April 20 (Reuters) – American Categorical Co’s (AXP.N) revenue missed Wall Road estimates on Thursday regardless of greater spending by its clients because the bank card large stored apart a big sum to cowl potential defaults and spent extra on promotions.

Shares fell as a lot as 7% to a close to three-month low of $154.01 as bills surged 22% to $11.1 billion within the first quarter, greater than expectations of $10.4 billion.

“Whereas the elevated provision doesn’t come as a shock, the miss on bills is probably going the driving drive behind the shares’ transfer decrease,” UBS analysts wrote in a shopper observe.

AmEx raised its provisions to $1.1 billion in contrast with a good thing about $33 million a yr in the past in anticipation of extra cardholders falling behind on their debt compensation.

Cussed inflation and a speedy rise in borrowing prices have begun to pinch clients of AmEx, which had up to now been in a greater place than its friends on account of a rich buyer base.

“We’re aware of the blended indicators within the exterior setting,” Chief Government Stephen Squeri mentioned.

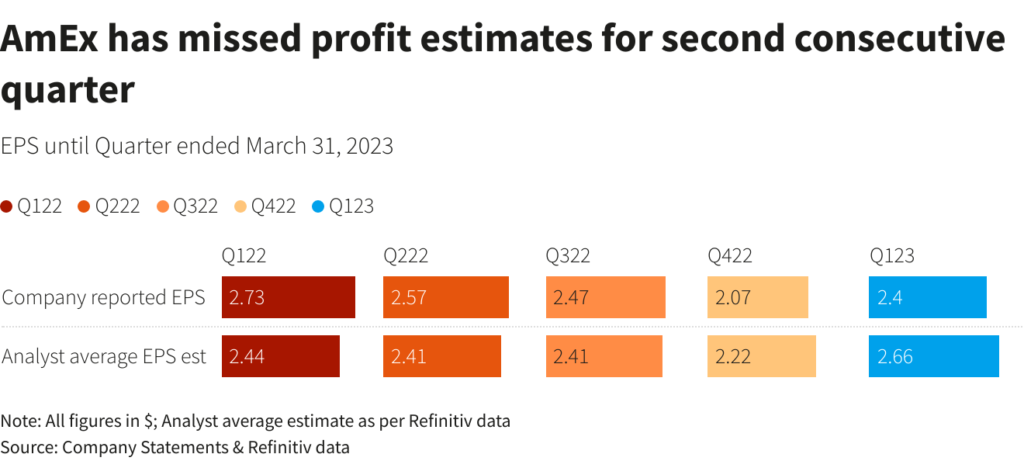

Revenue fell 13% to $1.8 billion, or $2.40 per share, for the three months ended March 31, lacking analysts’ common estimate of $2.66, in keeping with Refinitiv knowledge.

The corporate, nevertheless, reaffirmed its revenue forecast for 2023 as spending by clients on journey and leisure surged 39%.

It expects to earn $11 to $11.40 per share in comparison with analysts’ estimate of $11.10. Brokerage UBS mentioned AmEx’s premium buyer base will energy its progress outlook.

“Our clients are displaying resilience even on this unsure setting that we’re all working in,” finance chief Jeff Campbell advised Reuters, including that he was but to see any indicators of a recession.

Whole income, excluding curiosity expense, rose 22% to $14.3 billion within the first quarter.

Reporting by Siddarth S in Bengaluru; Enhancing by Arun Koyyur

: .