March 18 (Reuters) – With the U.S. and European banking disaster wreaking havoc in international markets, some monetary business executives are calling on the Federal Reserve to pause its financial coverage tightening for now however be able to resume elevating charges later.

Buyers are at the moment pricing a 60% chance that the Fed will increase charges by 25 foundation factors on Wednesday, with the rest betting on no change. Some business executives stated the central financial institution ought to prioritize monetary stability now.

“Go quick and laborious on monetary stability; go gradual and sluggish on worth stability,” stated Peter Orszag, chief govt of monetary advisory at funding financial institution Lazard Ltd (LAZ.N). Orszag stated the Fed ought to pause however be able to hike once more step by step because the state of affairs develops.

The central financial institution declined to remark. Fed officers are of their pre-meeting blackout interval, throughout which they’re barred from commenting on financial coverage or the financial outlook.

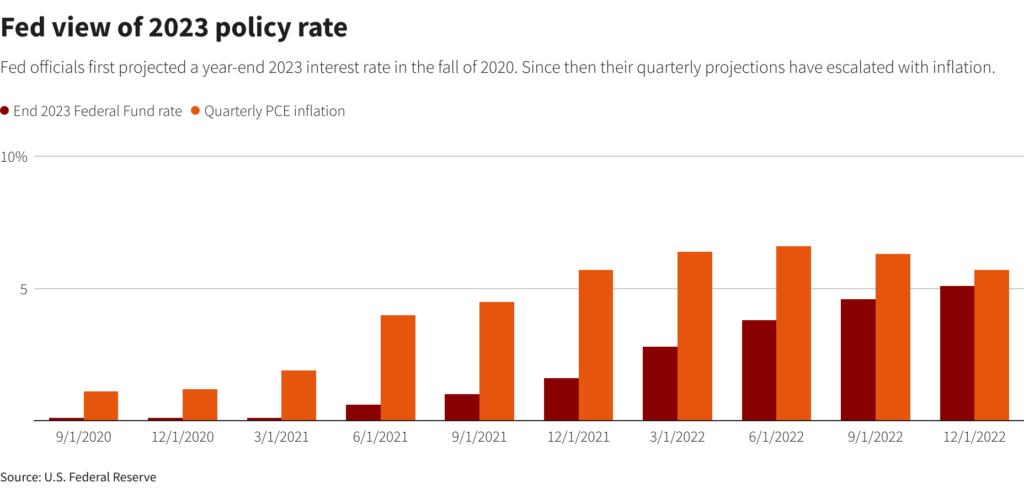

The Fed has quickly raised rates of interest over the previous 12 months in a bid to beat again inflation, at a tempo not seen because the Eighties. Others have joined in, with the European Central Financial institution elevating charges by 50 foundation factors earlier this week.

The speedy rise in charges after years of low-cost cash is rippling by way of international markets and business. Two U.S. banks have failed over the previous week and others have come underneath strain, whereas Swiss lender Credit score Suisse is scrambling to tug collectively a rescue deal this weekend.

Tumult within the banking sector has roiled asset costs, sending U.S. authorities bond yields plummeting previously week, with some traders complaining that large worth swings have made it tougher to commerce. U.S. shares took a rollercoaster journey, although the S&P 500 managed to shut larger on the week regardless of steep losses in financial institution shares.

WILD CARD

Some market observers have argued {that a} sustained pause may gasoline worries that shopper costs will rebound.

Current U.S. financial information give the Fed little motive to consider it has defeated inflation. Client costs rose at a 6% annual charge in February, practically thrice the central financial institution’s goal, and there have been solely nascent indicators of a major easing in hiring and wage progress.

“Whereas the banking woes will definitely command consideration, we consider that it’s not systemic however extra of a liquidity concern that the Fed can comprise with its lending services,” wrote Bob Schwartz, senior economist at Oxford Economics, in a observe.

However he added that the “wild card” will likely be market response.

James Tabacchi, chief govt of broker-dealer South Avenue Securities, stated he thought the Fed would ultimately have to go above 6%. The present Fed funds charge is 4.5% to 4.75%.

“I’m an inflation hawk. However what is going to it damage to attend a month and say, ‘We’d wish to see the market stabilize?’” Tabacchi stated. “I feel the Fed ought to pause.”

DISINFLATIONARY TRENDS

Orszag, who served because the director of the U.S. Workplace of Administration and Funds within the Obama administration, stated so long as long-term inflationary expectations weren’t unhinged, as was the case now, the Fed had time. Elevating charges too quickly may break issues, as the present banking disaster demonstrated.

A lot of components pointed to lingering results of the pandemic on inflation, resembling supply-chain disruptions and demand for journey and leisure.

In a brand new paper, Orszag and co-author Robin Brooks, chief economist on the Institute of Worldwide Finance, estimated that lagged results related to supply instances might clarify between 30% and 70% of elevated core PCE inflation within the fourth quarter of 2022. That might work out over time and be a disinflationary pressure this 12 months, they stated.

Torsten Slok, chief economist at Apollo World Administration, wrote in a observe on Saturday that the latest tumult within the banking sector is already tightening monetary situations. The occasions this previous week correspond to a 1.5% enhance within the Fed funds charge, Slok wrote.

“In different phrases, over the previous week, financial situations have tightened to a level the place the dangers of a sharper slowdown within the economic system have elevated,” he stated.

BlackRock Inc (BLK.N) strategists argued that the gyrations of the previous week confirmed that markets had woken as much as the injury attributable to the speedy rise and had been pricing in a recession.

“The trade-off for central banks – between combating inflation and defending each financial exercise and monetary stability – is now clear and rapid,” they wrote in a report earlier this week.

Reporting by Paritosh Bansal and Ira Iosebashvili; extra reporting by Dan Burns; Enhancing by Nick Zieminski

: .