Semiconductors are among the many most important applied sciences on the planet. They allow all the things from thermostats to smartphones to autonomous autos. Now, synthetic intelligence (AI) calls for even increased efficiency. These high-performance merchandise are so vital that there’s geopolitical pressure between the U.S. and China associated to import and export bans and Taiwan, the place a lot of the world’s semiconductors are manufactured.

Due to the excessive demand and wholesome tailwinds, many trade shares, together with Arm Holdings (NASDAQ: ARM), took off in 2024. The passion pushed Arm’s valuation to nosebleed ranges, however the current market sell-off has pulled Arm down almost 40% from its current highs, as proven beneath.

Arm is a unique form of semiconductor firm, and this can be a massive benefit. Let’s look at what it does and whether or not the downturn is a golden alternative.

Why is Arm’s enterprise mannequin so fascinating?

Arm Holdings is a semiconductor firm that does not really produce semiconductors. As an alternative, Arm designs the “infrastructure” for central processing unit (CPU) chips that its clients, like Apple, Samsung, Alphabet, Nvidia, and Taiwan Semiconductor Manufacturing (NYSE: TSM), use as a blueprint for constructing. Arm then receives funds for licensing and royalties based mostly on the variety of merchandise bought. The cumulative variety of Arm-enabled chips is 287 billion, and so they seize 99% of the worldwide smartphone market.

As a result of Arm just isn’t a producer, its monetary outcomes resemble these of a software program firm due to three traits:

Arm does not want to speculate a variety of capital in factories and tools (often called capital expenditures) like different semiconductor corporations do. Arm spends lower than 5% of its income on capex, whereas Taiwan Semiconductor, for instance, routinely spends greater than 30%. Due to the tiny spend on capex, Arm translated 20% of income, or $709 million, into free money circulation over the previous 12 months.

On the gross margin entrance, Arm compares favorably to software program corporations like Palantir Applied sciences (NYSE: PLTR) and is properly forward of different semiconductor shares, as depicted beneath.

A excessive gross margin usually means an organization can convert extra incremental gross sales progress into web income.

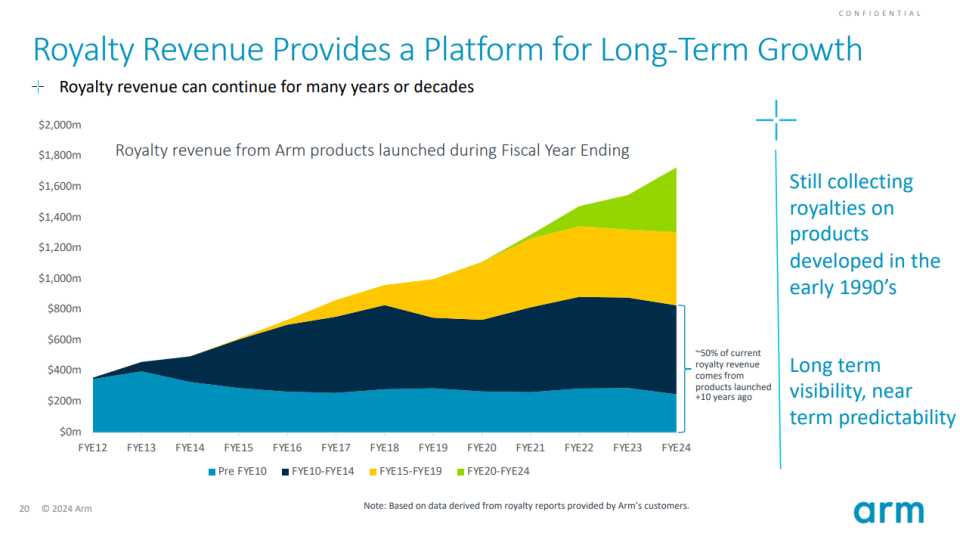

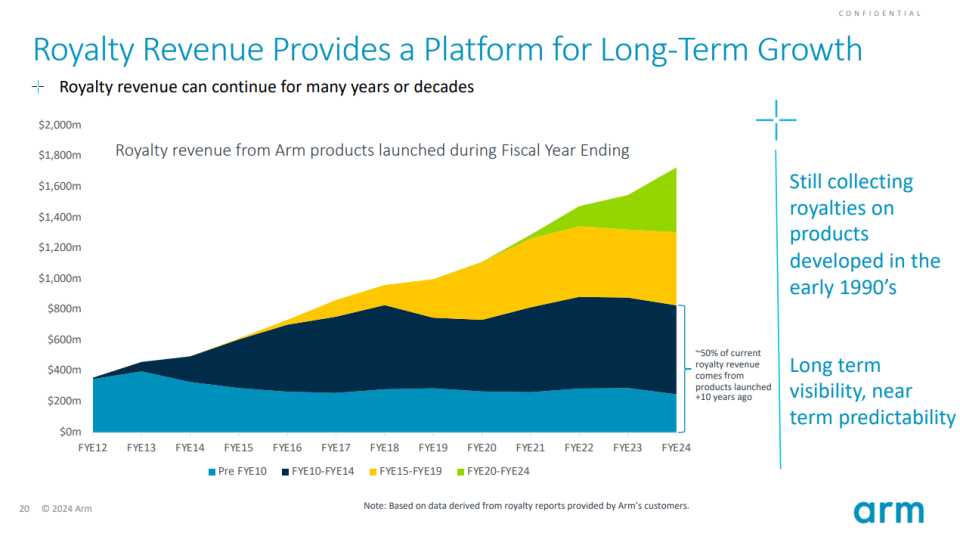

Lastly, Arm’s income is not simply recurring; it additionally takes benefit of legacy merchandise. When Arm creates a brand new product for a brand new use case, its older designs nonetheless promote. As proven beneath, this permits the corporate to “stack” new gross sales on high of previous.

Royalties from older merchandise are excellent for the underside line because the analysis and growth prices had been paid for years in the past. This enterprise mannequin is terrific for profitability.

Is Arm Holdings inventory a purchase now?

With its fascinating enterprise mannequin and brisk tailwinds, it is no marvel buyers bid the top off from its September 2023 IPO value of $51 to over $180 per share. Nonetheless, valuation remains to be vital. At its peak, Arm inventory traded for greater than 50 instances gross sales. The current sell-off decreased this to 34 and the share value to underneath $115; nonetheless, that is nonetheless pricy.

Many buyers and analysts think about Palantir richly valued. As proven beneath, Arm’s price-to-sales (P/S) ratio remains to be 25% increased than Palantir’s after the current correction.

Arm is a terrific firm that can most likely make buyers hefty income over the lengthy haul, however shares might proceed to fall within the brief time period because of the valuation. There are instruments buyers can use to handle short-term danger, like dollar-cost averaging, shopping for on dips, or just ready patiently for the valuation to fall. When it does, I will be able to pounce.

Must you make investments $1,000 in Arm Holdings proper now?

Before you purchase inventory in Arm Holdings, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Arm Holdings wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $641,864!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 6, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Alphabet, Arm Holdings, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Units, Alphabet, Apple, Nvidia, Palantir Applied sciences, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Arm Holdings Plummets 40% Amid the Promote-Off, Is It a Robust Purchase Now? was initially revealed by The Motley Idiot