LONDON, March 31 (Reuters) – European banking shares had been meant to shine in 2023.

However after a two-week storm which had analysts and buyers speeding to remodel their spreadsheets, the outlook is clouded.

Earlier than the autumn of Silicon Valley Financial institution (SVB) on March 10, stronger than anticipated euro zone financial knowledge and 50% fourth quarter earnings progress had prompted optimistic predictions.

That optimism lifted banking shares within the area to a five-year excessive in February and fed hopes that the battered sector would lastly see a rebound after years of underperformance in comparison with their U.S. opponents.

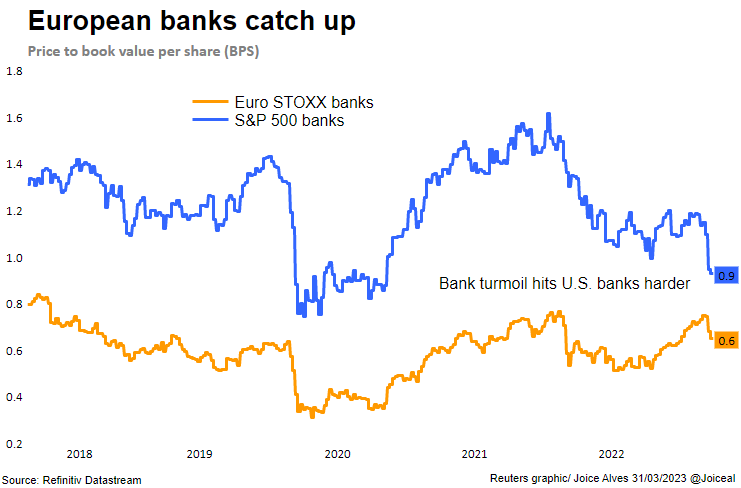

European shares are buying and selling at round 0.65 instances their price-to-book worth, in keeping with Refinitiv Datastream.

That is their lowest to this point since early January. However the hit from the latest tumult was more durable on U.S. banks, that are buying and selling at round 0.87 instances their price-to-book ratio, the bottom degree since November 2020.

And the ructions have left the hole between the ratios of European and U.S. banks at its narrowest since September 2017.

The weeks of turmoil and the emergency takeover of Credit score Suisse (CSGN.S) by UBS (UBSG.S) have dashed expectations for European banks as 2008-style volatility whip-sawed financial institution shares, with buyers quickly reviewing their holdings.

“We have been sharpening our pencils,” mentioned Paras Anand, chief funding officer at 24 billion pound ($30 billion) fund Artemis. After carefully inspecting his fund’s financial institution holdings, Anand determined to “selectively” add to positions.

Reflecting considerations over the steadiness of the sector, financial institution shares are set for an virtually 15% month-to-month drop in March, after 5 consecutive months of features.

And in an indication of wider uncertainty, Citigroup on Friday minimize the worldwide financials sector to impartial from obese.

Refinitiv knowledge exhibits analysts minimize their ahead 12-month earnings progress forecast for STOXX 600 banks (.SX7P), which incorporates euro zone and British banks however not the large Swiss lenders banks, to 9.4% in mid-March from 15% in February.

They’ve since revised up their expectations, to 11.2%. The February forecast had been the quickest for the sector since September 2021.

‘UNLIKELY TO BUY’

Different buyers see stress on European financial institution earnings as they anticipate the euro zone financial system will decelerate.

Traders at the moment are forecasting that banks themselves will tighten lending requirements and pay extra to safe deposits because the rumblings which started within the U.S. banking system stress establishments in Europe to exhibit that they’re properly capitalised.

Europe’s largest asset supervisor Amundi mentioned a weaker financial backdrop means progress in internet curiosity margins, a key measure of financial institution profitability, can be slower than anticipated and volumes can be decrease given tighter credit score circumstances.

Peter Doherty, head of funding analysis at non-public financial institution Arbuthnot Latham in London, mentioned he was “unlikely to purchase” European financial institution shares within the medium time period, with the most recent German investor morale survey signalling a bleak financial outlook.

“Merchants will wait to see a bit extra stability earlier than they add extra money to those (financial institution) shares. Lots of people simply wish to be sure that the contagion fears abate earlier than leaping again in,” mentioned Patrick Spencer, vice chair of equities at RW Baird.

Volatility final week in Deutsche Financial institution (DBKGn.DE) shares, after the price of insuring its debt in opposition to the chance of default jumped to a greater than four-year excessive, intensified worries in regards to the well being of Europe’s monetary sector.

Politicians, regulators and central banks have confused that the storm triggered by the collapse of SVB and Signature Financial institution within the U.S. was not a pre-cursor to a repeat of the 2008 world monetary disaster and circumstances now are very totally different.

However whereas European Central Financial institution (ECB) President Christine Lagarde instructed European lawmakers on March 20 the publicity of euro zone banks to Credit score Suisse was within the tens of millions fairly than billions of euros, she nonetheless warned that they need to put together for greater funding prices and decrease lending volumes.

‘ROBUST’ LIQUIDITY

ECB chief Lagarde additionally mentioned considerations over a credit score crunch in Europe had been extreme as banks have excessive liquidity ranges.

This view was echoed by Amundi, which mentioned that the liquidity profile of European banks “nonetheless seems very strong with much less competitors from cash market funds than within the U.S.”.

Credit score Suisse itself, which diminished European banks to ‘marginal obese’, mentioned they’re in higher form than U.S. lenders as their liquidity protection ratios (LCR), a measure of how a lot cash-like property banks maintain, are a lot greater.

In Europe, LCRs stand at 146% for main banks and 200% for smaller banks – properly above the minimal requirement of 100%, whereas the U.S. majors have LCRs of 119%, Credit score Suisse mentioned, with actual property wanting far much less weak in Europe.

However Barclays, which upgraded European banks to obese in late January, has minimize the sector again to impartial, citing expectations for elevated regulatory scrutiny, particularly on liquidity necessities.

Additionally within the calculation combine is the ECB’s marketing campaign to lift rates of interest to deal with rising inflation, which had beforehand been a boon for euro zone lenders.

Nevertheless, some buyers now fear that if the central financial institution continues to lift the price of borrowing it may really be in opposition to the curiosity of the banking sector as a complete.

The U.S. Federal Reserve’s price will increase have been partly blamed for sparking banking system turmoil, as purchasers pulled deposits from their banks to satisfy liquidity wants.

($1 = 0.8123 kilos)

Reporting by Joice Alves, Naomi Rovnick; Writing by Joice Alves; Enhancing by Amanda Cooper and Alexander Smith

: .