As two of the world’s largest and most prolific drugmakers, Pfizer (NYSE: PFE) and AstraZeneca (NASDAQ: AZN) each have grand visions for tips on how to develop even bigger over the approaching years. And with billions of {dollars} dedicated to analysis and improvement, it is virtually sure to result in the invention of recent golden-goose medicines that ought to enrich shareholders.

However for buyers, the main points about how these billions will probably be spent, and the way these profitable therapies will probably be discovered, are essential. And on that foundation, it seems that buyers can have extra to love about AstraZeneca’s plans than Pfizer’s. Let’s examine why that is the case.

These ambitions are greater and higher

Pfizer’s strategic plan for 2030 is to develop whole income by no less than $45 billion, utilizing a mix of inside analysis and improvement (R&D) and enterprise improvement actions like acquisitions, licensing offers, collaborations, and buying of engaging pharmaceutical belongings.

Whereas the imaginative and prescient requires persevering with to compete in lots of the similar segments as earlier than, most cancers medicines are an space of explicit focus. If all the pieces goes as deliberate, the corporate will produce no less than eight new blockbuster medicines earlier than the shut of the last decade.

In 2023, Pfizer introduced in $58.5 billion in income. Subsequently, its aim is to achieve a high line of $103.5 billion. Which means it is hoping to recapture the glory days of 2022, when annual income was simply over $100 billion due to unimaginable demand for its coronavirus vaccines and antiviral capsules. Nonetheless, it’s going to take years of centered effort to surpass its all-time heights when it comes to gross sales.

Then again, AstraZeneca’s newest strategic plan is much more bold. Its income was $45.8 billion in 2023; administration is now hoping to achieve a sum of $80 billion by 2030, launching no less than 20 new medicines alongside the way in which. Twelve of these new medication every have the potential to usher in no less than $5 billion in gross sales annually.

If administration is to be believed, the enterprise will not must do an excessive amount of to achieve its objectives apart from execute on its core pipeline because it exists at present. Most cancers medication, rare-disease therapies, and biologics would be the segments of focus.

And whereas there are some plans for collaborations, acquisitions, and licensing offers alongside the way in which, AstraZeneca’s general method would not emphasize the necessity to do in depth enterprise improvement work. So it in all probability will not must take out a lot in the way in which of debt, thereby leaving it extra capital to put money into development, or return to shareholders, for years to come back.

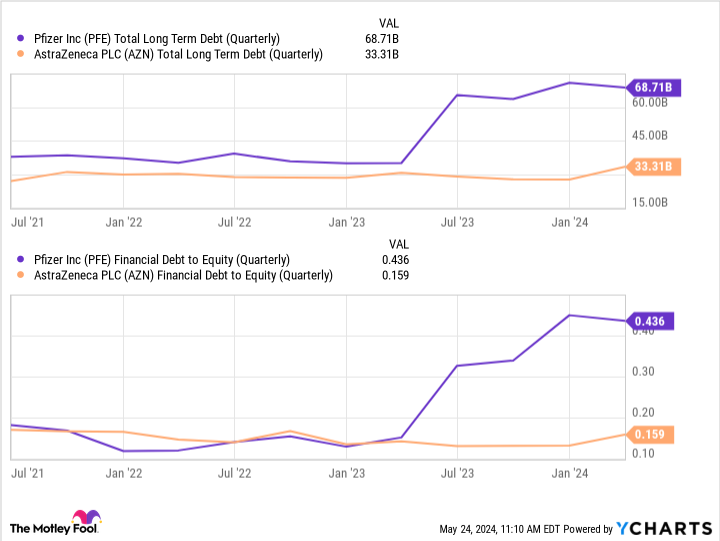

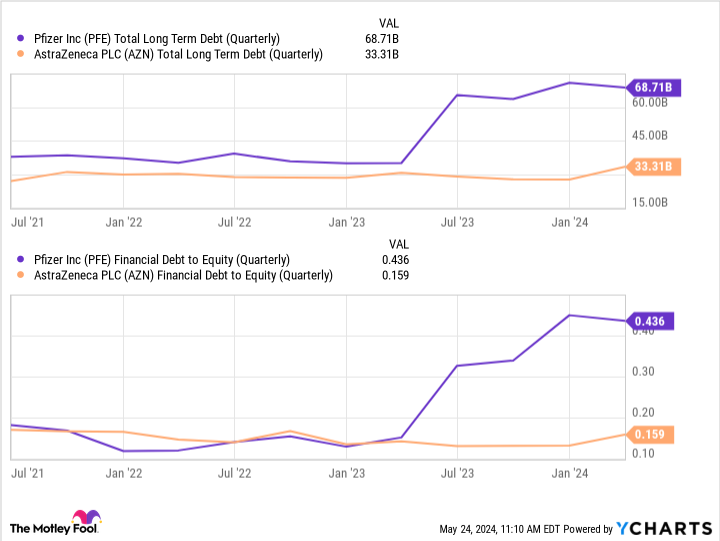

To see how that’ll go away AstraZeneca compared to Pfizer, check out this chart (are you able to guess when Pfizer began to make strikes to amass corporations as a part of its strategic roadmap?):

Ultimately that cash will should be paid again, and the method will doubtless be an extended one. AstraZeneca will not have that problem, and it will doubtless have extra high-profile medicines available on the market by 2030 as nicely.

Do not get too misplaced within the weeds right here

All of the elements above imply that AstraZeneca’s inventory is prone to durably outperform Pfizer’s if its medical trials proceed as anticipated and in the end yield worthwhile medicines.

Direct competitors between the businesses, almost certainly within the area of antibody-drug conjugates (ADCs) for most cancers, might lead to one gaining the higher hand in its shares of particular markets. However from an funding perspective, AstraZeneca nonetheless seems to be extra favorable.

Doing in depth enterprise improvement exercise to maintain the pipeline filled with promising applications is nothing new within the pharma trade. However needing to do it, as Pfizer’s leaders appear to be pondering it would, reveals a delicate insecurity within the consistency of the corporate’s pipeline (in each quantity and high quality). And there is nothing that is extra core to a pharma enterprise than a wholesome pipeline.

So, primarily based on these corporations’ ambitions, it is a safer guess to purchase AstraZeneca inventory than Pfizer over the following handful of years. It is unlikely that Pfizer’s grand plan will falter. However — particularly when you’re seeking to put money into one thing that is going to develop constantly — it now seems to be like AstraZeneca is a greater choice.

Do you have to make investments $1,000 in AstraZeneca Plc proper now?

Before you purchase inventory in AstraZeneca Plc, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and AstraZeneca Plc wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $697,878!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Might 28, 2024

Alex Carchidi has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Pfizer. The Motley Idiot recommends AstraZeneca Plc. The Motley Idiot has a disclosure coverage.

AstraZeneca Simply Massively One-Upped Pfizer. This is What It Means for the Inventory was initially revealed by The Motley Idiot