may very well be to observe press releases amongst main AI builders comparable to Microsoft, Amazon, Alphabet, or Oracle and see if any of them are hanging new partnerships with AMD or shopping for extra MI300X chips.

Though I do not personal AMD inventory for the time being, I’m intrigued by the present dynamics of the chip market and see the corporate as each a hedge to Nvidia and just like a long-term name possibility on the AI market extra broadly.

Buyers with the next tolerance for danger, nevertheless, might take into account shopping for AMD now. Given the corporate is enjoying second fiddle to Nvidia, it is onerous to think about a situation the place AMD falls behind within the midst of this Blackwell scenario.

One other technique may very well be to attend a few months till AMD publishes its subsequent earnings report and see if the corporate generated irregular development in comparison with prior intervals. Buyers must also take heed to administration’s commentary relating to the supply of recent enterprise.

In both case, I’m bullish that AMD will reap the benefits of Nvidia’s stumble and maybe ignite the catalyst wanted for longer-term sustained development as the 2 firms proceed going face to face within the chip realm.

Do you have to make investments $1,000 in Superior Micro Units proper now?

Before you purchase inventory in Superior Micro Units, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Superior Micro Units wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $758,227!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Amazon, Microsoft, Nvidia, and Oracle. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

AMD’s Leapfrog Second Has Arrived. Here is Why Now Might Be a As soon as-in-a-Lifetime Alternative to Purchase the Inventory. was initially revealed by The Motley Idiot