WASHINGTON, April 3 (Reuters) – Federal Reserve officers, more and more assured they’ve nipped a possible monetary disaster within the bud, now face a tough judgment on whether or not demand within the U.S. financial system is falling and, if that’s the case, whether or not it’s coming down quick sufficient to decrease inflation.

If the U.S. central financial institution’s coverage assembly two weeks in the past was dominated by concern {that a} pair of financial institution failures risked broader monetary contagion – a possible purpose to pause additional rate of interest will increase – debate has shortly refocused on whether or not tighter financial coverage has began to indicate its impression on the broader financial system, or if charges must rise greater nonetheless.

The choice will probably be a vital one because the Fed plans the ultimate steps in what has been a historic charge mountain climbing cycle, with policymakers nonetheless hoping to keep away from the form of deep financial downturn triggered by elevating charges too far, but additionally decided to not do too little and permit inflation to stay excessive.

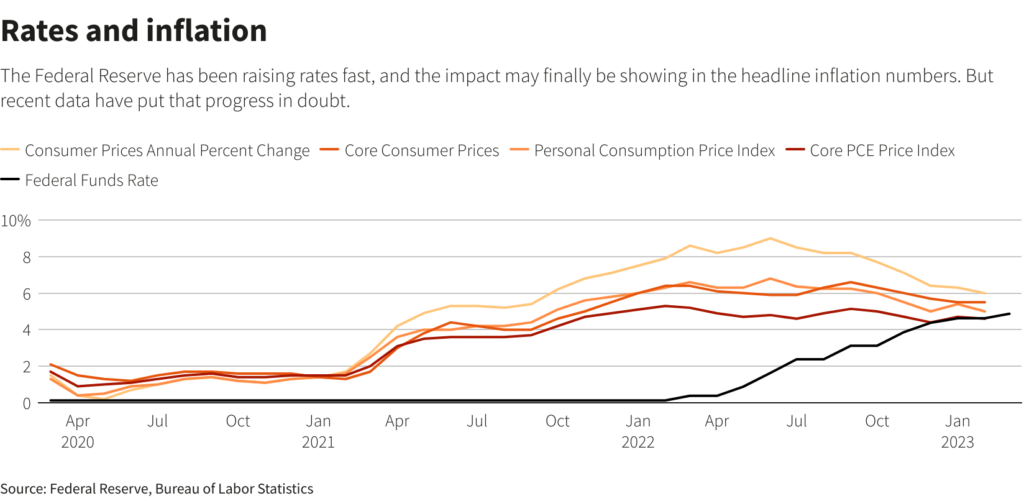

The 9 charge hikes delivered by the central financial institution since March of 2022 have pushed the benchmark in a single day rate of interest from the near-zero degree to the present 4.75%-5.00% vary, a tightening tempo not seen since Paul Volcker was Fed chair within the Nineteen Eighties. Client and enterprise rates of interest have adopted go well with.

But information launched on Friday confirmed the Fed’s most well-liked measure of inflation was nonetheless operating at 5% yearly, greater than double the two% goal, and projections issued by Fed policymakers on March 22 indicated charges wanted to rise a bit extra. Additionally embedded in these projections is the form of rise within the unemployment charge, from the present 3.8% to 4.6% by the tip of the 12 months, and progress slowdown sometimes related to recession, one thing Fed Chair Jerome Powell and his colleagues nonetheless preserve they’ll keep away from.

“It’s completely a steadiness … There are uncertainties,” Boston Fed President Susan Collins mentioned in an interview with Bloomberg Tv on Friday. “We do must steadiness the danger that we do not do sufficient … do not maintain the course, and do not convey inflation down … On the identical time I do monitor the information, once we may see the financial system turning. … It’s early days but.”

Richmond Fed President Thomas Barkin struck an identical observe final week. “Inflation continues to be very excessive. The job market continues to be very tight,” he informed reporters. “If you elevate charges there’s at all times the danger of the financial system softening quicker than it might need in any other case. In case you do not elevate charges, there’s the danger of inflation getting uncontrolled.”

That back-and-forth will play out between now and the Fed’s subsequent coverage assembly on Might 2-3, when officers will resolve whether or not to press forward with one other quarter-of-a-percentage-point charge enhance and sign if much more hikes are to return, or defer to early proof that buyers are lastly feeling the pinch of tighter credit score and better borrowing prices.

CREDIT CONCERNS

On an inflation-adjusted foundation, client spending dipped in February, whereas more moderen weekly information on bank card spending from retail banking giants like Citi and Financial institution of America pointed to a client pullback. Client sentiment has additionally edged decrease, a attainable precursor to retrenchment.

The Labor Division’s launch this coming Friday of the March employment report will probably be an vital snapshot for the Fed of whether or not a red-hot job market is cooling – one thing that will additionally trigger demand to sluggish.

Buyers at the moment regard the Fed’s charge resolution subsequent month as a toss-up, the primary time that has been the case for the reason that present tightening cycle started in March of 2022.

Issues stay in regards to the banking sector and the situation of credit score markets.

On the final Fed assembly, Powell famous that even when additional financial institution failures are averted, lending establishments should still grow to be extra cautious and, by curbing entry to credit score, sluggish the financial system quicker than anticipated. That’s partly how financial coverage is meant to function, but when the method goes too far or too quick it might increase the danger of a recession, one thing Minneapolis Fed President Neel Kashkari has warned about.

The potential for an acute disaster, nonetheless, appears to have receded. Fed emergency lending to banks, which jumped within the week after the March 10 collapse of Silicon Valley Financial institution and failure of Signature Financial institution two days later, declined final week in an indication that monetary sector stress was easing.

Total credit score supplied by banks fell barely within the week ending March 22 to a seasonally adjusted degree of $17.53 trillion from $17.6 trillion the week earlier than. Total financial institution deposits fell, however rose barely on the smaller establishments the place latest monetary stress has been targeted.

Even when credit score slows or dips, that will not translate clearly into much less spending – and decrease inflation – so long as the job market stays as sturdy as it’s.

“Individuals will proceed to spend so long as they receives a commission,” mentioned Yelena Shulyatyeva, senior U.S. economist with BNP Paribas. “They get a bit of bit much less entry to credit score, is it going to actually have an effect on the selections? It is going to, however solely on the level at which they cease getting paid” due to a slowing financial system and rising unemployment.

‘MARKED CHANGE’

However no matter how a lot or little an upcoming “credit score crunch” impacts the financial system, there are indicators client habits is already beginning to flip.

The private financial savings charge, for instance, has risen steadily from 3% – a pandemic-era low and nicely beneath the extent of latest years – to 4.6%, a textbook response to the upper yields savers can now earn on cash market funds and different short-term money accounts, with much less disposable revenue left for spending.

Current spending and financial savings information present “a marked change in client behaviors … with inflation prompting extra warning,” Diane Swonk, chief economist at KPMG, wrote after the discharge final week of the latest private consumption statistics.

A latest decline in client sentiment was coupled with a drop in inflation expectations, one thing that would give the Fed confidence to be extra cautious with any additional charge will increase, permitting its inflation combat to spool out over an extended time however with much less threat of a full-on recession.

Karen Dynan, a Harvard College economics professor and senior fellow on the Peterson Institute for Worldwide Economics, mentioned her outlook was for the Fed to face a “slog” in opposition to inflation that can require extra charge will increase however, due to the power of family steadiness sheets and the labor market, skirt a recession.

Current financial institution stress “has achieved a little bit of the Fed’s work for it, however I do not view it as a full substitute,” she mentioned.

Finally, the labor market must give approach at the least considerably, reducing demand and pushing the U.S. financial system’s output far sufficient beneath its potential for costs to fall.

“I do not assume growing ‘slack’ is the entire story,” Dynan mentioned, with issues like improved provide and falling rents serving to decrease the tempo of value will increase, however “some cooling of client and labor demand will probably be wanted.”

Reporting by Howard Schneider;

Enhancing by Dan Burns and Paul Simao

: .