March 30 (Reuters) – Borrowing prices in a few of the world’s greatest economies finish a unstable quarter eyeing their sharpest drops in years and extra swings are probably till it’s clear whether or not central banks will give attention to monetary stability or inflation.

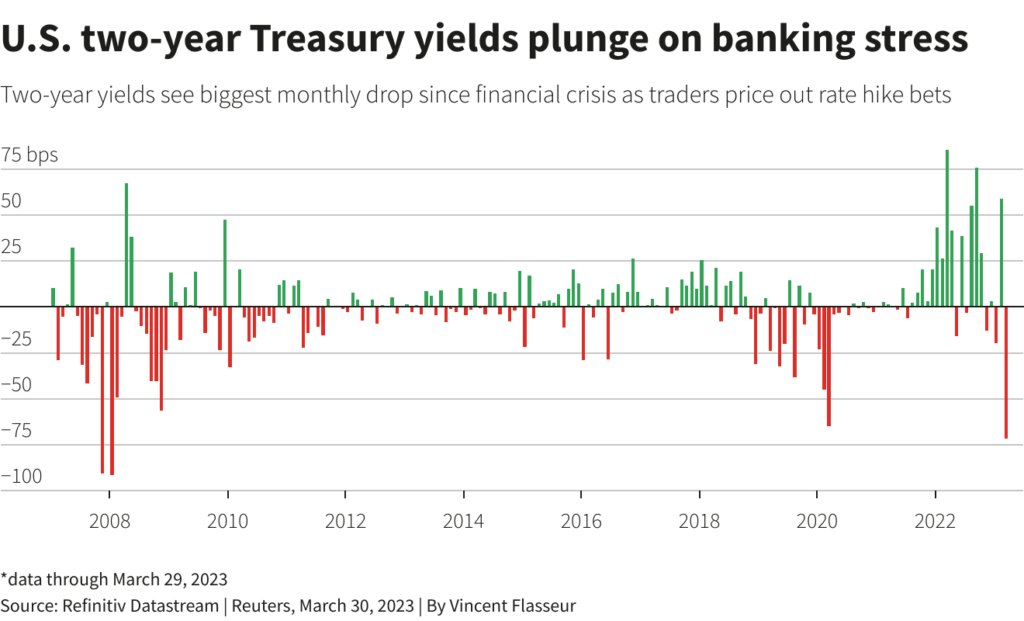

As of Thursday, two-year U.S. Treasury yields have slid 65 foundation factors (bps) in March, nearing their greatest month-to-month drop since January 2008 , as U.S. lenders Silicon Valley Financial institution and Signature Financial institution failed and Credit score Suisse was rescued.

Alongside that sprint for secure havens was a speedy repricing of rate-hike bets as banking turmoil raised monetary stability dangers, fuelling the rally in authorities debt.

However coming so quickly after markets had positioned for larger U.S. price hikes to tame inflation, bonds swung wildly. March’s sharp drop in two-year yields adopted a 59 bps soar in February. A measure of volatility within the Treasury market hit its highest since 2008 in mid-March. (.MOVE)

“That isn’t a traditional transfer,” stated Mike Riddell, senior mounted revenue portfolio supervisor at Allianz World Traders, which manages 673 billion euros in belongings.

Two-year U.S. yields are at the moment simply above 4%, ranges seen in early February earlier than surging to over 5% shortly earlier than SVB’s collapse on March 10, solely to then fall sharply.

“You are seeing 100 bps (yield) swings, a technique after which the opposite within the house of six weeks, when it comes to the place the market thinks the Fed may have charges a yr from now, which is the type of volatility that you just usually solely ever see in the course of an enormous disaster,” Riddell stated.

Markets now worth round a 50% likelihood of a final, 25 bps Federal Reserve price hike to 4.75%-5%, then cuts. In early March, that they had priced charges peaking at 5.7%.

European Central Financial institution charges are seen peaking round 3.5%, from over 4% in early March.

The general route for bond yields was decrease. Two-year Treasury yields are down 24 bps this quarter, their greatest quarterly drop because the 2020 COVID-19 disaster.

Germany’s two-year bond yield in the meantime has tumbled 35 bps in March, the second largest month-to-month drop since 2011. However it rose 5 bps in the course of the quarter, one other reflection of untamed market swings.

Australian two-year yields dropped greater than 50 bps of their greatest month-to-month fall since 2012 . Japan’s 10-year yield fell probably the most since 2008 with a 19 bps drop.

WHAT’S NEXT?

What’s subsequent could depend upon whether or not additional banking stress results in a credit score crunch that helps tame inflation.

The likes of JPMorgan, BofA and Morgan Stanley, count on Treasury yields to finish 2023 decrease; others akin to Goldman Sachs and BNP Paribas count on an increase.

“If we predict that monetary stability will likely be a much less compelling, smaller downside than up to now two weeks, and worth stability the larger one … charges shouldn’t decline an excessive amount of,” stated Mauro Valle, head of mounted revenue at Generali Investments Companions.

Some are betting that banking woes have raised recession dangers, a stark distinction to inventory markets nonetheless up 1% this month regardless of a financial institution shares rout.

Riddell at Allianz stated the agency anticipated a recession forward, that means the Fed would probably decrease charges “far beneath” 3% in a yr to 18 months from now.

He favoured 5 to 10-year Treasuries, anticipating a average recession may push yields one other 100 bps decrease however was underweight bonds in Europe, the place inflation is stickier.

For others, markets have gone too far.

Craig Inches, head of charges and money at Royal London Asset Administration, stated lots of the similar pressures that had made central banks uneasy about pausing price hikes, akin to excessive inflation, remained.

Certainly on Thursday, euro zone bond yields shot larger as German inflation information got here in above forecast.

He took income from a commerce betting on shorter-dated yields falling quicker than longer-dated ones and has diminished publicity to rate of interest threat, anticipating two extra Fed hikes.

“If (central banks) do truly go on a pause or begin reducing charges, then you definitely open an actual can of worms about what that’s going to imply for inflation expectations if an enormous systemic monetary disaster doesn’t materialise,” Inches stated.

Reporting by Yoruk Bahceli; Enhancing by Dhara Ranasinghe and Alison Williams

: .