ZURICH, March 22 (Reuters) – The autumn of Credit score Suisse (CSGN.S) has dealt a severe blow to Switzerland’s credentials because the world’s main wealth administration centre, specialists warn, calling into query its fame for stability, regulation and company governance.

Battered by years of scandals and losses, Credit score Suisse had been combating a disaster of confidence for months, earlier than its demise was sealed in only a matter of days final week when Swiss authorities brokered a takeover of the financial institution by bigger rival UBS.

UBS itself wanted to be rescued by the federal government in 2008 after a disastrous foray into U.S. mortgage securities.

The Credit score Suisse collapse and its aftermath “goes to be very damaging,” mentioned Arturo Bris, Professor of Finance on the Worldwide Institute for Administration Growth (IMD) in Lausanne, including it may gain advantage rival monetary centres.

Switzerland manages $2.6 trillion in worldwide property in accordance with a 2021 Deloitte research, making it the world’s largest monetary centre forward of Britain and america. Nevertheless it faces competitors from different centres together with Luxembourg and specifically Singapore, which has grown quickly lately.

“The bankers in Singapore are going to be uncorking the champagne bottles,” Bris informed Reuters.

Switzerland’s credibility as a secure, predictable nation had been upended by strikes like the choice to wipe out the holdings of Credit score Suisse bondholders, he mentioned.

Beneath the takeover deal, holders of Credit score Suisse AT1 bonds will get nothing, whereas shareholders, who normally rank under bondholders in compensation phrases, will obtain $3.23 billion.

Whereas Credit score Suisse’s AT1 prospectus made clear that hybrid (AT1) holders wouldn’t get well any worth, few anticipated the financial institution’s demise.

The Swiss Bankers Affiliation has tried to place a courageous face on the disaster, presenting the rescue engineered by the federal government, central financial institution and regulator as signal of energy.

“The Swiss monetary sector was in a position to tackle a serious concern of a major participant,” SBA Chairman and former UBS CEO Marcel Rohner informed reporters on Tuesday.

“In that sense I additionally see a affluent future for the monetary centre as a result of we’ve got lots of of very properly capitalised banks and really profitable wealth administration and asset administration banks.”

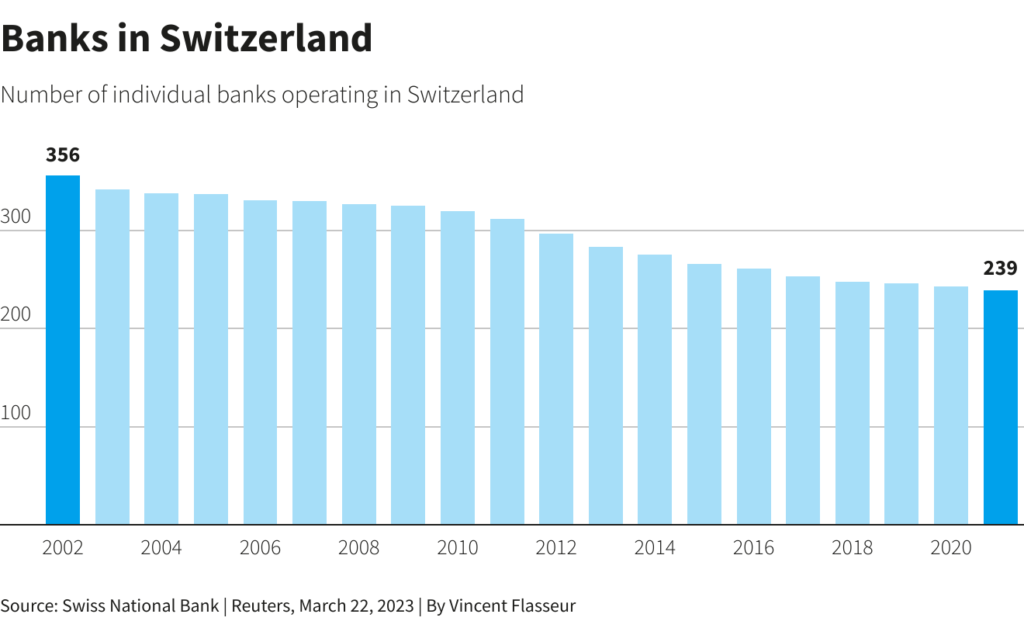

Nonetheless, the variety of banks has fallen, right down to 239 in 2021 from 356 in 2002. Employees numbers since 2011 have slipped to 91,000 from 108,000.

Others had been extra skeptical concerning the future, highlighting a reluctance to confront errors at Credit score Suisse or take duty for the aftermath.

“There are a variety of open questions: the usage of emergency regulation overriding the views of shareholders or the therapy of bond holders,” mentioned Stefan Legge, head of tax and commerce coverage on the College of St. Gallen’s IFF Institute for Monetary Research.

“Possibly some persons are a bit delusional – and actually consider they’re doing an awesome job.”

Switzerland invoked emergency laws to permit a public liquidity backstop (PLB) which can present as much as 100 billion Swiss francs in liquidity to Credit score Suisse because the PLB was not but a part of Swiss regulation.

However maybe most controversially, the emergency regulation allowed the takeover to go forward with out shareholder approval.

Legge mentioned the collapse ought to function a wake-up name, and will see new legal guidelines to enhance company governance launched.

Switzerland has few mechanisms for holding prime bankers individually liable for mismanagement, not like centres resembling Britain the place senior managers can face prison sanctions.

Unions and politicians have additionally reacted angrily to the rescue, which might depart the taxpayer having to cowl as much as 9 billion francs in losses.

LONG DECLINE

Switzerland’s outsized banking sector has been underneath stress for years following a decline in banking secrecy as different international locations sought to clamp down on tax evasion by residents.

The monetary sector’s contribution to the Swiss financial system has additionally slipped, falling to eight.9% of Swiss GDP in 2022 from 9.9% in 2002 as industries like prescribed drugs turned extra essential in a rustic with the third highest GDP per capita on this planet, in accordance with IMF information.

BAK Economics, a Swiss analysis institute, mentioned the fallout from the debacle could be contained throughout the banking sector. It estimated as much as 12,000 Swiss jobs being misplaced, though the influence on the broader financial system could be restricted.

Jan-Egbert Sturm director of the KOF Swiss Financial Institute at ETH Zurich, a college, predicted the financial influence of Credit score Suisse’s demise would quantity to a lack of round 0.05% of GDP per 12 months.

Switzerland’s lengthy banking custom and structural benefits meant the nation would stay closely concerned in banking in future, he mentioned, with buyers nonetheless selecting it for its stability and the energy of its Swiss franc foreign money.

Nonetheless competitors was getting fiercer, and the latest occasions would finally see Singapore overtake Switzerland, warned IMD’s Bris.

“I believe it is solely a matter of time.”

Reporting by John Revill, extra reporting by Paul Arnold, Enhancing by Alexandra Hudson

: .