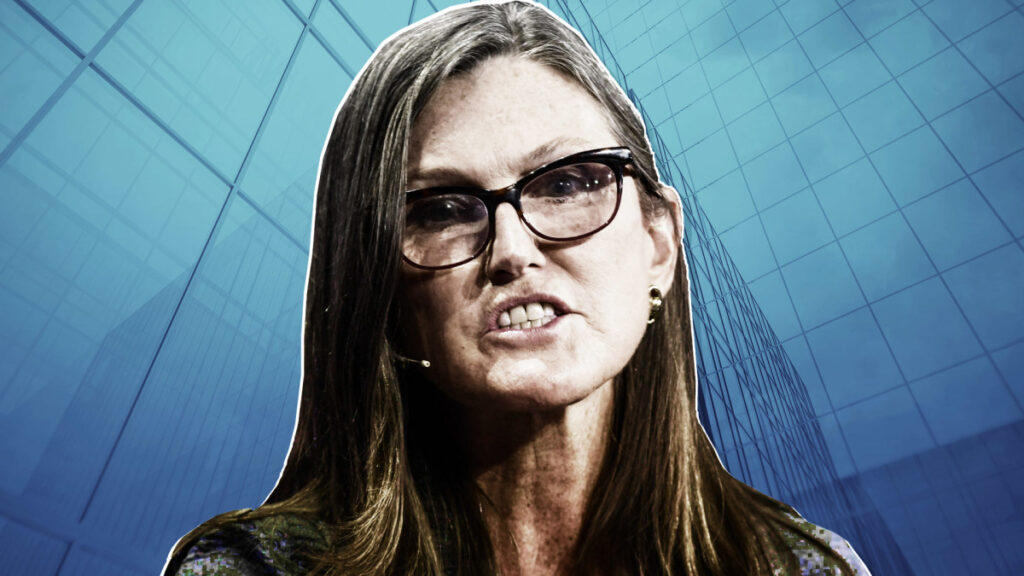

It’s been a tough 2022 for famed cash supervisor Cathie Wooden, chief government of Ark Funding Administration, as her exchange-traded funds sink.

Wooden’s flagship fund, Ark Innovation ETF (ARKK) , plunged 64% yr to this point via Oct. 14, hitting a five-year low. Ark Innovation has tumbled 79% from its February 2021 file excessive.

Hovering rates of interest and sluggish financial development have dented Wooden’s younger, “disruptive” (as she describes them) expertise corporations. Rising charges damage them as a result of their earnings stream will come down the highway (if in any respect), whereas the secure yields of Treasury bonds are rising now.

Ark Innovation’s largest holding, electrical car titan Tesla (TSLA) , has misplaced 42% yr to this point. No. 2, video conferencing firm Zoom Video Communications (ZM) , has plummeted 61%. And No. 3, video streaming service Roku (ROKU) , has dived 78%.

Wooden calls this yr’s descent by tech shares a shopping for alternative. And she or he defends her current losses by noting that she has a five-year funding horizon.

5-12 months Underperformance

The five-year observe file of Ark Innovation may certainly give traders consolation as much as Might 9. The fund’s five-year return beat that of the S&P 500 till then.

However the five-year annualized return of Ark Innovation totaled a paltry 1.07% via Oct. 14, far behind the S&P 500’s 8.93% return, in keeping with Morningstar.

Regardless of that underperformance, the $6.7 billion fund loved a web influx of $1.27 billion yr to this point via Oct. 13, in keeping with VettaFi, an ETF analysis agency. Clearly many traders are loyal to Mama Cathie, as some followers name her.

However the tide could also be beginning to flip. Over the 5 days via Oct. 13, Ark Innovation suffered a $204 million outflow.

Investor Loyalty

You would possibly marvel why so many traders have caught with Wooden, regardless of her mediocre returns. The truth that she had one spectacular yr definitely helps. Ark Innovation ETF skyrocketed 153% in 2020.

Additionally, Wooden has change into one thing of a rock star within the funding world. She has appeared continuously within the media during the last couple years. She is clearly clever and articulate, explaining monetary ideas in ways in which novice traders can perceive.

Nonetheless, Wooden has drawn detractors. On March 29, Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation.

“ARKK reveals few indicators of enhancing its danger administration or capability to efficiently navigate the difficult territory it explores,” he wrote.

Wooden countered Greengold’s factors in an interview with Magnifi Media by Tifin. “I do know there are corporations like that one [Morningstar] that don’t perceive what we’re doing,” she stated.

If Wooden’s funding efficiency rebounds, her true believers will say, “I advised you so.” If it doesn’t, will probably be attention-grabbing to see how lengthy traders are prepared to stay together with her.