The tempo of change within the trendy world is usually fast and dizzying. Applied sciences that appear integral to our lives can, in what looks like an instantaneous, grow to be redundant and irrelevant.

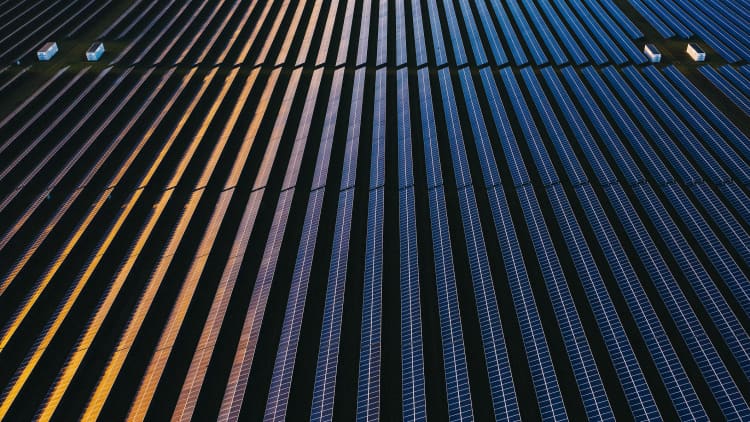

Power is one sector the place innovation and new concepts matter a terrific deal, as international locations and corporations attempt to discover methods to shift to a society based mostly round renewables like wind and photo voltaic moderately than fossil fuels like coal, oil and pure gasoline.

Throughout a panel dialogue ultimately week’s World Financial Discussion board in Davos, Switzerland, one analyst expressed his concern that the market didn’t appear to have realized from different technological revolutions.

Thomas Hohne-Sparborth, head of sustainability analysis at Lombard Odier, highlighted the massive shifts happening within the area of low and zero-carbon applied sciences and, by extension, wider society.

“We have seen previous industrial revolutions, together with previous vitality transitions,” Hohne-Sparborth mentioned. “What we’re actually seeing now’s the entire transformation of our complete economic system.”

“The demand aspect of our economic system, the best way we energy autos, the best way we warmth our buildings, the best way we use vitality in business — all of that must be remodeled.”

We have been, Hohne-Sparborth mentioned, ” funding wants within the trillions of {dollars}.”

In the case of the vitality transition, the sums being mentioned are certainly vital. Final 12 months, the Worldwide Power Company’s “World Power Outlook 2022” report mentioned clear vitality funding might be on track to exceed $2 trillion per 12 months by 2030, a rise of over 50% in comparison with at the moment.

Because the dialogue in Davos — which was moderated by CNBC’s Joumanna Bercetche — progressed, Hohne-Sparborth was requested if clear vitality was now reasonably priced on the scale required.

The reply to that query was, he replied, “very quickly shifting, and at the moment I might say, sure, it has grow to be the most cost effective supply of vitality.”

“What I believe the market at massive is underestimating is just the tempo at which this transition is unfolding,” he added, explaining that classes might be realized from historical past.

“We have executed some work previous technological revolutions, whether or not it is the adoption of steamships, of cell phones — any piece of main type of new expertise of infrastructure.”

All such transitions had, Hohne-Sparborth argued, “tended to observe a really related sample. They unfold very slowly … after which the transition completes in a span of 10 to twenty years.”

“But if you happen to look at the moment at what the market is anticipating — how lengthy it would take us to impress our buildings, to impress our car fleets — the timeframes there are nonetheless for much longer.”

For Hohne-Sparborth, it did not appear to be getting by that, “when a brand new, superior expertise emerges, that turns into value aggressive, that rollout can occur in a short time.”

Dramatic change

Additionally showing on the CNBC panel was Andrés Gluski, the CEO of vitality agency AES.

“What we’re dealing with … is a dramatic change,” he mentioned, including that renewables now represented “the most cost effective type of vitality, typically.”

“The issue is capability — how do you retain the lights on 24/7 — and that is the place you must use lithium-ion batteries each day.”

Increasing on his level, he went on to emphasise the significance of adopting quite a lot of applied sciences.

“To actually get to a whole decarbonization we will want inexperienced hydrogen, we’ll most likely want small modular nukes, etcetera.”

“And I additionally agree very a lot that what we’d like is for renewables to be extra than simply aggressive — simply higher in order that we decrease prices, [and] equal in high quality.”

“And that is truthfully what the company sector is demanding very a lot, and lots of customers.”