-

There are rising indicators the US financial system is about to enter a full-blown recession, mentioned Financial institution of America.

-

The financial institution cited worrying indicators in manufacturing and the roles market, and mentioned buyers aren’t listening to the dangers.

-

“Buyers too optimistic on charge cuts and never pessimistic sufficient on recession,” BofA mentioned.

Fears of an imminent recession have reached a fever pitch this yr, with everybody from Wall Avenue market strategists to firm CEOs warnings of a slowdown within the US financial system.

However thus far, no recession has materialized as the roles market and shopper spending have remained pretty resilient.

However based on Financial institution of America, there are many indicators that counsel a recession has not been averted. These are the 12 charts that point out the US is on the verge of coming into a full-blown recession, based on Financial institution of America’s Michael Hartnett.

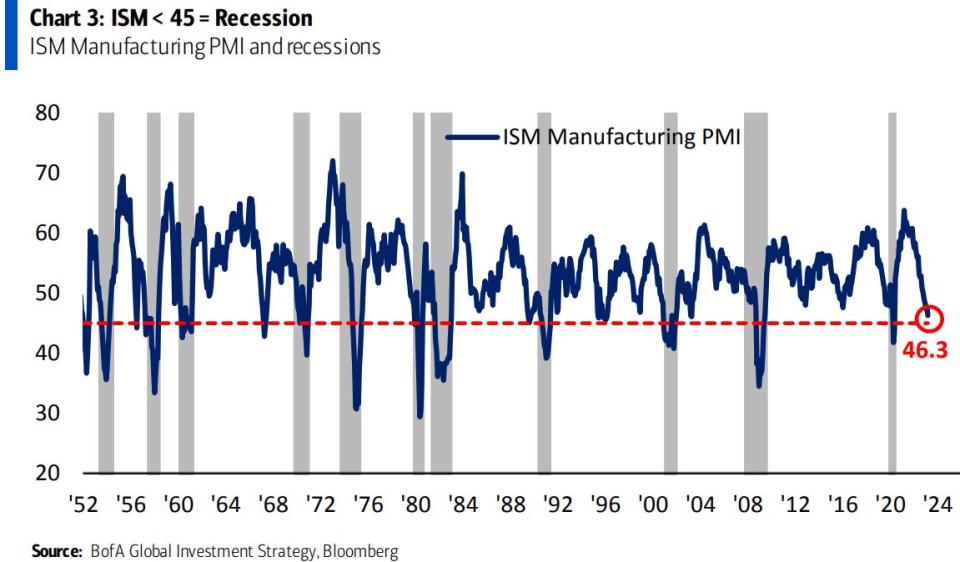

1. A decline in manufacturing exercise

“March ISM was 46.3, lowest since Could 2020. In previous 70 years each time manufacturing ISM dropped beneath 45, recession occurred on 11 out of 12 events (exception was 1967),” BofA mentioned.

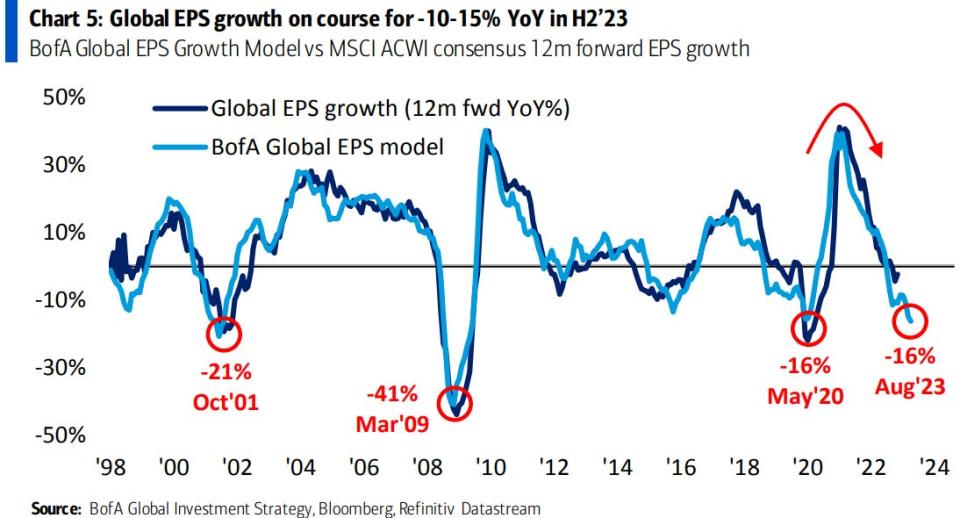

2. A decline in manufacturing typically coincides with decrease earnings

“New orders part of producing ISM at 44.3. New orders < 45 have coincided with EPS recessions (see 1991, 2001, 2008, 2020),” BofA mentioned.

3. International earnings mannequin suggests imminent decline

“BofA International EPS Progress Mannequin presently predicts EPS to fall -16% year-over-year by August. Mannequin is pushed by Asian exports, world PMIs, China monetary circumstances, US yield curve,” BofA mentioned.

4. Steepening yield curve typically precedes a recession

“US Treasury 2-year/10-year yield curve flattens and inverts in anticipation of recession. Yield curves steepen instantly as recessions start. US Treasury 2-year/10-year yield curve has steepened from -110 foundation factors to -50 foundation factors in previous 4 weeks,” BofA mentioned.

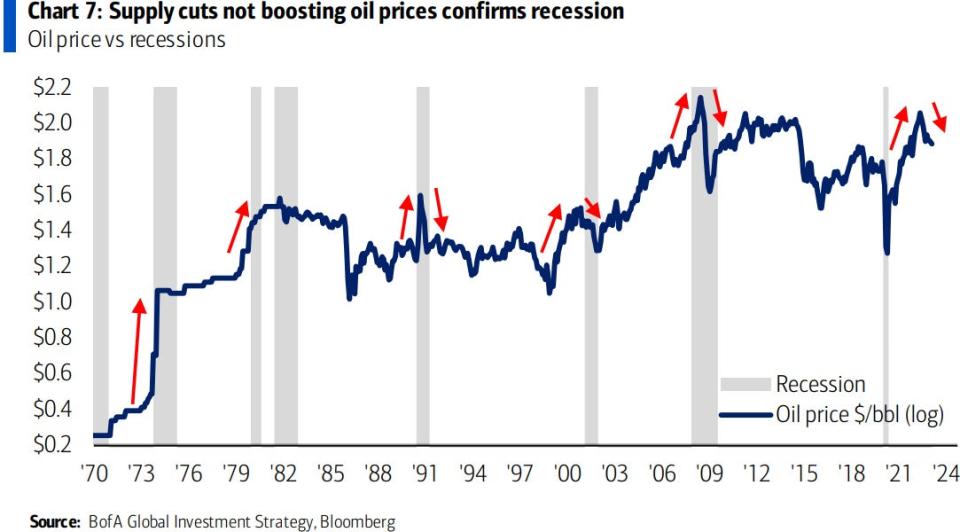

5. Worth of oil displaying issues of a recession

“Oil costs traditionally rise into recessions and decline throughout recessions. Newest OPEC+ output cuts underscore recession issues, with restricted upward pricing pressures from China reopening thus far,” BofA mentioned.

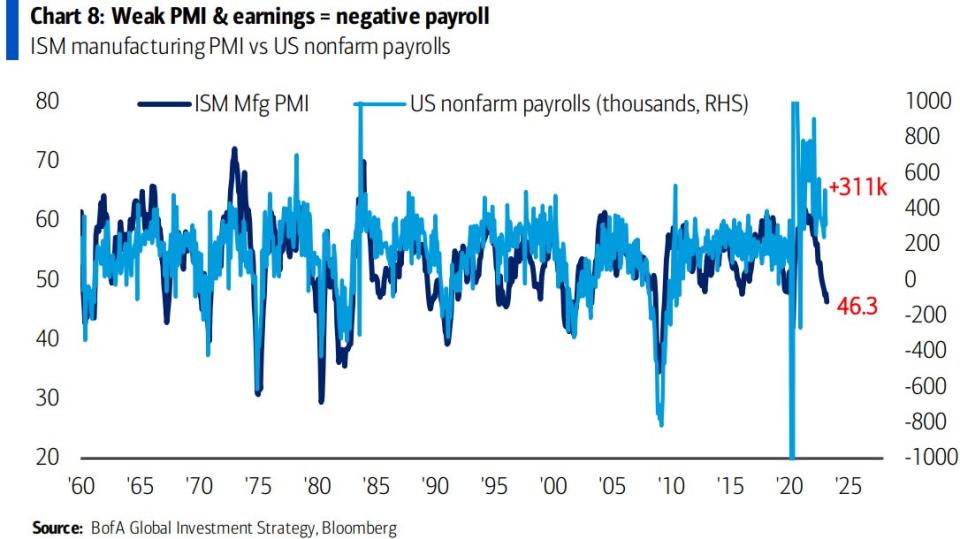

6. The roles market typically follows manufacturing exercise

“Weak ISM manufacturing PMI suggests US labor market will weaken subsequent few months,” BofA mentioned, including that it seen the February and March jobs report as “the final robust payroll studies of 2023.”

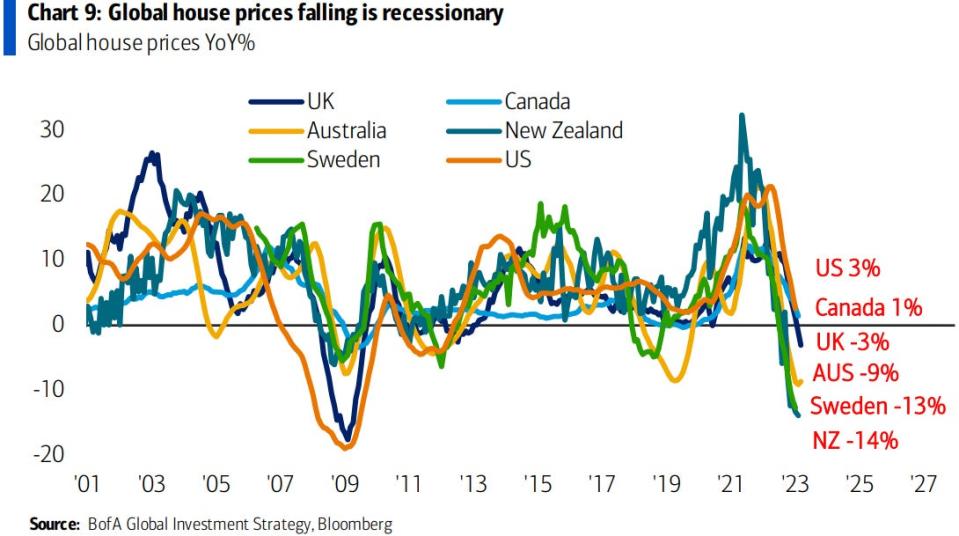

7. International dwelling costs are falling

“International home costs turning adverse as greater charges hit actual property in US, UK, Canada, Sweden, Australia, and New Zealand,” BofA mentioned.

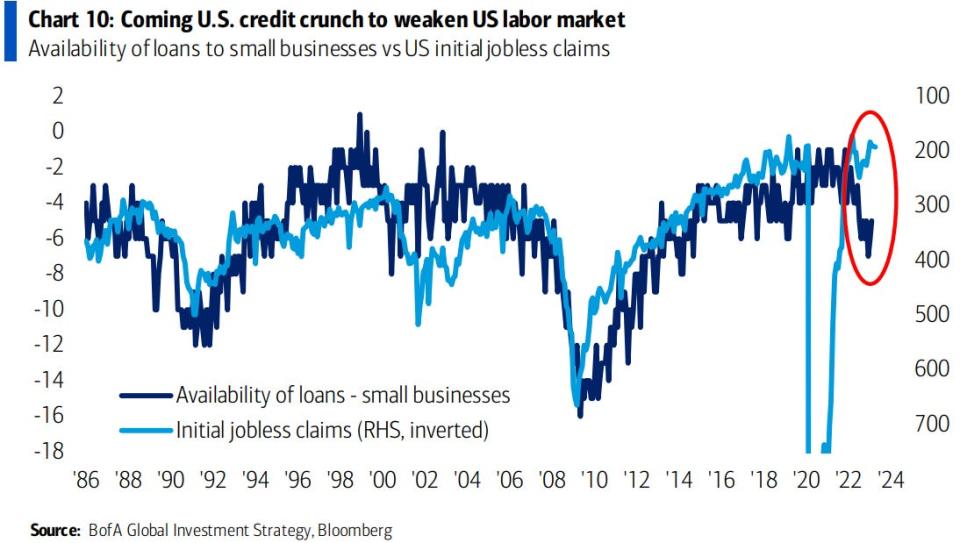

8. A credit score crunch will damage the roles market

“US banks have been tightening lending requirements to small corporations previous few quarters. Credit score crunch to accentuate and extremely correlated with small enterprise demand for staff. Ought to Could SLOOS report present drop in mortgage availability to -10 or beneath = unambiguous credit score crunch,” BofA mentioned.

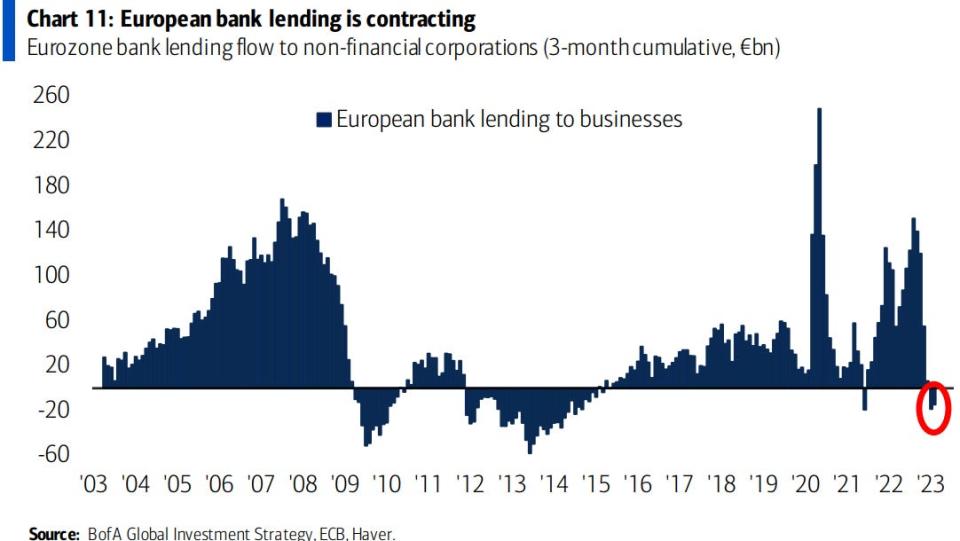

9. A decline in European financial institution lending

“Financial institution lending in Eurozone down three months in a row (very uncommon exterior Nice Monetary Disaster, Euro debt disaster, COVID). $14 trillion Eurozone financial system extremely depending on financial institution credit score,” BofA mentioned.

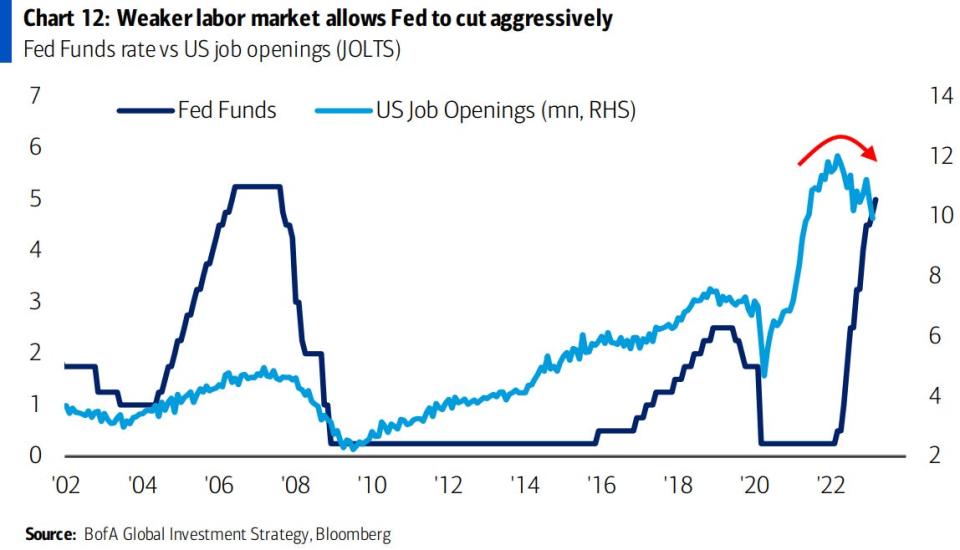

10. Weak jobs market results in huge rate of interest cuts

“Falling US job openings = weaker labor market = decrease Fed funds charge. Yield curve prone to steepen very dramatically subsequent six to 12 months as Fed cuts forward of election however long-end draw back inhibited by inflation and financial shenanigans,” BofA mentioned.

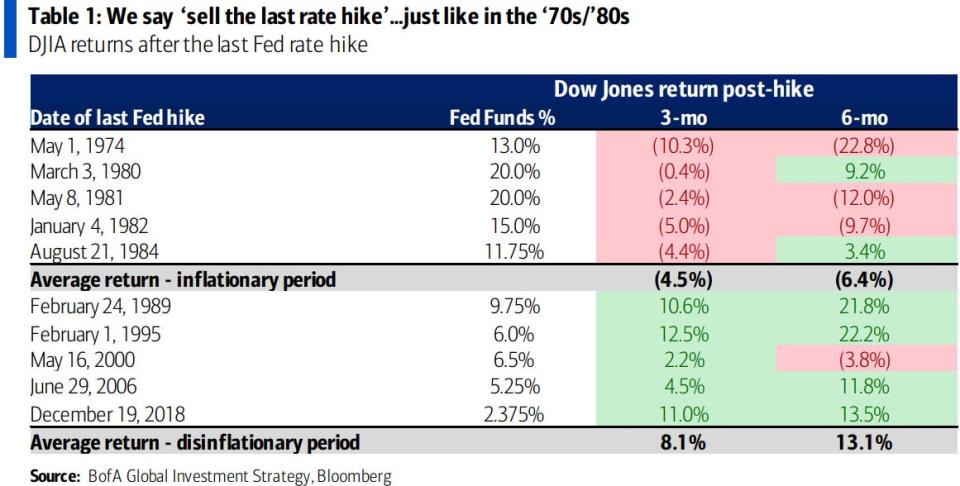

11. Shares dropped after final Fed charge hike in inflationary durations

“Our view: Promote the final charge hike. Buyers too optimistic on charge cuts and never pessimistic sufficient on recession. ‘Promote the final hike’ was right technique for shares in inflationary ’70s/’80s, ‘purchase the final hike’ labored within the ’90s disinflationary market,” BofA mentioned.

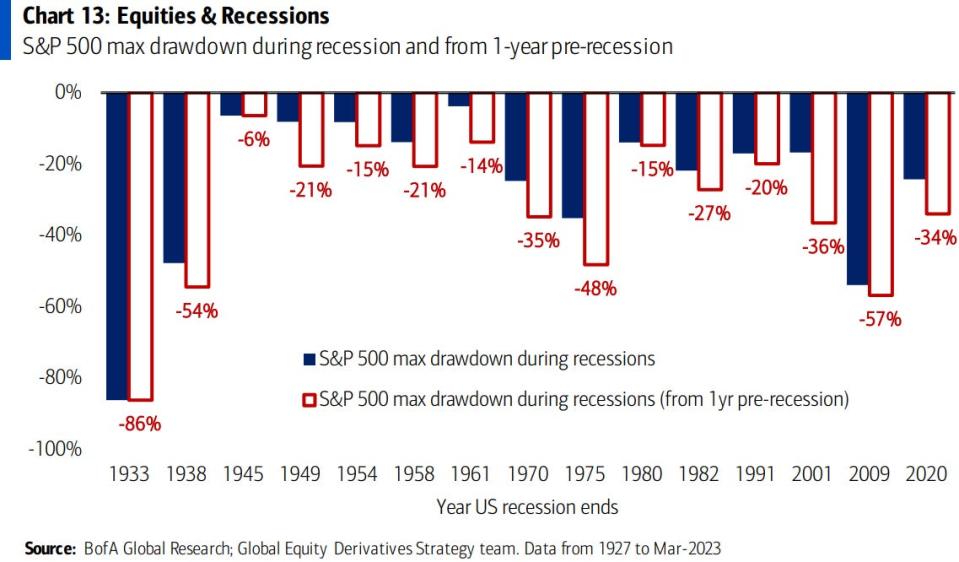

12. Shares and recessions do not combine effectively

“Recessions reliably adverse for equities all through historical past and insufficiently discounted upfront. Loads of room for extra S&P 500 draw back,” BofA mentioned.

Learn the unique article on Enterprise Insider