One of the vital acknowledged names in private finance is urging Individuals to extend their monetary literacy, and urging the nation to do a greater job of offering the schooling.

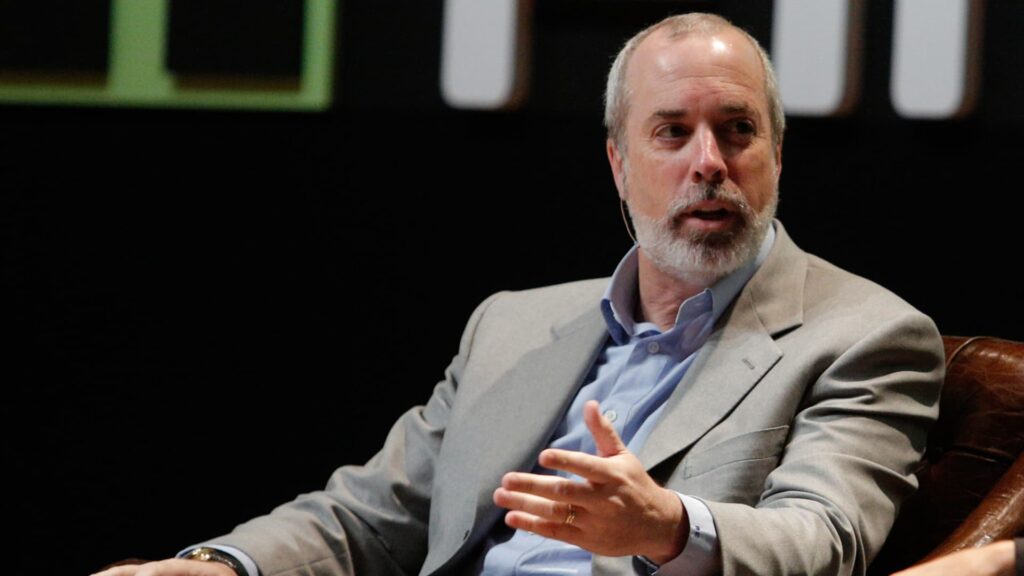

“We spend loads of time attempting to enhance monetary literacy. We stink at it,” mentioned Ric Edelman, founding father of Edelman Monetary Engines, on this week’s CNBC “ETF Edge.”

Edelman believes the issue is rooted within the truth the U.S. has by no means had an amazing custom of encouraging good private finance, and he says it has by no means been extra vital to repair, given how lengthy individuals are actually dwelling. That will increase the dangers associated to operating out of cash later in life and creates severe questions on customary investing fashions for long-term monetary safety, such because the 60-40 inventory and bond portfolio.

“We’re the primary technology, as child boomers, that may reside lengthy lives as a part of the norm,” Edelman mentioned. “Everybody earlier than us, our dad and mom and grandparents largely died of their 50s and 60s. You did not have to plan for the longer term, since you weren’t going to have one,” he added.

One in all his largest issues with the present technology of younger buyers is that they appear to consider in get-rich-quick schemes. Most of the new investing web sites have been too encouraging of dangerous methods that lure younger buyers in, he says, selling monetary playing somewhat than investing. Choices and zero-day choices have develop into a major a part of the every day buying and selling panorama within the final a number of years. In response to knowledge from the New York Inventory Trade, the % of retail merchants taking part within the choices market approached the 50% mark in 2022. In 2024, choices quantity hit an all-time document.

Edelman says youthful generations ought to be cautious of a company America that makes shopper finance extra sophisticated than it ought to be, which incorporates the manufacturing of overly subtle and costly monetary merchandise. “They need to make it complicated, to make you a hostage somewhat than a buyer,” he mentioned.

He additionally cautions younger buyers to ensure they’re getting details about private finance from credible sources. “When so many are getting their monetary schooling from TikTok, that is a bit of scary,” he mentioned.

Edelman believes the playing cards are stacked towards younger buyers due to the shortage of excessive colleges mandating a course in private finance. “The one method we uncover the problems of cash is thru the college of laborious knocks as adults, and we’re over our heads in terms of shopping for a automobile, getting a mortgage, insurance coverage and saving for school” he mentioned.

That state of affairs is enhancing for the following generations of adults. Utah was the first state to require a private finance course for highschool commencement in 2004, and the listing grew to incorporate 11 states by 2021. As of this 12 months, 27 states now require highschool college students to take a semester-long private finance course for commencement, based on Subsequent Gen Private Finance.

One other massive problem for younger buyers is that they usually haven’t got some huge cash to speculate, with many latest faculty graduates struggling to pay payments and left with little to place in the direction of different monetary objectives. However there’s no less than one cause to be hopeful about youthful Individuals, Edelman says: they’re extremely motivated to achieve monetary success.

“As we speak’s youth appears at their dad and mom and sees how poorly they had been ready for retirement. They do not need that to be their future” he mentioned.