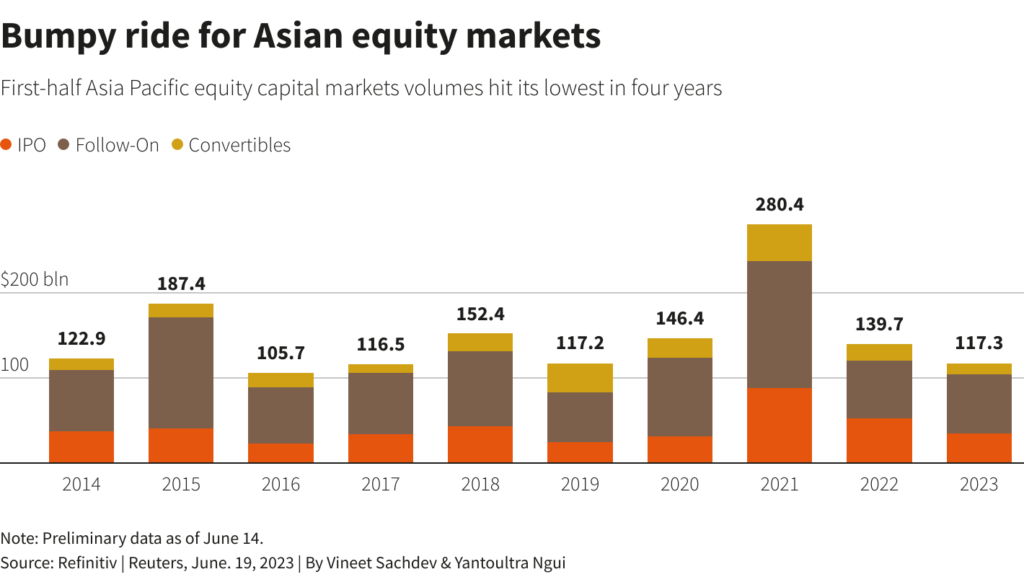

SYDNEY/SINGAPORE, June 20 (Reuters) – Asia’s dealmakers are relying on a pause in fee hikes globally and an financial rebound in China to rekindle exercise within the area’s fairness capital markets, after volumes within the first half of the 12 months sank to their lowest in 4 years.

First-half Asia Pacific fairness capital markets volumes dropped 16% to $117.2 billion from the identical interval in 2022, together with a 34% drop in preliminary public choices (IPOs) to $34.3 billion, Refinitiv information confirmed.

Flatlining exercise has prompted some banks like Goldman Sachs (GS.N) to start out shedding employees throughout practically all main funding banking divisions.

“For investor sentiment to return for IPOs we have to see a extra steady rate of interest surroundings within the U.S., extra financial stimulus from China and an enhancing geopolitical backdrop,” stated Cathy Zhang, head of Asia Pacific fairness capital markets at Morgan Stanley.

On international league tables, China now holds the highest two spots for IPOs. Corporations itemizing on Shanghai’s STAR Market raised $10.1 billion within the first half, practically double the proceeds of New York offers, whereas firms debuting on Shenzhen’s ChiNext market raised $8.1 billion.

Hong Kong, historically generally known as a serious international itemizing venue, raised simply $1.9 billion within the first half, whereas Indonesia emerged as a uncommon shiny spot within the area with $1.6 billion in new share gross sales.

Regardless of the continuing downturn, bankers are betting on stabilisation of rates of interest globally and a Chinese language financial rebound spurred by stimulus measures to spice up deal exercise within the subsequent six months.

“We hope to see extra IPO exercise within the second half and beginning to see some inexperienced shoots within the U.S. and Europe,” stated Udhay Furtado, Citigroup’s co-head of Asia fairness capital markets.

“Financial coverage is the primary (macro) driver (to help issuance situations). It impacts sentiment, it impacts volatility and valuations. In mixture that’s the greatest issue.”

As bankers scan their pipeline of IPO candidates for the second half, bigger transactions within the area are being favoured to assist kick-start exercise.

“The primary IPOs that may appeal to broad international investor consideration might be bigger firms which have scale, robust earnings and could have a liquid after-market,” stated Sunil Dhupelia, JPMorgan’s co-head of Asia fairness capital markets ex-Japan, including shopper, clear vitality and sectors linked to China’s reopening offers can be a key focus.

By way of potential large offers, China’s JD.com has filed to spin off models JD Industrial and JD Property, every to lift $1 billion in Hong Kong offers this 12 months.

Equally, Alibaba Group (9988.HK) has stated it might separate six enterprise models that will additionally look to hold out IPOs or capital raisings to fund future progress.

A rush of IPOS in Indonesia price $1.64 billion led that market to double its share of the worldwide new itemizing volumes within the first half in comparison with the identical time final 12 months.

A lot of the offers got here from miners and state-owned enterprises. Bankers count on there might be extra within the second half in Southeast Asia from the likes of Indonesia’s Pertamina Hulu Energi’s deliberate $1.4 billion IPO and Amman Mineral Internasional’s anticipated $880 million float.

“We perceive there are nonetheless a number of potential listings within the works within the area which ought to bolster new issuances raised,” stated Edmund Leong, Head of Group Funding Banking, UOB.

Reporting by Scott Murdoch in Sydney and Yantoultra Ngui in Singapore; Further Reporting by Vineet Sachdev in Bangalore; Modifying by Sonali Paul

: .