March 21 (Reuters) – Tighter financing circumstances in markets sparked by banking sector turmoil might have finished a lot of central banks’ jobs for them, boosting the case for an finish to rate of interest hikes quickly.

In lower than two weeks, U.S. banking shares alone have slid over 15%, weaker corporations’ borrowing prices have jumped and the chance premium on U.S. monetary debt is at its highest since Might 2020.

Such strikes, some economists estimate, are the equal of a number of charge hikes by the U.S. Federal Reserve. The turmoil has additionally prompted traders to cut back rate-hike bets.

The Fed is tipped to boost charges by 25 foundation factors on Wednesday, in contrast with expectations of a 50 bps transfer earlier this month.

European Central Financial institution President Christine Lagarde reckons market turmoil might do a few of the ECB’s tightening for it if it dampens demand and inflation.

Monetary circumstances replicate the supply of funding in an economic system, so that they dictate spending, saving and funding plans of companies and households. Central banks have been attempting to tighten them by elevating charges to gradual rising costs.

Because the collapse of Silicon Valley Financial institution and a rout in Credit score Suisse shares that led to its takeover on Sunday by Swiss rival UBS, market funding circumstances have tightened sharply.

Torsten Slok, chief economist at Apollo World Administration, reckons the dimensions of tightening was equal to including 1.5 proportion factors to the Fed’s coverage charge.

“Monetary circumstances are the tightest they’ve been because the Fed started to extend rates of interest,” he stated, noting a Bloomberg U.S. index factoring in cash markets, company debt and inventory market strikes had hit its tightest since March 2020.

Indicators of tightening monetary circumstances have been plentiful.

Since March 9, the extra yield U.S. company junk bonds (.MERH0A0) pay on high of risk-free charges has risen by a whopping 88 bps.

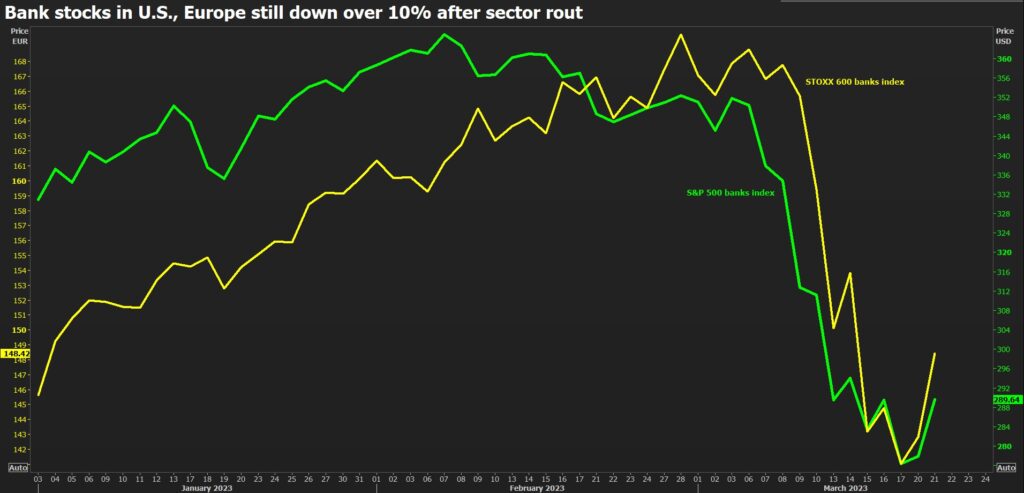

U.S. financial institution shares (.SPXBK) have fallen some 16%. European banks (.SX7P) are down 11% even after a publish Credit score Suisse-rescue bounce.

The chance premium on debt issued by banks and different monetary corporations has surged 56 foundation factors in the USA (.MERCF00) and 76 bps within the euro zone. (.MEREB00)

These strikes and heightened uncertainty may result in a major tightening in euro zone and UK financial institution lending requirements, Goldman Sachs stated, though of much less magnitude than through the 2008 monetary disaster or 2011 euro zone debt disaster.

“Even assuming that market volatility does subside over the approaching days and weeks, we expect some residual tightness in monetary circumstances is prone to stay,” stated ABN AMRO senior economist Invoice Diviney.

“Provided that this may do a few of the Fed’s tightening work for it, by miserable lending to the actual economic system, that is prone to cut back the necessity for additional coverage tightening.”

Diviney stated this may be a purpose for the Fed to chop charges this 12 months.

Oil costs in the meantime are down 9% since March 9, one other disinflationary issue that might assist central bankers.

“LARGELY GUESSWORK”

Goldman Sachs stated the tightening in financial institution lending requirements it expects may subtract 0.25 to 0.5 proportion factors from 2023 financial development in the USA, equal to the affect of one other 25-50 bps of Fed charge hikes. The affect risked being even bigger, it added.

Others have been cautious of utilizing market-based indicators to interpret monetary circumstances at a time when poor liquidity is driving outsized market strikes.

“The charges volatility has been pushed by inflation and development fears and positioning washouts so these strikes must be taken with a grain of salt,” stated Patrick Saner, head of macro technique at Swiss Re, referring to wild swings in authorities bonds.

“An abrupt tightening of economic circumstances issues solely to the extent that the tightness is maintained and stays orderly,” he stated, including that this depends upon central banks sustaining their inflation-fighting resolve.

Dario Perkins, managing director, world macro at consultancy TS Lombard and a former advisor to Britain’s Treasury, known as estimates of the affect current turmoil would have on efficient coverage charges “largely guesswork”.

“Central banks now not have a good suggestion in regards to the true tightness of financial coverage,” he stated.

He anticipated smaller banks to limit lending in a means that might have a big effect on smaller and medium-sized companies, in a blow to combination demand.

“This may assist the authorities to defeat inflation, however in a means that’s uncontrolled and intractable, risking pointless hardship.”

Reporting by Yoruk Bahceli; Enhancing by Dhara Ranasinghe and Catherine Evans

: .