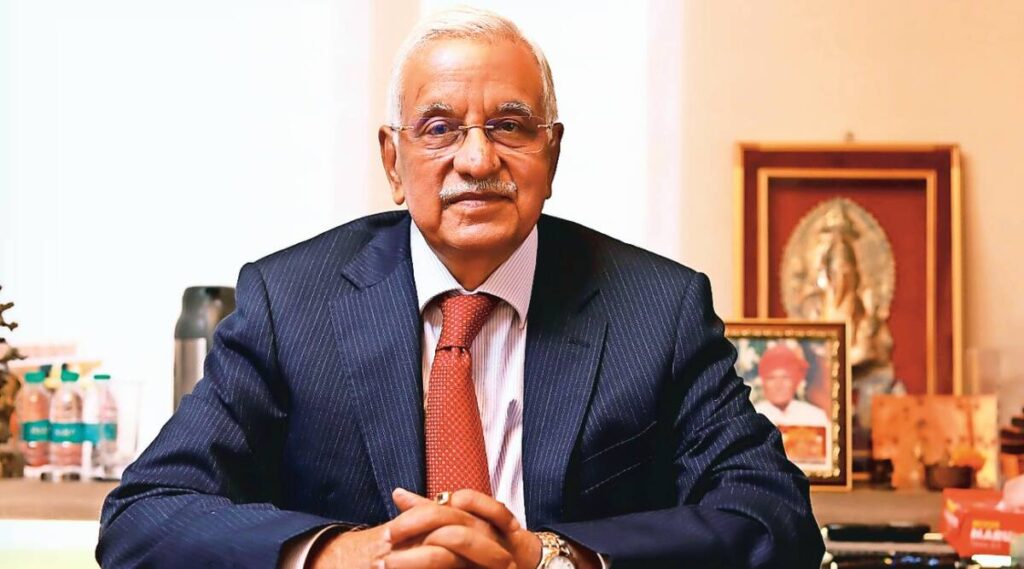

Even because the world economic system is dealing with macroeconomic challenges, the Indian economic system has been termed as comparatively secure and so have been the Indian fairness markets. Anand Rathi, chairman AnandRathi Group informed Sandeep Singh that India ought to goal a GDP progress charge of at the very least 8-10 per cent for the following decade or two. Stating that India must construct infrastructure at a sooner tempo, he additionally mentioned that it was necessary to ease laws and belief individuals with the intention to nurture entrepreneurship and enterprise atmosphere. Edited excerpts:

How do you see India within the present international atmosphere?

I believe it’s the starting of India taking a unique flip and position with respect to the western world. Whereas I believe that we might not be capable of replicate what China did, we’re shifting in that course when it comes to progress. A number of modifications which have been pushed by the federal government over the previous couple of years have been far reaching ones and I consider they’ll have a superb impact.

India ought to goal a minimal GDP progress charge of 8-10 per cent for the following 1-2 a long time to maintain the inhabitants it has.

Traditionally, if we have a look at any nation, their highest progress was achieved once they have been creating their infrastructure — a long-term funding — and that’s what’s going on in India, although at a slower tempo than desired. If that’s one space we have to tackle, one other space is capital items and defence.

I’m hopeful that the modifications could be seen from this decade onwards and we received’t miss out on the alternatives which can be there. India goes to be a taking place place and there’s going to be sooner progress.

What’s required from the federal government to realize this minimal 8-10 per cent progress?

Authorities has performed a key position in no matter we’ve got achieved to date and the largest act was opening up the economic system in 1991. Even going ahead, it has to play a task however the important thing benefit that India has is its entrepreneurship. The nation has reached to this degree due to the large entrepreneurial drive. I believe managing enterprise in India is most tough compared to anyplace on this planet, however nonetheless individuals have succeeded as they’re keen to face hurdles and difficulties as they develop.

We’ve to make it simpler to do enterprise in India and all reforms must be a part of it. Whereas we’ve got carried out away with some approvals, however on the identical time some extra are being added. I consider that bureaucratic involvement ought to be lowered. I can see that some administrative departments take 6 months to a yr to approve. A person might have the land however he can’t do something. In addition to that, we additionally want agricultural, land and judicial reforms.

What are the important thing challenges that you simply suppose can are available in the way in which of India’s progress?

Infrastructure is the at first problem; second is reforms which we want significantly to make it simple to do enterprise. Third, our monetary system ought to turn out to be stronger and availability of cash — debt or fairness — ought to be simple.

At some stage, individuals are a bit scared and the system of belief has taken a beating. There’s a feeling of mistrust and we have to make issues simpler for individuals to each stay and do enterprise. We’ve huge alternative and entrepreneurship and if we are able to try this, India will take-off.

Whereas big investments have are available in fairness markets each from home traders and FPI, don’t you suppose the funding basket has not elevated and that’s creating some danger?

There are firms which can be rising from small to medium cap and from medium cap to massive cap, however sure we want extra firms. I might say that there are various firms in India that may go public however many promoters really feel that there’s an excessive amount of regulation. So, typically overregulation, which is one thing we should look into, is a priority. The truth is, many individuals are even pondering of taking their publicly listed firms, personal. There’s a sense amongst promoters that though they’ve 70-75 per cent stake, they’re made answerable to everybody.

I consider that regulation ought to be minimal and there must be belief in individuals. How a lot are you able to regulate? No matter regulation you’ve gotten, some unhealthy apples will at all times be there. One fundamental precept is that there should be belief between the federal government and the individuals. What we’ve got seen is that further powers which can be being given to varied authorities is leading to extra misuse than use and it’s rising as an enormous problem.

What would you advise a retail investor?

I believe that retail traders ought to depart fairness funding selections with mutual funds. They need to not turn out to be a danger fund and mustn’t put cash in dangerous belongings, however as an alternative go along with confirmed firms. Fairness is a good funding avenue and I believe it’s one of the simplest ways to place cash, whether it is meant for the long run. I count on 13-15 per cent CAGR over the following 5-10 years.