The place is the subsequent massive media merger?

Fueled by sinking inventory costs, debt-ridden stability sheets, elevated competitors, and a renewed deal with profitability, media and leisure firms are reevaluating their portfolios as trade watchers count on extra merger exercise in 2023.

“It is a fairly good inflection level,” Jon Christian, EVP of digital media provide chain at Qvest, the biggest media & entertainment-focused consulting firm, instructed Yahoo Finance. “The sport has modified. It was once simply subscribers in any respect price…however now [investors] want these providers to be worthwhile.”

Bart Spiegel, companion of world leisure & media offers at PwC, added: “We’re getting into a chapter two of the streaming wars.”

“Solely time will inform, however I believe every part’s on the desk to attempt to enhance profitability and make the platforms extra artistic to their general enterprise,” he continued.

Deal volumes and values within the media and telecommunications sector slowed in 2022 in comparison with final yr’s file, in keeping with PwC’s biannual U.S. Offers Outlook.

Over the previous 12 months ending in November, there have been 3,772 offers — a 26% year-over-year lower — with introduced deal worth totaling $624 billion, an 18% dip versus 2021.

The agency attributed the slowdown to greater rates of interest and inflation, coupled with rising geopolitical tensions and regulatory oversight.

The FTC’s latest antitrust lawsuit towards Microsoft (MSFT) and its $69 billion acquisition of “Name of Responsibility” writer Activision Blizzard (ATVI) and Paramount’s (PARA) blocked sale of Simon and Schuster function the most recent examples of this extra combative regulatory surroundings.

The Microsoft-Activision deal, together with Elon Musk’s $44 billion Twitter takeover, had been the 2 largest offers introduced within the media and telecom house this yr.

The report included all offers introduced in 2022 — no matter whether or not or not they closed. Amazon’s $8.5 billion acquisition of MGM and WarnerMedia’s $43 billion merger with Discovery didn’t depend towards this yr’s complete as they had been introduced previous to 2022.

‘Consolidation will occur’

Amid this shifting panorama, media executives have floated merger and consolidation potentialities.

Paramount CEO Bob Bakish not too long ago revealing throughout a UBS media convention earlier this month: “Consolidation has been the rule in enterprise for a very long time, actually been the rule in media. So, it’s exhausting for me to guess on something aside from consolidation will occur sooner or later.”

Jason Kilar, former CEO of WarnerMedia and the founding CEO of Hulu, wrote in a Wall Avenue Journal op-ed revealed earlier this month he expects, “two or three main mergers and/or acquisitions involving leisure firms within the coming 24 months” as money move challenges deepen.

Streaming losses have mounted lately as the price of content material continues to skyrocket.

Disney’s (DIS) direct-to-consumer division shed a whopping $4 billion-plus in its fiscal 2022, which ended on October 1, whereas Paramount guided streaming losses would complete about $1.8 billion this yr — greater than Wall Avenue expectations.

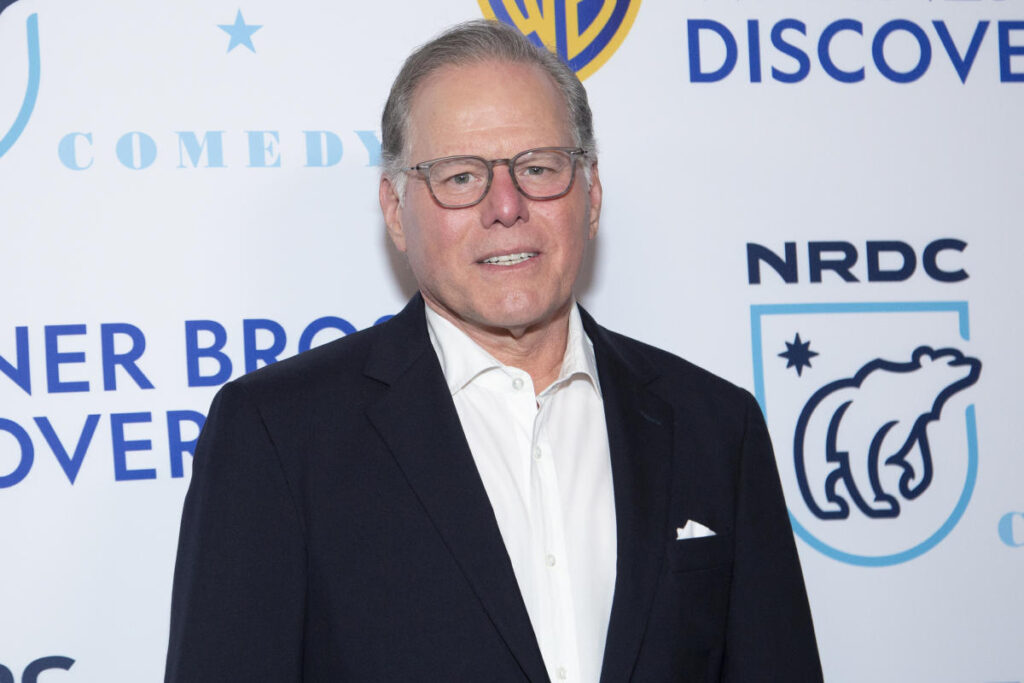

Warner Bros. Discovery (WBD), which has slashed its market cap in half amid its messy restructuring efforts, reported free money move of adverse $192 million within the third quarter, in comparison with $705 million within the yr prior. The corporate now plans to tackle $3.5 billion in content material impairment and growth write-offs by 2024.

As WBD struggles for path, many trade insiders imagine the embattled firm will promote once more — making it a potential acquisition goal in 2023 and past.

One other asset on the market can be Lionsgate’s movie and TV studio, which the leisure large plans to spin off right into a separate firm, whereas AMC Networks (AMCX) continues to bear a restructuring that might end in a sale.

Needham’s Laura Martin wrote in a latest consumer be aware Paramount may very well be enticing to unload, whereas smaller gamers like WWE (WWE), Curiosity Stream (CURIW), and Rooster Soup for the Soul (CSSE) will probably promote as a result of their dimension.

Disney CEO Bob Iger may even face a slew of choices — together with what to do with notable belongings like Hulu (promote it to Comcast?) and ESPN (spin it off?).

“There’s positively going to be belongings on the market available in the market,” Mary Ann Halford, companion at Altman Solon, mentioned. “The larger query is: What can we see popping out of the very giant media firms? And we have additionally seen that the tech giants have been quite gradual to scoop up these belongings.”

As for tech behemoth Amazon (AMZN), Amazon CEO Andy Jassy mentioned in an interview at The New York Occasions’ Dealbook Summit final month, “I do assume over time we now have alternatives to make our Prime Video enterprise a standalone enterprise with very enticing economics.”

“Clients want to go to a spot and discover every part they need, they don’t wish to go to five or 6 completely different locations,” Jassy mentioned.

What is going to drive M&A?

PwC famous demand for reside sports activities, together with sports-adjacent industries like sports activities playing, will probably drive future M&A exercise.

“There may be a lot cash in sports activities, and getting reside sports activities onto the streaming platforms is an space that’s nonetheless not utterly tapped,” Qvest’s Christian mentioned. “The query there may be: Can they put a pencil to it? As a result of the worth is so excessive for the content material. Are they now going to have the ability to get the subscribers essential to be worthwhile in that enterprise?”

Spiegel agreed that rising content material prices will probably stress future dealmaking, though extra disciplined content material spend might pressure platforms to companion up to be able to offset manufacturing dangers.

Different M&A alternatives might revolve round film theaters, as field workplace ticket gross sales battle to achieve pre-pandemic ranges, and video video games, which give profitable monetization alternatives via franchise mental property (IP).

“A number of these media firms are counting on their present IP to monetize available in the market throughout geographies and home windows, versus investing closely and creating new IP,” Spiegel mentioned, citing profitability issues. “Extra conventional online game firms have that IP [and] even have the engines and applied sciences that assist in the content material creation course of.”

General, although, the largest M&A chance can be content material — particularly as customers develop into extra picky with their subscription plans.

“Content material and IP will all the time be enticing, as a result of, not solely is there a direct means to monetize that present content material, IP, or library, but additionally the tangential alternatives to monetize via sequels or different kinds of storylines,” Spiegel mentioned.

“You possibly can take a look at so many alternative issues, however you could have high quality content material,” Christian added. “Content material is all the time going to be king.”

‘It is a powerful world for financing’

As recession issues weigh on investor sentiment heading into the brand new yr, PwC predicated a adverse influence on valuations.

“It is a powerful world for financing so [private equity] is extra sitting on the sidelines proper now,” Spiegel mentioned.

“There’s probably going to be a spot between what sellers count on for the valuation of their properties, versus what consumers are keen to pay, as a result of you’ve got a diminished purchaser pool and the entry to financing is far more costly,” he mentioned.

Nonetheless, “I do count on personal fairness will return — they’re sitting on a major quantity of dry powder, however we simply have to attend for the markets to come back again of their favor.”

Altman Solon’s Halford added greater rates of interest will gasoline macro challenges after the Federal Reserve delivered buyers its seventh and remaining rate of interest enhance of 2022.

“When individuals want to purchase out one thing with fairness and debt, the rate of interest surroundings is certainly a headwind,” Halford mentioned.

Nonetheless, Halford mentioned there’ll nonetheless be belongings on the market subsequent yr, even with these challenges: “Wall Avenue goes to be on [these companies’] tails.”

Alexandra is a Senior Leisure and Media Reporter at Yahoo Finance. Observe her on Twitter @alliecanal8193 and electronic mail her at alexandra.canal@yahoofinance.com

Click on right here for the most recent trending inventory tickers of the Yahoo Finance platform

Click on right here for the most recent inventory market information and in-depth evaluation, together with occasions that transfer shares

Learn the most recent monetary and enterprise information from Yahoo Finance

Obtain the Yahoo Finance app for Apple or Android

Observe Yahoo Finance on Twitter, Fb, Instagram, Flipboard, LinkedIn, and YouTube