April 9 (Reuters) – As First Republic Financial institution’s share worth fell by double-digits within the aftermath of the collapse of Silicon Valley Financial institution final month, some individuals near the San Francisco-based lender had been nervous quick sellers had been exacerbating its travails, in keeping with a supply aware of the scenario.

Traders who wager shares in an organization will fall had been rising bets on First Republic’s (FRC.N) inventory when it was already taking a beating, making it troublesome for the financial institution to get well its worth, in keeping with the supply.

Quick curiosity in First Republic certainly elevated as turmoil within the banking sector intensified, though measures range. The % of shares borrowed — the essential mechanism of a brief guess — was minimal to begin the month however elevated to between 7% and 37% by March 31, in keeping with numerous knowledge supplier calculations, versus averages between 3% and 5% throughout all shares.

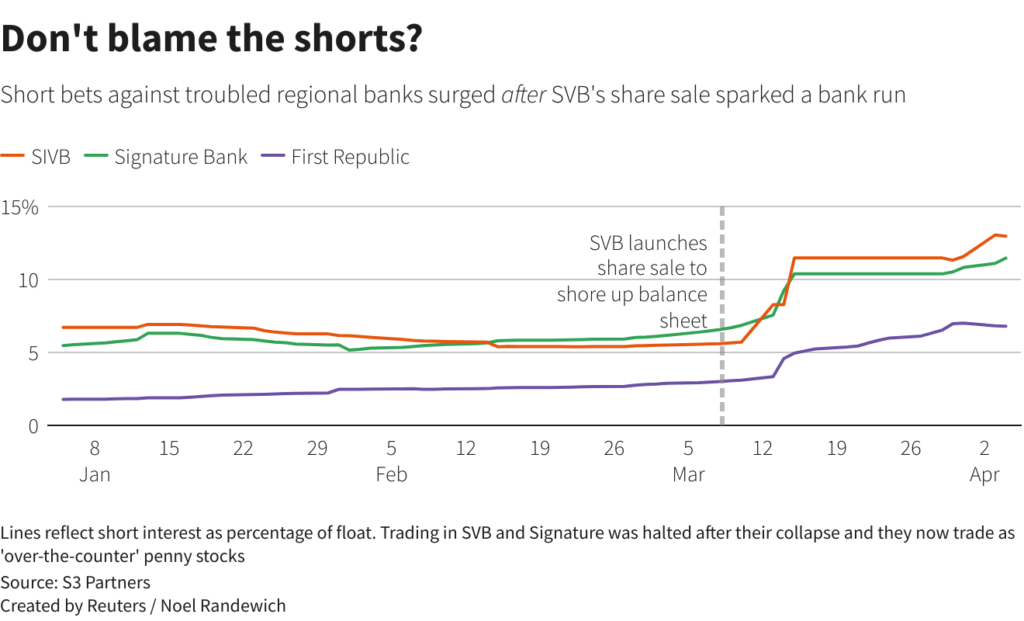

Two of the banks that shut down final month, Silicon Valley Financial institution (SVB) (SIVBQ.PK) and Signature Financial institution (SBNY.PK), confirmed an analogous sample: quick curiosity elevated as their inventory began to fall, at various levels of depth.

Issues at U.S. regional banks grew final 12 months, as quickly rising rates of interest slashed the worth of some banks’ holdings in long-term property equivalent to residence loans and authorities bonds. Some lenders had been additionally challenged by publicity to cryptocurrency and know-how corporations. The underlying points exploded final month when depositor flight spiraled uncontrolled and regional lenders throughout the board noticed their shares hit.

How a lot quick sellers contributed to the downward spiral reprises the talk about whether or not so-called shorts are market watchdogs or opportunistic buyers who revenue from others’ distress. Within the case of the banking disaster, a evaluation of information and interviews with quick sellers and their critics present, the reply could also be each.

“The shorts within the months earlier than the collapse had been precisely warning the markets…that the financial institution (SVB) was being dangerously mismanaged,” Dennis Kelleher, President and CEO of Higher Markets, a nonprofit trade group in Washington, DC, stated in an e mail. “The issue is as soon as that collapse occurred, shorts with numerous motives began concentrating on different banks.”

Some quick sellers have been public about their destructive views on banks however reject ideas that they’re guilty for the issues.

Quick-seller Jim Chanos wrote in a March 13 shopper letter seen by Reuters that buyers had recognized concerning the underlying steadiness sheet issues that introduced down SVB since final summer time. However it was solely when the financial institution, which his fund was quick, “abruptly tried, and failed, to lift capital … that anybody cared.”

First Republic and Chanos declined to remark. Signature and SVB didn’t reply to requests for remark.

CONTROVERSIAL PRACTICE

Quick promoting is a controversial observe, blamed within the monetary disaster of 2008 for including to the ache; it was quickly banned, albeit with little influence. Some excessive profile quick sellers had been later celebrated as making prophetic calls concerning the U.S. housing market.

The disaster of confidence in U.S. regional banks began when shares of SVB plunged and depositors fled after it introduced plans on March 8 to lift capital to fill an almost $2 billion gap from the sale of securities.

The Santa Clara, California-based lender was taken over by regulators on March 10, in flip dragging down the shares of different regional lenders. New York’s Signature failed on March 12, and First Republic misplaced greater than 80% of its market worth by mid-March.

Because the disaster accelerated, JPMorgan Chase & Co fairness analysts wrote on March 17 that short-sellers had been “working collectively to drive runs on banks,” and enterprise capitalist David Sacks requested on Twitter whether or not “scurrilous quick sellers” had used social media to exacerbate depositor flight from SVB.

JPMorgan and Sacks didn’t reply to requests for remark.

Even so, interviews and public postings present a minimum of some quick sellers had positioned bets in opposition to regional banks effectively earlier than the disaster hit.

These included: William C. Martin, who shorted SVB in January 2023; Nate Koppikar of Orso Companions, who shorted SVB in early 2021; Barry Norris of Argonaut Capital Companions, who shorted SVB in late 2022; John Hempton of Bronte Capital Administration, who shorted Signature in late 2021; and Marc Cohodes, who shorted Silvergate Financial institution (SI.N) in November 2022, in keeping with interviews with Reuters.

Porter Collins, co-founder of hedge fund supervisor Seawolf Capital, stated he noticed how rising rates of interest would seemingly hit banks and, in early 2022, shorted SVB, Signature, First Republic, Silvergate and Charles Schwab Corp. (SCHW.N).

“There have been warning indicators,” he stated, “that had been fairly simple to see for many who seemed.”

Schwab and Silvergate didn’t reply to requests for remark.

SHORT POSITIONS

Such early quick sellers, nonetheless, had been within the small minority. Shorts represented solely about 5% of SVB’s inventory float as of March 1, in keeping with knowledge tracker S3 Companions, with First Republic at round 3% and Signature at 6%. That compares to a mean of about 4.65% throughout all shares, per S3.

Information from S&P International Market Intelligence and ORTEX, who use totally different methodologies, have comparable numbers exhibiting SVB, First Republic and Signature with comparatively low total quick ranges earlier than the disaster.

Quick positions elevated over March, though the measures range, per the three knowledge suppliers. On First Republic, the proportion of shares on mortgage peaked at between 7% and 39% final month, whereas SVB peaked at between 11% and 19%, and Signature peaked between 6% and 11%.

Regardless, quick positions in most regional banks had been nowhere close to some extremely shorted shares like electrical carmaker Tesla Inc, which hit round 25% as not too long ago as 2019, and GameStop Corp, which surged previous 100% of shares in 2020, in keeping with Refinitiv knowledge.

An exception was Silvergate, a cryptocurrency-focused lender, which for months confronted an unusually excessive degree of quick curiosity in comparison with different banks – above 75% by the point it stated it will wind down operations on March 8.

S3’s Ihor Dusaniwsky stated the general improve in shorts on U.S. regional banks throughout March was an “terribly small” a part of total sector buying and selling; the declines had been pushed by common inventory holders promoting their shares.

“The shorts aren’t driving the inventory worth,” Dusaniwsky stated. “Persons are saying that the tail is wagging the canine. It is actually not the case in most of those names.”

Quick-sellers scored regardless: total quick bets in U.S. regional banks gained $4.76 billion in March, up 35% on a mean quick curiosity of $13.4 billion, in keeping with S3.

Reporting by Lawrence Delevingne in Boston; extra reporting by Megan Davies in New York and Noel Randewich in San Francisco. Enhancing by Megan Davies, Paritosh Bansal and Anna Driver

: .