March 24 (Reuters) – A disaster of confidence in world banking and a backlog of uncleared contracts is making an already cumbersome shift to a brand new set of charges even tougher as the top of the LIBOR period approaches, based on trade specialists.

As soon as dubbed the world’s most necessary quantity, London Interbank Supplied Price or LIBOR, is a charge based mostly on quotes from massive banks on how a lot it will value to borrow short-term funds from each other. It was discredited when authorities discovered merchants had manipulated it, prompting requires reform.

It’s largely being changed by risk-free charges (RFRs) compiled by central banks as they’re based mostly on precise transactions, together with the Federal Reserve’s Secured In a single day Financing Price (SOFR) as an example, making them tougher to rig.

Libor has already been scrapped to be used in new contracts, with the usage of a couple of remaining dollar-denominated charges in excellent contracts resulting from finish in June.

“With the transition deadline in sight, LIBOR’s grand finale could also be extra dramatic than beforehand thought with by-product contracts piling up amid the present banking turmoil,” stated Glenn Yin, head of analysis and evaluation at AETOS Capital Group.

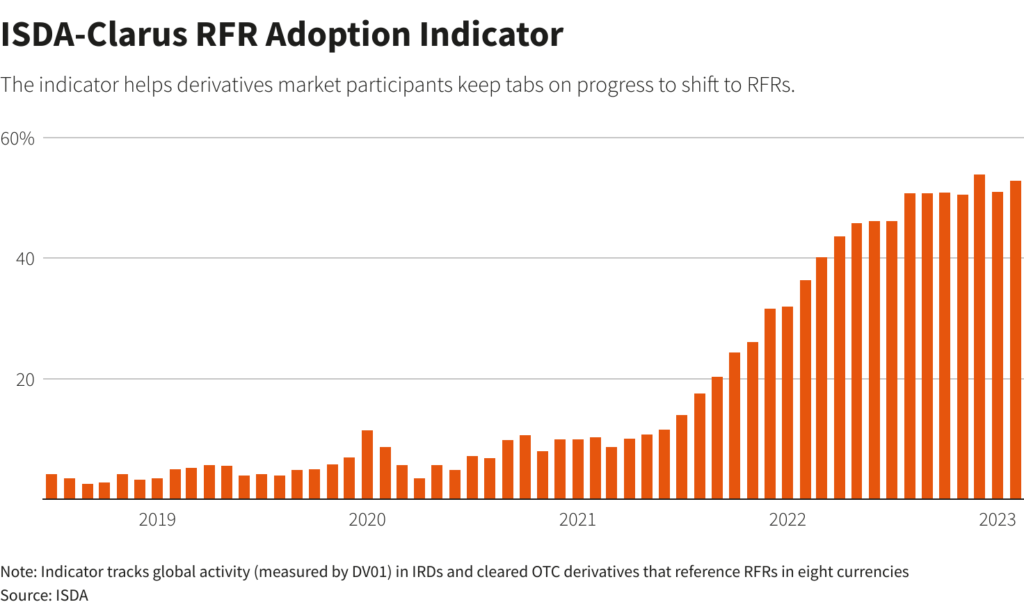

International buying and selling exercise (as measured by DV01) in cleared over-the-counter (OTC) and exchange-traded rate of interest derivatives (IRD) that reference RFRs in eight main currencies was at 52.9% in February, based on the ISDA-Clarus RFR Adoption Indicator.

It helps derivatives market individuals hold tabs on progress on the shift to RFRs. The indicator was at 4.7% in June 2020 after which surged to 53.9% in Dec 2022, its highest degree, earlier than declining barely within the first two months this 12 months.

DV01 is a gauge of danger that represents the valuation change in a by-product contract ensuing from a 1 bp shift within the swaps curve.

“SOFR’s gradual uptake was already setting the stage for a late rush to amend credit score agreements, and I think the continuing challenges within the banking sector will push transition plans again even additional,” stated Matt Orton, chief market strategist at Raymond James Funding Administration.

Banks around the globe are dealing with a significant upheaval after three U.S. banks collapsed in per week and 167-year previous Swiss banking large Credit score Suisse was taken over by UBS (UBSG.S) in a state-orchestrated rescue to stem broader repercussions within the crisis-laden sector.

“The present turmoil is forcing banks to separate their focus and could also be diverting sources from the transition,” stated Gennadiy Goldberg, U.S. rate of interest strategist at TD Securities.

“This may make it a bit tougher for banks to transition on time, however I think regulators are extremely unlikely to postpone the top date for Libor,” Goldberg added.

Whereas plans are in place to transform cleared U.S. greenback LIBOR swaps and eurodollar futures and choices into corresponding contracts referencing SOFR earlier than June 30, non-cleared derivatives that proceed to reference U.S. greenback LIBOR “might transition through bilateral negotiations,” ISDA stated earlier this month.

Many contracts will reference SOFR-based fallbacks after that date and the Adjustable Curiosity Price (LIBOR) Act will change U.S. greenback LIBOR in powerful legacy contracts that would not have fallbacks and don’t present clearly outlined benchmark replacements.

“Solely about 15%-20% of excellent loans are utilizing SOFR and I totally count on to see administrative logjams for debtors, lenders, legal professionals, and bankers,” stated Orton.

Round 80% of institutional loans and collateralized mortgage obligations (CLOs) are nonetheless tied to LIBOR even because it nears its June 30 end-date, personal fairness agency KKR & Co Inc (KKR.N) stated final month. KKR and Co can also be a lender, borrower and investor in CLOs.

Libor has been used globally to cost trillions of {dollars} of economic merchandise from mortgages and scholar loans, to derivatives and bank cards.

“One of many hurdles within the flip to SOFR has been in agreeing to amendments that tackle credit score unfold changes, and the wild swings out there will solely add to lender reticence to resolve these points within the close to time period,” stated Orton.

Reporting by Mehnaz Yasmin in Bengaluru; Modifying by Amanda Cooper and Christina Fincher

: .