Inventory markets supply one of many nice paradoxes of life – that when circumstances develop tough and costs fall, alternatives for revenue will seem. For buyers, it’s an opportunity to money in – after a correct look into the nuts and bolts behind a market decline. As at all times with shares, knowledgeable selections are the almost certainly to pan out.

To jumpstart that due diligence, we will test in with Wall Road’s analysts. These are the professionals, the fairness specialists who’ve constructed their reputations studying and analyzing the interior workings of the buying and selling atmosphere, and their revealed notes and suggestions give the investing public a sound information to worthwhile investments.

Utilizing their insights and the TipRanks database, we’ve got recognized a number of shares which are primed for positive aspects – however are priced low for now. These are Purchase-rated equities which have fallen on onerous occasions – with over 60% losses prior to now 12 months – however in line with the analysts, they nonetheless supply triple-digit upside potential. Let’s take a better look.

Plug Energy (PLUG)

First on our checklist is Plug Energy, a ‘inexperienced energy’ participant designing and manufacturing zero-emission hydrogen gasoline cell methods, together with the manufacturing, storage, and supply infrastructure wanted to construct out this new know-how to industrial or utility scales. Hydrogen gasoline cells use electrochemical reactions to generate usable electrical energy. The result’s a cleaner energy supply, based mostly on clear, renewable hydrogen – the commonest ingredient within the universe.

Plug Energy’s hydrogen gasoline cell battery merchandise have discovered makes use of in each motive and stationary functions, together with backup energy technology and in warehousing. The gasoline cells are rising in recognition with information facilities, and have been discovered to be cost-effective in warehousing, the place they’re used to energy pallet jacks and fork lifts. Different functions embody house heating methods and transportable electronics. To this point, Plug has deployed greater than 60,000 energy cells for e-mobility, and has grow to be the most important purchaser of liquid hydrogen in North America. The corporate’s buyer base contains names akin to Amazon, Walmart, and BMW.

The long-term prospects for Plug look good. In in the present day’s cultural atmosphere, which locations a premium on each clear and renewable vitality sources, Plug might be positive of discovering each political and social help. Brief-term, nonetheless, the image is much less rosy, and PLUG shares are down 67% during the last 12 months.

At the very least a part of the explanation might be seen in Plug’s latest quarterly earnings studies. The corporate is just not hitting the income expectations. Within the final report, from 4Q22, Plug reported a high line of $221 million – that was up 36% year-over-year, however it missed the $277.3 million forecast by a 20% margin. Worse, the corporate’s annual web diluted EPS loss worsened y/y, from -$0.82 cents to -$1.25.

On a optimistic be aware, Plug does have loads of enterprise lined up going ahead. The corporate got here out of 2022 with a strong backlog of labor, in each the hydrogen manufacturing electrolyzer enterprise and in hydrogen liquefaction orders.

The backlog and the prospect for continued orders build up momentum going ahead type the bottom for Wolfe analyst Steve Fleishman’s optimistic view of this inventory.

“Plug closed 2022 with a miss on income however noticed its backlog leap 27% within the quarter on growing demand for electrolyzers, gasoline cells, and liquefiers. We see a whole lot of optimistic momentum to return over 2023 for PLUG as hydrogen funding rises and there’s extra readability on the IRA incentives and hydrogen hubs, although execution might be key this 12 months,” Fleishman opined.

Anticipating that Plug will have the ability to execute, Fleishman charges the shares as Outperform (i.e. Purchase) and units a worth goal of $25, suggesting a one-year upside of ~138%. (To look at Fleishman’s observe file, click on right here)

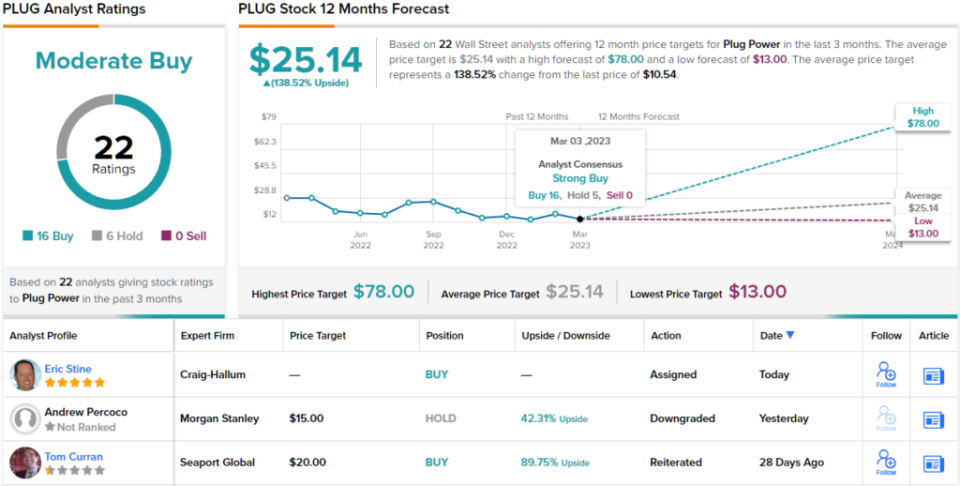

General, Plug has been producing loads of buzz, and has 22 opinions from the Road’s analysts. These embody 16 Purchase suggestions and 6 Holds, for a Average Purchase consensus score. General, the Road sees a powerful 138% upside potential right here, based mostly on the typical worth goal of $25.14. (See PLUG inventory forecast)

Adicet Bio (ACET)

Subsequent on our checklist is Adicet Bio, a small-cap agency within the biopharmaceutical sector. Adicet is engaged on a brand new line of ‘off the shelf’ T cell therapies for most cancers therapy, based mostly on allogenic gamma delta T cells. These characterize a brand new technology of T cells, when in comparison with the present alpha beta T cell immunotherapies, and supply the promise of better efficacy in antitumor exercise towards each strong tumors and hematological cancers. The corporate is producing its line of gamma delta T cell drug candidates by way of a proprietary cell platform.

Adicet is at present within the transition from the pre-clinical stage to the human medical trial stage. The corporate’s pipeline has a number of analysis tracks ongoing, together with 5 at present in discovery/preclinical testing, two on the IND-enabling regulatory stage, and one in a Section 1 human medical trial.

That medical trial is the first issue for buyers to think about on this inventory. The drug candidate, ADI-001, is below investigation within the therapy of relapsed or refractory B-cell non-Hodgkin’s lymphoma, in an ongoing Section 1 examine. The drug acquired the FDA’s Quick Monitor designation final 12 months, and in This fall Adicet launched interim information on security and efficacy.

The launched information confirmed a ‘favorable’ security and tolerability profile in any respect dose ranges, in addition to a 75% general response price (ORR) and a 69% full response (CR) throughout all dose ranges. The corporate is at present persevering with enrollment within the trial, with the purpose of acquiring extra information on sturdiness of response in help of a deliberate Section 2 dose. Further updates are anticipated in 2Q23.

Whereas these information have been optimistic, the corporate’s inventory fell sharply after the outcomes have been launched. Considerations have been raised over the six-month full response price, as the information confirmed an entire response price for dose ranges 2 and three of simply 33%. The corporate plans to deal with these points with the dose degree 4 course of underway. Within the meantime, shares in ACET are down 74% for the previous 12 months.

Regardless of the considerations over the sturdiness problems with ACI-001, Wedbush analyst Robert Driscoll stays upbeat on Adicet by way of the remainder of this 12 months. Explaining his place, Driscoll says, “We proceed to imagine the information stay spectacular with an ORR of 75% included a putting 5/5 CRs in LBCL sufferers who relapsed after prior CD19 CAR-T remedy, and count on longer-term sturdiness information from extra dose cohorts will present higher perception into potential sturdiness. We see ACET’s platform as considerably differentiated, and see important upside potential for shares over the subsequent 12–18 months as applications progress.”

This justifies the Outperform (i.e. Purchase) score, in Driscoll’s view, and the analyst’s $30 worth goal signifies his confidence in a hefty 482% upside for the subsequent 12 months. (To look at Driscoll’s observe file, click on right here)

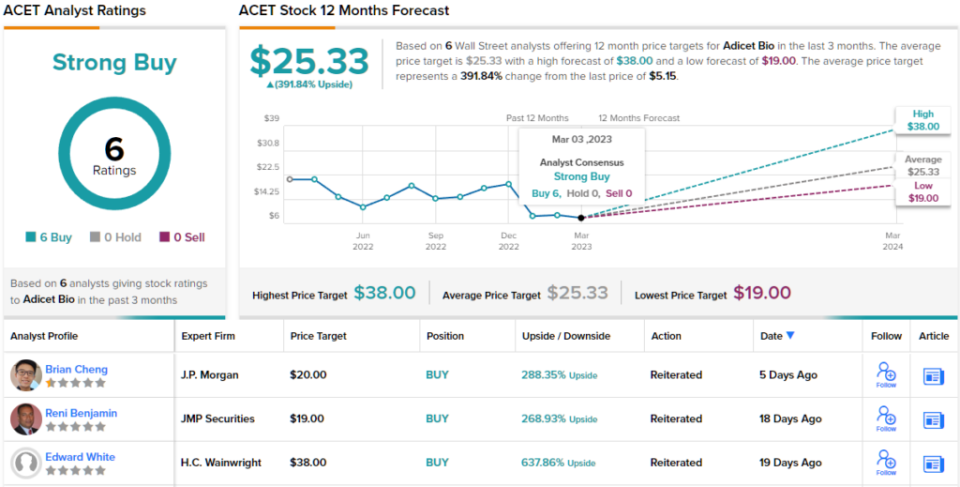

General, with 6 latest analyst opinions, all optimistic, Adicet’s inventory has earned its Sturdy Purchase consensus score. The shares are buying and selling for $5.21 and the typical worth goal, which stands at $25.33, suggests a powerful acquire of ~392% mendacity forward. (See ACET inventory forecast)

Design Therapeutics (DSGN)

For the final inventory on our checklist, we’ll persist with the biotech sector. Design Therapeutics, one other research-oriented biopharma, is targeted on discovering disease-modifying remedies that concentrate on underlying causes of inherited nucleotide repeat enlargement circumstances. Briefly, the corporate is creating new therapeutic brokers for genetically-based degenerative ailments with excessive unmet medical wants.

Design’s method relies on gene focused chimeras (GeneTACs), forming the bottom of small-molecule genomic medicinal brokers. These novel drug candidates work by modifying the faulty inherited nucleotides that underlie the focused circumstances.

The corporate’s analysis pipeline at present options three tracks, two of that are attracting investor consideration. Essentially the most superior, on the Section 1/2 medical stage, is drug candidate DT-216, a possible therapy for Friedreich Ataxia. The Section 1 stage of the trial is ongoing, evaluating grownup sufferers to construct a profile on security, tolerability, pharmacokinetics, biodistribution, and pharmacodynamic results, all based mostly on three weekly doses. Earlier outcomes, based mostly on the single-ascending dose (SAD) portion of the trial confirmed that DT-216 was typically well-tolerated; outcomes from a a number of ascending dose (MAD) portion are anticipated by the center of this 12 months, and the Section 2 portion of the trial is deliberate for initiation in 2H23.

In one other improvement of be aware to buyers, the corporate’s second drug candidate, DT-168, stays on observe for a Investigational New Drug (IND) submission in 2H23. This is a vital regulatory milestone, and approval will clear the best way for human medical trials. DT-168 is a possible therapy for the genetic eye illness Fuchs Endothelial Corneal Dystrophy, or FECD.

Regardless of the optimistic place of the corporate’s analysis applications, shares in DSGN are down by 68% prior to now 12 months.

That mentioned, RBC analyst Leonid Timashev takes a bullish stance on the corporate and believes the shares will push forward from right here.

“The workforce continues to execute on DT-216, with this system nonetheless on observe for information mid-year and a ph.II begin in 2H23. Moreover, we be aware the corporate continues to maintain prices below management whereas progressing lead program DT-216 by way of ph.I MAD work and two extra geneTACs in the direction of the clinic. With shares having pulled again following the December SAD uptake, we imagine buyers are undervaluing the demonstrated proof of precept, and we search for extra validation as this system progresses by way of MAD and ph.II to assist shares recuperate,” Timashev opined.

These feedback again up Timashev’s Outperform (i.e. Purchase) score and he has set the one-year worth goal at $24, implying a acquire of ~340% in that point. (To look at Timashev’s observe file, click on right here)

Wanting on the consensus breakdown, different analysts are on the identical web page. With 4 Buys and no Holds or Sells, the phrase on the Road is that DSGN is a Sturdy Purchase. DSGN shares are priced at $5.46 and their $27 common goal implies a whopping 394% acquire within the subsequent 12 months. (See DSGN inventory forecast)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.