NEW YORK, March 27 (Reuters) – As U.S. banking contagion worries ebb, some traders are trying to find shares of basically robust regional lenders that have been swept up on this month’s epic sell-off.

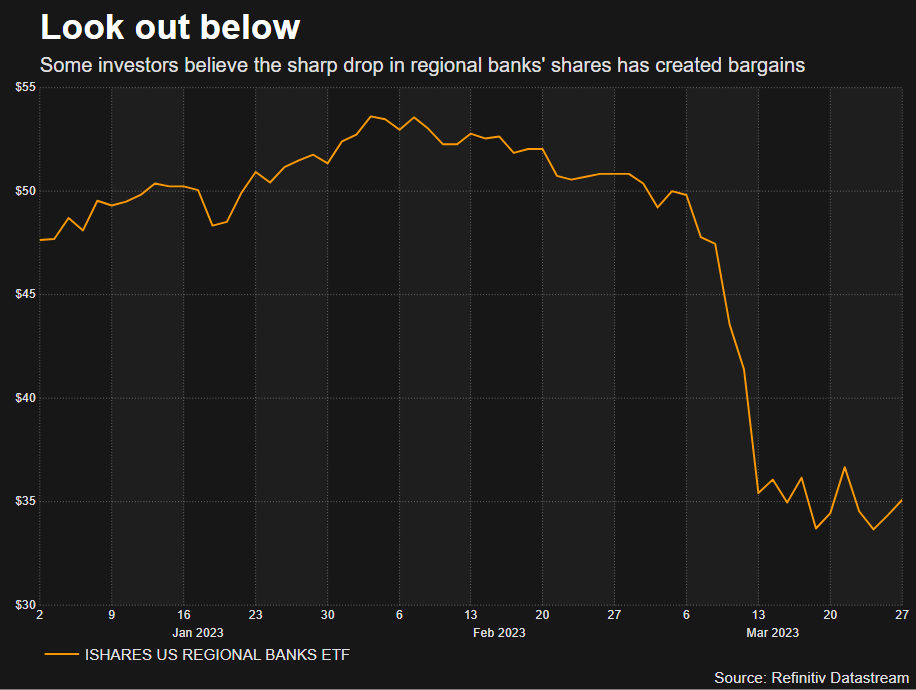

Buyers despatched a document internet $236.2 million into the iShares Regional Financial institution ETF (IAT.P) during the last two weeks, after Silicon Valley Financial institution’s collapse earlier this month fueled concern about banking system stability and sparked a sector-wide rout. The ETF has slumped almost 26% since March 8, when SVB’s troubles grew to become recognized, whereas the S&P Regional Banks Choose Business Index (.SPSIRBK) is down round 23%.

Considerations over deposit flight are nonetheless swirling round some regional banks. Some fund managers, nevertheless, consider the sell-off has created bargains and are constructing positions in corporations they suppose will pull by way of.

“There’s an terrible lot of corporations that we consider as being comparatively far-off from the middle of the storm which can be down greater than 20%, so the valuations have improved materially,” stated Hunter Doble, a portfolio supervisor at Hotchkis & Wiley. He owns shares of huge regional banks together with Residents Monetary Group Inc (CFG.N), which have fallen about 22% thus far this 12 months, and US Bancorp (USB.N), that are down some 18%.

Latest developments have buoyed hopes that the banking disaster could also be contained. U.S. regulators stated on Monday they might backstop a deal for regional lender First Residents BancShares (FCNCA.O) to accumulate SVB, sending the rescuer’s shares up almost 54% on the day.

On Saturday, Bloomberg Information reported that U.S. authorities are contemplating increasing an emergency lending facility that might supply banks extra help.

Lawmakers are anticipated to place high U.S. financial institution regulators on the defensive over the sudden failures of Silicon Valley Financial institution and Signature Financial institution once they testify earlier than Congress on Tuesday.

Margie Patel, a senior portfolio supervisor at Allspring International Investments, has been including new positions in regional banks over the previous few weeks, citing “worth.”

“The decline that we have seen within the sector is reflecting fears of repeating 2008 however I feel it is basically completely different,” she stated.

Banks will quickly have a greater match between income from higher-rate loans revamped the previous 12 months and better curiosity funds to depositors, a stability that went “out of whack” after the Federal Reserve raised benchmark charges almost 500 foundation factors, Patel stated.

Inflows into financial institution shares and ETFs are additionally being bolstered as retail traders search bargains in battered shares, analysts at Vanda Analysis stated final week.

Nonetheless, loads of headwinds stay, particularly for smaller banks whose shoppers have moved deposits to bigger banks for better stability. Purchasers may be ditching their checking accounts in favor of short-term Treasuries, cash markets and different investments with far increased yields.

Massive banks gained $120 billion in deposits however small banks misplaced $109 billion final week, whereas cash market fund balances grew by $121 billion, including to document inflows earlier within the month, in response to Moody’s Buyers Service.

Regional banks “want constructive information that exhibits their deposits are holding agency or rising,” stated Rick Meckler, a companion at household workplace Cherry Lane Investments.

Buyers have in current days turn out to be extra assured the Fed will increase charges at its subsequent assembly, as worries over monetary stability have ebbed. Increased charges may strain margins whereas additional boosting the attract of higher-yielding merchandise which were draining deposits.

Buyers on Tuesday morning have been pricing a 48% likelihood of one other fee hike, up from a 17% likelihood on Friday, in response to CME FedWatch Instrument.

Nonetheless, Christopher Marinac, director of analysis at Janney Montgomery Scott, believes regional banks have stronger stability sheets than many worry, which allow them to climate a recession and a rise in dangerous loans.

Marinac recommends shopping for PacWest Bancorp (PACW.O) and New York Neighborhood Bancorp Inc (NYCB.N), citing positive aspects within the trade’s mortgage loss reserve ratio – cash put aside to cowl dangerous loans – to an estimated 1.12% from 0.92% within the fourth quarter of 2019.

“We really feel reserves are strong and rising for the banking trade,” he stated.

Reporting by David Randall; Further reporting by Sinead Carew; Modifying by Ira Iosebashvili and Richard Chang

: .