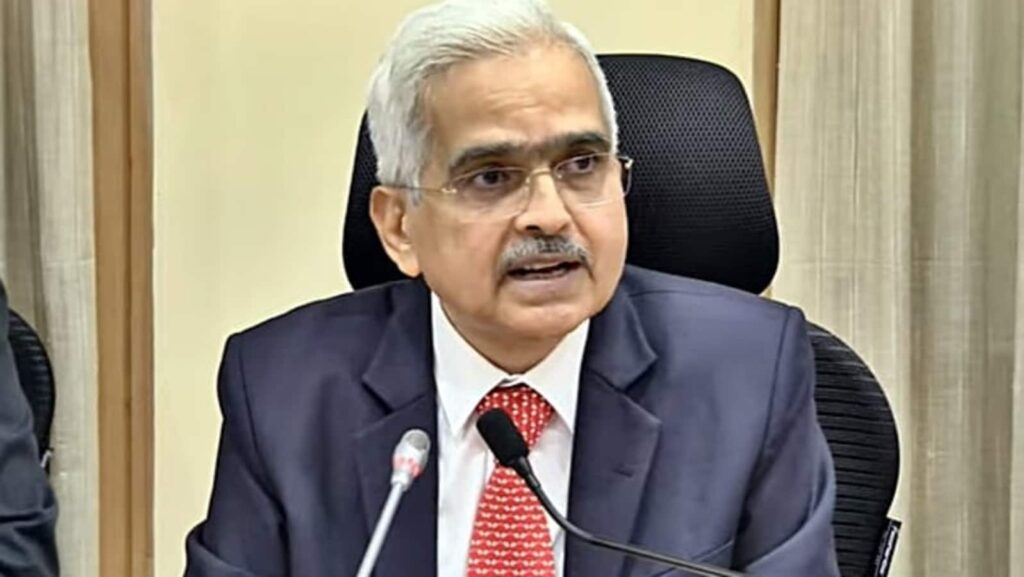

India is anticipated to be among the many quickest rising main economies this fiscal, geopolitical turbulence however, RBI Governor Shaktikanta Das opined finally month’s assembly of the speed setting panel MPC whereas going with the bulk to boost the repo price by 50 foundation factors to tame inflation.

On September 30, the six-member Financial Coverage Committee (MPC), headed by Das, had raised the short-term lending price for the third consecutive time by 50 foundation factors to take the repo price to five.9 per cent. In Could, the repo price was hiked by 40 foundation factors.

Aside from Ashima Goyal, who favoured a 35 foundation factors hike, the opposite 5 members had voted for 50 foundation factors enhance within the repo price.

ALSO READ: Wholesale inflation eases to 10.7% for September 2022: Govt

As per the minutes of the MPC assembly launched by the RBI on Friday, Governor Das had mentioned that financial exercise was steadily enhancing, although there have been combined alerts.

“Whereas excessive frequency indicators are displaying continued momentum in exercise, world components are placing strain on exterior demand.

“The expansion projection of seven.0 per cent for 2022-23, due to this fact, carries dangers that are broadly balanced. No matter be the unfolding state of affairs, India is anticipated to be among the many quickest rising main economies on this planet,” the minutes quoted him as saying.

RBI Deputy Governor and MPC Member Michael Debabrata Patra had confused that financial coverage has to carry out the function of nominal anchor for the financial system because it charts a brand new development trajectory.

The main target, he mentioned, must be on being time constant in aligning inflation with the goal.

“On this context, front-loading of financial coverage actions can preserve inflation expectations firmly anchored and stability demand in opposition to provide in order that core inflation pressures ease,” Patra mentioned.

The RBI, which has been tasked to make sure retail inflation stays at 4 per cent (with margin of two per cent on both facet), has failed to fulfill the goal for 3 consecutive quarters, and now should submit a report on this regard to the federal government.