(Bloomberg) — The Federal Reserve’s marketing campaign to tighten monetary circumstances has resulted in notably elevated borrowing by US banks on the central financial institution’s low cost window, usually a last-resort funding supply.

Most Learn from Bloomberg

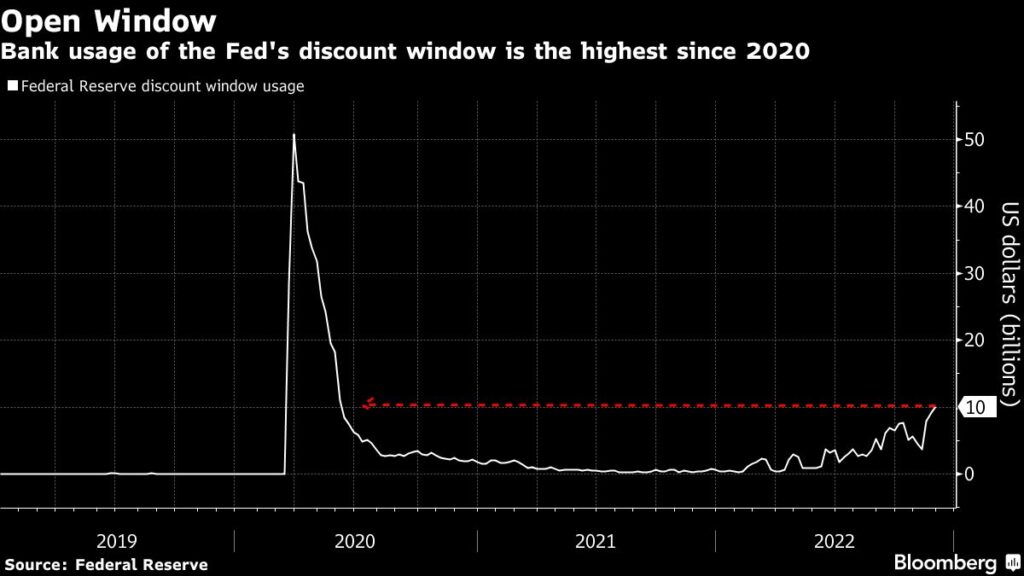

Balances on the low cost window rose to $10.1 billion on Nov. 30, the very best stage since June 2020, from $9.1 billion every week earlier. Mixed with a rise in US banks’ wholesale borrowings, it means that banks are dropping deposits to higher-yielding alternate options, in accordance with a report by Moody’s Traders Service.

“Low cost window credit score is meant for use by banks to cowl short-term funding shortfalls and isn’t supposed to be relied upon as a everlasting funding supply for a financial institution,” Moody’s analysts Jill Cetina, David Fanger and Donald Robertson wrote. “Ongoing and rising low cost window utilization over the previous few months might level towards deeper funding weaknesses in some corners of the banking sector.”

The low cost window “is mostly thought of solely as a final resort,” so the extra borrowing counsel that some banks “are already going through extra vital short-term liquidity strain” on account of Fed fee will increase totaling 3.75 share factors since March, Moody’s mentioned.

The speed will increase have led to comparatively larger yields on alternate options to financial institution deposits comparable to money-market funds and Treasury payments. On the similar time, the Fed’s balance-sheet discount measures are lowering the quantity of financial institution reserves within the monetary system.

Banks traditionally have been reluctant to make use of the low cost window out of concern buyers view it as signal of operational weak spot, a stigma that the Fed has tried to dispel.

(Updates low cost window knowledge in second paragraph, chart)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.