NEW YORK, April 19 (Reuters) – U.S. actual property shares are struggling this 12 months after a tough 2022, as fears that banks will tighten lending requirements pile strain on a sector already hit by larger rates of interest.

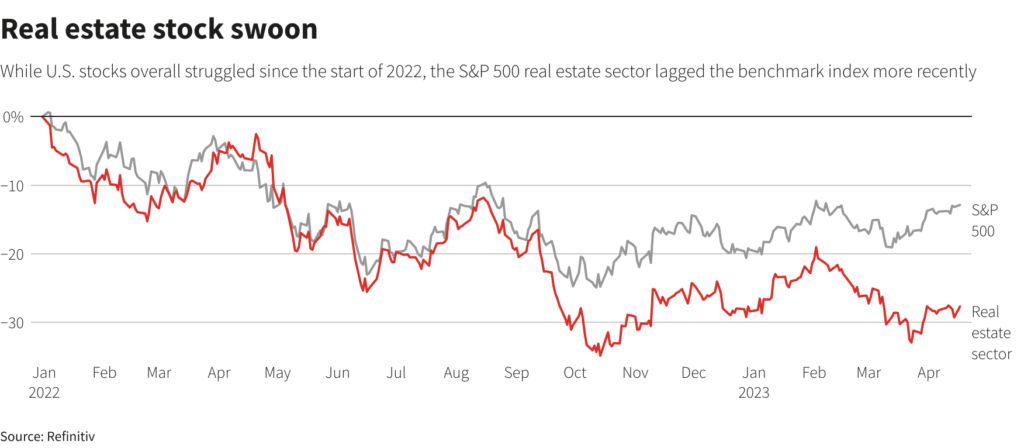

After slumping 28% final 12 months, the S&P 500 actual property sector (.SPLRCR) has gained about 1% in 2023, lagging an 8% rise for the general S&P 500 (.SPX). Actual property is the one one of many 11 S&P 500 sectors to underperform the benchmark index in each 2022 and thus far in 2023.

Driving this 12 months’s struggles are fears that tumult within the banking sector following the collapse of Silicon Valley Financial institution in March will make it tougher for actual property firms to entry debt, as banks change into extra stringent on lending. The true property sector has slumped 2% since SVB’s troubles got here to mild on March 8, in comparison with a 4% rise for the S&P 500.

“There may be nothing in regards to the present banking state of affairs … that made life simpler for actual property firms,” mentioned Peter Tuz, president of Chase Funding Counsel. As a result of banks have misplaced deposits, “they are going to be simply extra cautious who they lend cash to,” he mentioned.

With the S&P 500 actual property sector off practically 30% from its all-time excessive on the finish of 2021, traders want to upcoming earnings to find out the sector’s near-term trajectory. S&P 500 actual property firm earnings are anticipated to fall 0.3% this 12 months after rising nearly 11% in 2022, in accordance with Refinitiv IBES.

The businesses should ship on their earnings forecasts in the event that they need to reassure traders, mentioned Wes Golladay, an fairness analyst at R.W. Baird.

“They simply not too long ago offered steering with their fourth quarter earnings they usually must ship that,” he mentioned.

Traders are additionally carefully watching workplace demand, as a few of the largest U.S. banks single out industrial actual property as an space of rising concern, partly resulting from a surge in distant working for the reason that COVID-19 pandemic.

The S&P 1500 workplace REITs index (.SPCOMORE) is down 16% over since March 8 and a few particular person shares have seen sharper declines, with shares of SL Inexperienced Realty (SLG.N) down 26% and Vornado Realty (VNO.N) off 19%.

“Whereas the market has clearly priced in quite a lot of negativity for workplace REITs, rising delinquency charges and the upward trajectory of emptiness charges implies there could possibly be extra draw back danger forward,” wrote LPL Monetary’s Adam Turnquist in a observe earlier this week.

One other key issue is more likely to be the longer term path of rates of interest, traders mentioned. Regular future money flows from industrial buildings change into much less engaging as charges rise, and actual property shares have been among the many worst hit by the Fed’s aggressive fee will increase of 2022.

Valuation for a bunch of over 130 actual property shares — evaluating inventory costs to funds from operations, a typical business metric — fell from 25.5 occasions earnings initially of 2022 to 17 occasions by 12 months finish, in accordance with R.W. Baird.

Traders are pricing in one other fee improve on the Fed’s financial coverage assembly subsequent month, with charges then beginning to fall after the summer time. The Fed, alternatively, has projected charges will stay round present ranges for the remainder of 2023.

Nonetheless, some traders consider the selloff might have created alternatives to purchase on a budget.

Greg Kuhl, portfolio supervisor on the worldwide property equities workforce at Janus Henderson, mentioned most publicly traded actual property firms nonetheless have ample entry to capital in the event that they require it, regardless of final month’s banking points.

Kuhn’s portfolio is chubby industrial actual property firms, together with shares of warehouse firm Prologis (PLD.N), an space of the market the place he says occupancy charges are comparatively excessive.

“We expect the basics are actually sturdy there,” he mentioned.

Certainly, whereas emptiness charges have gone up in workplace house in comparison with earlier than the coronavirus pandemic hit in 2020, they’ve fallen over that point in areas resembling retail and industrial actual property, in accordance with Glenmede.

The agency at the moment maintains its weighting in the actual property sector at a stage that it has held in earlier years, mentioned Michael Reynolds, vp of funding technique at Glenmede.

“Folks have been blindly divesting from REITs due to fears on places of work, pondering that what’s going on in places of work is indicative of the general house,” Reynolds mentioned. “We are inclined to suppose that that’s not the case.”

Reporting by Lewis Krauskopf; Modifying by Ira Iosebashvili and Deepa Babington

: .