One in 5 Chinese language youths can’t discover a job. Oliver Jiang has to combat off employers with a stick.

When the first-time job-seeker posted his resume on a recruitment web site earlier this yr, his inbox exploded and his cellphone buzzed continuous. The 28-year-old doctoral grad spent the next month turning away suitors – together with one which promised him 15 months of pay a yr – earlier than touchdown his dream job at a $600 million funding agency.

Jiang is among the chosen few in China’s quickly evolving finance sector: a PhD in electrical automobile expertise. This type of methodical researchers steeped within the classical sciences are changing well-connected bankers as probably the most fascinating hires at enterprise capital companies throughout the nation – generally doubling their salaries after they swap over.

“Everyone’s looking out for deeptech expertise. A background in science and expertise is now usually listed as a should in job postings,” Jiang mentioned. “Who knew such robust demand would come from the enterprise capital sector?”

It’s a phenomenon that displays a broader shift on the planet’s No. 2 financial system. This month, Xi Jinping vowed to depose the US as a expertise chief and turn into self-sufficient – formalising a groundswell that’s been underway since Beijing in 2021 made it clear the times of freewheeling enlargement and deal-making that constructed web giants like Alibaba Group Holding Ltd. had been over.

The hassle is taking over urgency because the Biden administration escalated efforts to comprise its geopolitical rival, imposing a sequence of chip export restrictions in its most aggressive effort but to comprise China’s rise. Hardline nationalist media together with the International Occasions argued that may solely speed up Beijing’s ambitions. China’s prime expertise overseer convened a sequence of emergency conferences with main semiconductor firms, in search of to evaluate the fallout and pledging help for the vital sector.

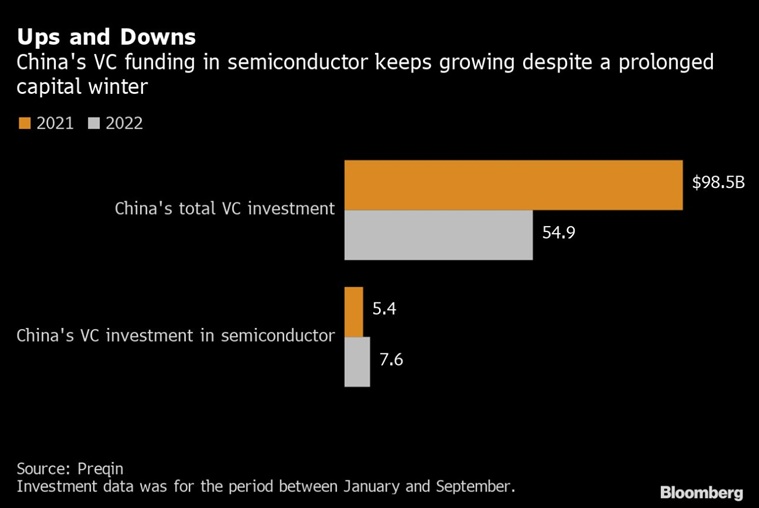

The nation’s whole startup funding has shrunk roughly 44% this yr by September from a yr earlier, however the quantity of enterprise cash flowing into semiconductor startups has really climbed by 40%, in keeping with international knowledge tracker Preqin.

The nation’s whole startup funding has shrunk roughly 44% this yr by September from a yr earlier, however the quantity of enterprise cash flowing into semiconductor startups has really climbed by 40%, in keeping with international knowledge tracker Preqin.

That final is what funding companies are relying on. As Chinese language buyers scramble to regain momentum by embracing hard-core tech startups, the nation’s seek for the subsequent Tesla or SpaceX has fueled demand for bona fide engineers like Jiang.

“It’s a means for enterprise capitalists to distinguish their funds and compete for one of the best startups at a time when fund-raising has confirmed to be more difficult for all however for the very prime tier,” says Rebecca Fannin, founding father of Silicon Dragon Ventures that researches tech traits in China. “The cash is following the tech, deeper tech that’s.”

Spooked by the ferocity of final yr’s web crackdown, China’s fast-reacting tech funding business is taking no probabilities this time. As soon as rivalling Silicon Valley, Beijing’s heightened scrutiny and Xi’s Covid-zero coverage specifically have crippled China’s startup funding business.

Whereas there’s little dependable knowledge on the secretive business, the overwhelming majority of latest hires since 2021 at enterprise capital companies have sported science and technological credentials, in keeping with interviews with startup financiers and recruiters.

There’s no assure that stacking the deck with PhDs produces higher yields. The struggle for expertise can also be inflating prices for enterprise companies battling a worsening drought in capital, the aftermath of the tech crackdown and a realisation that the simple double-digit returns of years previous aren’t any extra.

However what’s forcing their hand is the indisputable fact that buyers as soon as enamoured of the buyer and cellular web are shifting their focus, heeding indicators from Xi’s administration that’s prioritising semiconductors, clear power and synthetic intelligence to wean China off a reliance on American suppliers.

The nation’s whole startup funding has shrunk roughly 44% this yr by September from a yr earlier, however the quantity of enterprise cash flowing into semiconductor startups has really climbed by 40%, in keeping with international knowledge tracker Preqin.

Hillhouse Capital Group, the personal fairness big that made its identify as an early backer of Tencent Holdings Ltd. and JD.com Inc, just lately raised its first “carbon-neutral” fund devoted to local weather applied sciences.

Then there’s Sinovation Ventures. The Beijing-based enterprise agency based by former Google govt Kai-Fu Lee plans to increase its funding crew by roughly 15% this yr – with new additions engaged on elementary expertise. That comes as almost all of the enterprise capitalists there now dedicate their consideration to startups alongside these strains. In contrast, solely half of its buyers did that 5 years in the past.

The hiring of deep-tech buyers is significant for Chinese language enterprise companies to succeed, some business observers say. That’s a sea change from only a decade in the past. Xiong Hao, a semiconductor researcher who returned from the US to hitch China’s then-nascent enterprise funding sector within the early 2010s, deliberate to construct a profession on discovering and funding startups on the cutting-edge of science and expertise. No one cared.

“Deep-tech startups within the nation had been few and much between,” recalled Xiong, now a companion at Sinovation. “Buyers would additionally query your selection of funding – ‘Why not decide web firms that might develop right into a monopoly and provides us a house run?’”

Xiong now co-leads a workforce of six individuals hoping to groom the Chinese language model of graphics chip pioneer Nvidia Corp. and chip-equipment maker Utilized Supplies Inc. He plans to rent 4 extra this yr to maintain tempo with the business growth.

Within the quest for expertise, enterprise capital companies are compelled to get inventive. Hiring managers say they’ve begun looking workers rosters on the Chinese language Academy of Sciences – the nation’s premier analysis organisation – whereas others are befriending engineers at tech giants just like the Warren Buffett-backed automaker BYD Co. The combat can get nasty, too.

Enterprise companies are cannibalising one another. The larger gamers have begun focusing on expertise at smaller rivals corresponding to Lenovo enterprise arm Legend Capital and even billionaire Jack Ma’s Yunfeng Capital, business insiders and headhunters say. Legend Capital and Yunfeng Capital didn’t reply to Bloomberg’s inquiries in search of remark.

The shift in fortunes not solely has reshaped enterprise companies’ hiring technique but additionally reshaped the trail of on-the-job professionals.

The shift in fortunes not solely has reshaped enterprise companies’ hiring technique but additionally reshaped the trail of on-the-job professionals.

On no less than one event, a Beijing-based US greenback fund doubled the bottom wage of an funding affiliate with a view to get that particular person on board – virtually unthinkable a couple of years in the past for anybody specialising in superior manufacturing, says Duke Duan, a companion who makes a speciality of tech expertise at boutique recruitment advisory agency Bowers. Business-wide, Duan estimates the bottom wage for buyers energetic in hard-core expertise climbed no less than 50% this yr after they joined a brand new agency, up from a extra typical 20% to 30% beforehand.

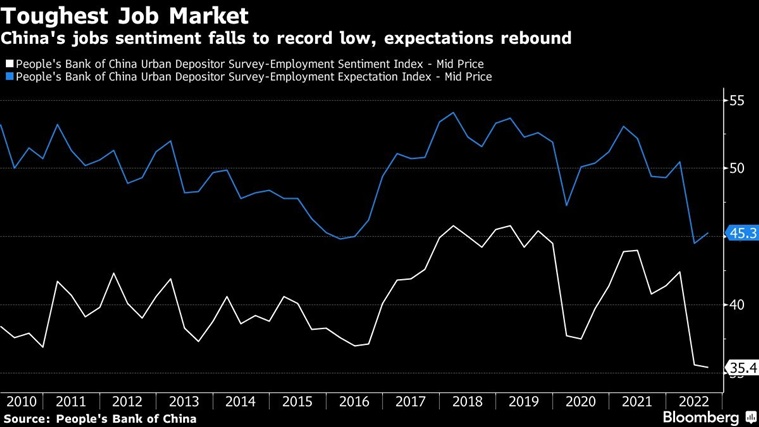

All that belies a job market in disaster. Tencent, for one, diminished its workforce by hundreds within the June quarter -– its first staffing cuts since 2014, whereas Alibaba let go of almost 10,000 workers throughout the identical interval.

The shift in fortunes not solely has reshaped enterprise companies’ hiring technique but additionally reshaped the trail of on-the-job professionals. One living proof is Zhang Lijun, Xiong’s colleague and a companion at Sinovation.

After Chinese language policymakers final yr banned for-profit tutoring – an area that when attracted billions of {dollars} from buyers together with Zhang – she determined to align her future picks partly with the federal government’s imaginative and prescient. The enterprise capitalist took programs in biology, even volunteering on the China Agricultural College, to reinvent herself because the authority on next-generation farming.

“Branching out into elementary expertise has turn into a typical selection for enterprise capitalists,” she mentioned.

However changing scientists and engineers into enterprise capitalists isn’t a straightforward matter. Not everybody has the aptitude for dealmaking, the place human relations can matter as a lot as data. The softer abilities important to funding, corresponding to communications and networking, aren’t taught in school rooms or explored in labs.

Jiang, the engineer-turned-investment-analyst, made it clear that financing wouldn’t be his long-term profession selection. He joined his firm – a Shenzhen-based enterprise agency specializing in consumer-facing companies – as a result of it assembled a workforce for the primary time to spend money on electrical vehicles. That was important to his subsequent transfer.

“That is only a stepping stone,” Jiang mentioned. “I’d like to begin my very own enterprise at some point, ideally within the manufacturing of sensible vehicles.