LONDON, March 31 (Reuters) – Because the mud settles on a shock transfer by Switzerland to write down down $17 billion of bonds underneath Credit score Suisse’s rescue, the marketplace for debt designed as a shock absorber for banks faces an extended haul to regain investor belief.

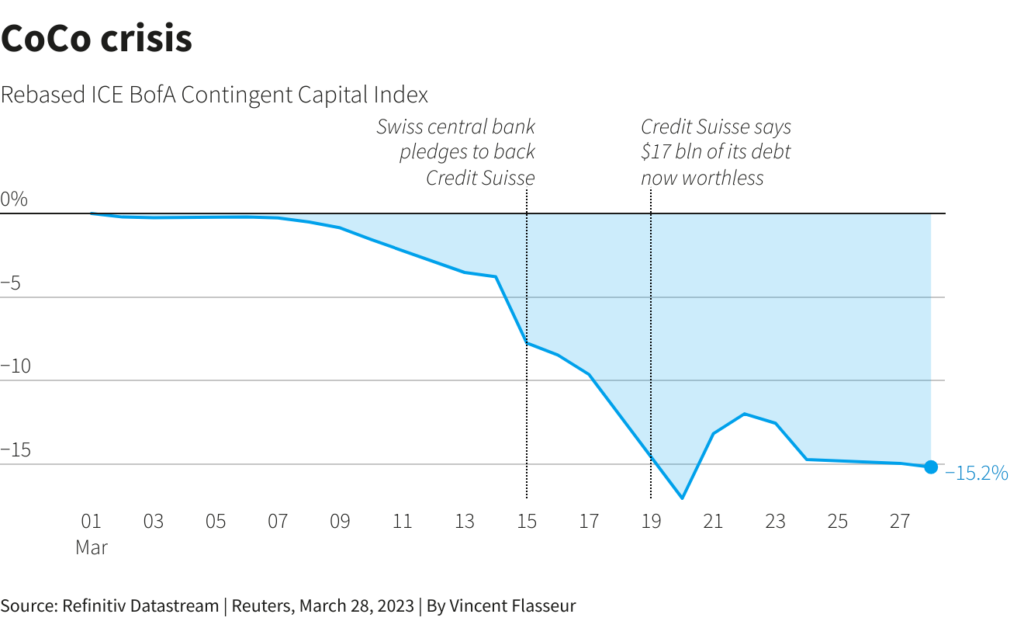

The worldwide $275 billion marketplace for Extra Tier 1 (AT1) bonds, a part of financial institution capital buffers that insulate taxpayers from funding bail-outs, was rocked by the Swiss authorities’ choice on March 19 on Credit score Suisse AT1s.

Some buyers, for example hedge funds, see a chance after sharp worth falls over the past week.

And whereas costs have stabilised, many others suspect additional ache forward with the fee to banks of issuing this debt turning into so costly that the market, seen by regulators as integral to banking sector resilience, may wither.

Eric Larsson, managing director at asset supervisor Alcentra, stated the market would grow to be “bifurcated”. Nicely-capitalised banks, he added, will have the ability to difficulty AT1s, paying buyers the upper returns demanded, whereas smaller ones “get quickly, doubtlessly shut out”.

If small lenders are unable to faucet the AT1 market, they are going to probably face larger funding prices in different capital devices which may cut back the quantity they’ll lend, in flip elevating recession dangers for international locations, particularly in Europe whose banks dominate the AT1 sector.

Concern that banks will likely be unable to promote AT1 debt has weighed on share costs, with European banking shares down 13% in March of their greatest month-to-month drop in two years (.SX7P).

“The AT1 market is hurting and whereas it is hurting, you will not see any new issuance,” stated Mark Holman, accomplice at TwentyFour Asset Administration, noting that present yields had been too excessive for banks to difficulty at.

The typical yield on AT1 bonds in Europe has jumped to round 14.5% from simply over 7% in February, knowledge from index supplier ICE present.

Credit score Suisse AT1 bondholders get nothing underneath the UBS merger deal. Shareholders, who normally rank under bondholders when it comes to who will get paid when a financial institution collapses, obtain $3.23 billion.

Any extra bondholder wipeouts forward of shareholders would “carry into query the entire level of this asset class”, stated Keith Thomas, head of securities litigation at London regulation agency Stewarts.

Thomas stated that like different finance legal professionals, he has been coping with enquiries from Credit score Suisse AT1 bondholders about whether or not to pursue litigation over the Swiss ruling.

European regulators have stated they might proceed to impose losses on shareholders first if a financial institution fails, serving to calm panicked buyers. Hong Kong and Singapore additionally stated they might stick with the normal hierarchy of insolvency claims.

ING analysts stated it was “uncertain” banks would have the ability to difficulty new AT1s “anytime quickly” even with the reassurances from European regulators.

“The rule ebook (was) sort of torn up,” stated Russell Investments’ head of mounted earnings, Gerard Fitzpatrick, including that “lots of people will really feel worry and can transfer out” of AT1s.

SHOCK ABSORBER

AT1s, also referred to as “contingent convertibles” or “CoCos”, had been launched after the 2008 monetary disaster to behave as shock absorbers if financial institution capital ranges fell under a sure threshold. They are often transformed into fairness or written off and are thought-about a high-risk type of financial institution debt.

Their costs have recovered however stay nicely under ranges seen earlier than the Swiss choice.

A WisdomTree change traded fund that tracks a broad index of financial institution AT1s, has dropped 11% previously fortnight. Credit score Suisse AT1s made up lower than 3% of the fund simply earlier than the Swiss financial institution’s rescue, the asset supervisor disclosed.

Deutsche Financial institution AT1 debt is buying and selling at 74 cents on the greenback, off final week’s lows round 67 cents however nonetheless under ranges seen earlier than the Credit score Suisse writedown, Tradeweb knowledge reveals. It is a comparable case with UBS AT1s, buying and selling round 64 cents.

Buyers had been now watching intently whether or not banks would refinance AT1s when the primary accessible date for them to take action nears. Not doing so could be a damaging sign for the market, they added.

Italy’s UniCredit , for example, has requested European Central Financial institution supervisors if it might probably redeem a 1.25 billion euro ($1.36 billion) perpetual bond on the first alternative in June, a supply informed Reuters.

Some AT1 buyers had been hopeful.

The bonds have by no means been as low-cost in comparison with fairness, Bjoern Jesch, world chief funding officer at DWS stated in a analysis be aware.

Peter Doherty, head of funding analysis at London personal financial institution Arbuthnot Latham, stated the group had added extra European AT1 publicity to shoppers’ portfolios within the final week.

The Credit score Suisse scare had left “the remaining banks with very excessive yields”, Doherty stated, including he believed it unlikely that extra main European banks would fail as a result of the business stays nicely capitalised.

($1 = 0.9216 euros)

Reporting by Naomi Rovnick, Chiara Elisei and Nell Mackenzie in London, further reporting by Yoruk Bahceli in Amsterdam and Gaurav Dogra in Bengaluru; Enhancing by Dhara Ransinghe and Emelia Sithole-Matarise

: .