-

An extremely uncommon bullish inventory market indicator simply flashed, suggesting extra upside forward.

-

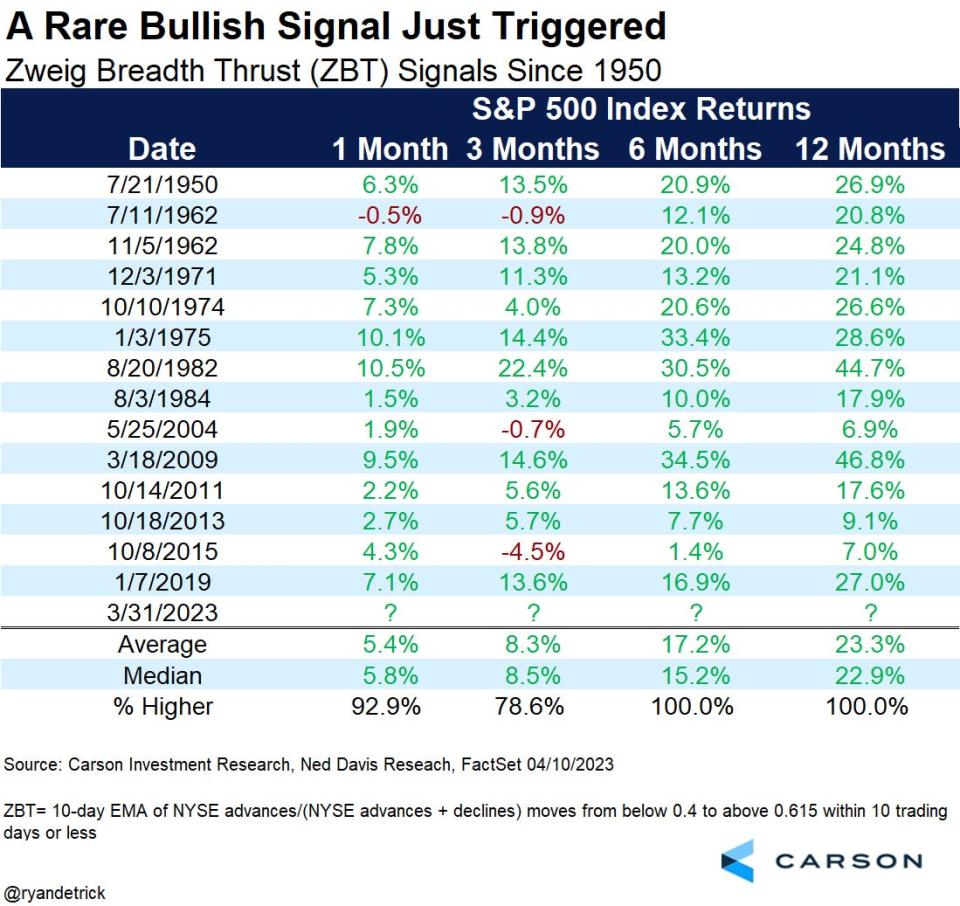

The Zweig Breadth Thrust indicator flashed for the primary time since 2019, in keeping with Ryan Detrick of the Carson Group.

-

“It has solely occurred 14 different occasions since 1950 and the S&P 500 was greater a yr later each single time,” he stated.

An extremely uncommon bullish inventory market indicator simply flashed for the primary time since 2019, suggesting that the 18% rally within the S&P 500 that began in mid-October has extra gas to proceed greater.

That is in keeping with Carson Group chief market strategist Ryan Detrick, who pointed out that the “extraordinarily uncommon” Zweig Breadth Thrust Indicator simply triggered.

It measures general participation amongst particular person points within the inventory market and was developed by investor and “Profitable on Wall Avenue” writer Martin Zweig.

The indicator is calculated by taking a 10-day transferring common of the variety of advancing shares divided by the variety of advancing shares plus the variety of declining shares. The calculation derives a proportion, and when it falls under 40% then surges above 60% in 10 days or much less, the indicator is triggered.

“Though the computation is a tad complicated, the underside line is many shares went from oversold to overbought in a short while body,” Detrick informed Insider on Monday. “That is what you are inclined to see in the beginning of latest bullish phases.”

The final time the Zweig Thrust Indicator triggered was in early 2019. Earlier than then, the indicator flashed in October 2015, October 2013, October 2011, and March 2009, simply two weeks after the S&P 500 hit its generational low through the Nice Monetary Disaster.

“It has solely occurred 14 different time since 1950 and the S&P 500 was greater a yr later each single time,” Detrick stated, including that each the common and the median ahead one-year return was 23%. In the meantime, the six-month ahead common return after the Zweig Thrust Indicator triggered is 17%.

Solely two cases since 2000 has the Zweig Thrust Indicator flashed and the S&P 500 went on to fall to a brand new low: in late 2015 and early 2004. Nonetheless, whereas the S&P 500 did transfer decrease within the brief time period, the index nonetheless moved considerably greater one yr after the sign was triggered.

There have been a number of breadth thrust indicators that flashed through the ongoing bear market rally final summer time. However notably none of them had been the Zweig Breadth Thrust Indicator, they usually in the end proved to be a false sign because the S&P 500 went on to fall to new lows.

“Final summer time’s massive rally did not see a Zweig Breadth Thrust Indicator, as that rally faltered ultimately. So perhaps that is one other clue that this rally off the October lows is legit,” Detrick stated.

Mark Ungewitter, portfolio supervisor on the Constitution Belief firm, said the Zweig Thrust Indicator is exclusive in that it “provides a dimension of ‘velocity’ by way of exponential transferring common, to a typical measure of depth.”

And whereas the indicator isn’t a foolproof signal that the ache in inventory market is over, it is positively a great signal for bullish traders. “Undoubtedly not bearish, although maybe not instantly bullish,” Ungewitter stated.

Learn the unique article on Enterprise Insider