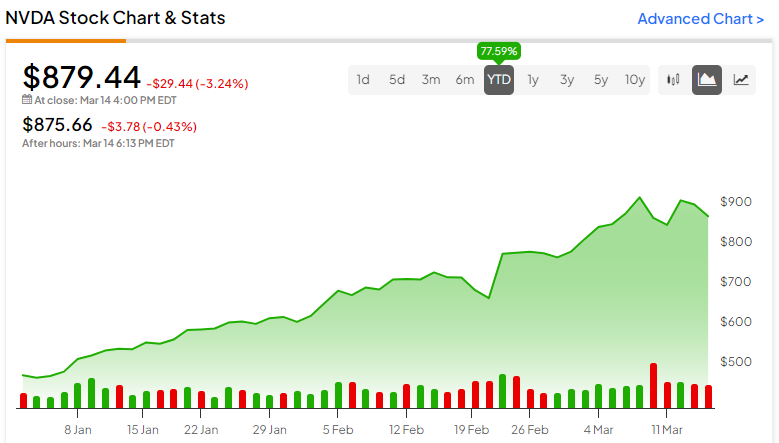

Chipmaker and AI prodigy Nvidia (NASDAQ:NVDA) continues its unstoppable upward journey, having greater than tripled in worth in 2023 and up about 78% year-to-date. The latest This autumn beat was spectacular and drove NVDA to its all-time highs. Being on the helm of the AI revolution, my bullish stance on NVDA stays. I’m assured in its long-term potential for progress, pushed by the bogus intelligence (AI) growth and its comparatively favorable valuation. Therefore, I’ll purchase the inventory at present ranges.

NVDA Posts Blowout This autumn Earnings But Once more

Now the third largest firm on this planet, Nvidia posted yet one more blowout This autumn outcome on February 21, pushed by accelerated computing and generative AI momentum. Adjusted earnings of $5.16 per share handily beat the analysts’ estimates of $4.59 per share. Additionally, the determine got here in a lot greater (+486%) than the Fiscal This autumn-2023 (ended January 2023) determine of $0.88 per share.

Impressively, This autumn income jumped 265% year-over-year to $22.1 billion, surpassing the consensus estimate of $20.5 billion. On prime of that, its adjusted gross margin expanded 10.6 share factors to 76.7% from 66.1% a 12 months in the past.

Importantly, NVDA’s crown-jewel section, Information Middle revenues, greater than trebled year-over-year to $47.5 billion in Fiscal 2024. This autumn revenues for the section additionally noticed outstanding progress, rising by 409% year-over-year to $18.4 billion.

As anticipated, revenues declined in China because of the U.S. export management restrictions. Through the earnings name, administration affirmed that China represented solely a mid-single-digit share of Information Middle income in This autumn versus 20-25% on a median foundation over the previous few quarters.

Trying forward, the Q1 steering seems promising, with revenues anticipated to hover round $24 billion. Adjusted gross margins are forecasted to be round 77%.

Exuberating nice optimism for the long run, CEO Jensen Huang commented through the name, “We’re firstly of two industry-wide transitions and each of them are industry-wide. The primary one is a transition from common to accelerated computing… [and] a second industry-wide transition known as generative AI.”

NVDA’s Lengthy-Time period Trajectory Stays Spectacular

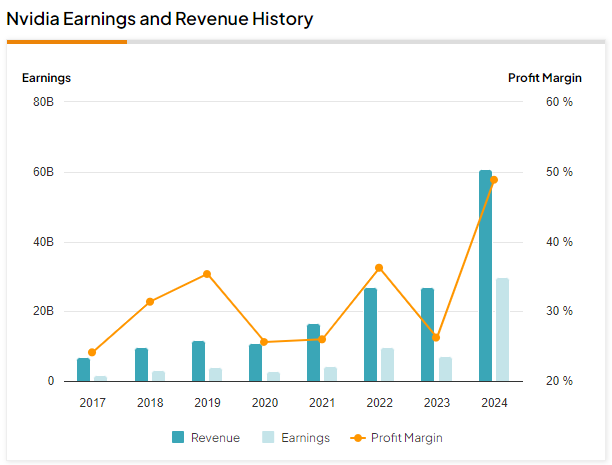

NVDA is Wall Road’s favourite for an excellent purpose. During the last six years, Nvidia’s revenues have skyrocketed by practically 9x, from $6.91 billion in FY2017 to $60.9 billion in FY2024 (see under). What’s much more applaudable is that its earnings have grown by 18x from $1.67 billion to $29.8 billion over the identical interval, due to its rising revenue margins. This information instills in me a profound sense of confidence in NVDA’s robust enterprise fundamentals and its anticipated progress trajectory, pushed by AI.

Based on Wall Road estimates, NVDA is projected to realize a web revenue of $64.3 billion in Fiscal 2025, doubling from the $32.3 billion reported within the not too long ago concluded Fiscal 2024. Moreover, revenues are anticipated to surpass the monumental $100 billion milestone. These outstanding progress expectations present compelling causes to proceed investing on this AI big, particularly contemplating that the expansion narrative of disruptive generative AI is barely simply starting.

NVDA May Probably Go for a Inventory Cut up

Inching nearer to the $1,000 milestone value mark, many Wall Road analysts opine {that a} inventory break up might happen within the subsequent 12 months or so. NVDA underwent a 4:1 inventory break up in Might 2021, when it was priced at roughly $600. This transfer facilitated simpler entry for smaller retail buyers to buy the inventory. Whereas a inventory break up doesn’t inherently alter the corporate’s valuation or fundamentals, it does broaden its investor base by attracting smaller buyers.

Different outstanding firms which have opted for inventory splits embody EV maker Tesla (NASDAQ:TSLA) (in 2020 and 2022) and Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), and Alphabet (NASDAQ:GOOGL). Subsequently, it’s seemingly that NVDA could take into account one other inventory break up within the close to future.

NVDA Valuation Nonetheless Isn’t Costly, Given Its Earnings Prowess

Having overtaken Amazon by market capitalization and on the verge of eclipsing Apple’s market cap, many buyers are hesitant to buy NVDA inventory amid its outstanding rally and considerations about overvaluation.

Quite the opposite, nevertheless, NVDA inventory isn’t costly in any respect. At the moment, it’s buying and selling at a lovely ahead P/E ratio of 36.9x (primarily based on FY2025 earnings expectations). That is comparatively cheaper than the multiples of its peer group. For example, U.S.-based semiconductor firm Superior Micro Units (NASDAQ:AMD) is buying and selling at a ahead P/E of 53.4x.

Moreover, its present valuation displays a reduction from its five-year common of 46x. These are enticing low cost ranges and sure current an amazing shopping for alternative, given the supernormal progress potential for the AI market titan NVDA.

Is NVDA Inventory a Purchase, Based on Analysts?

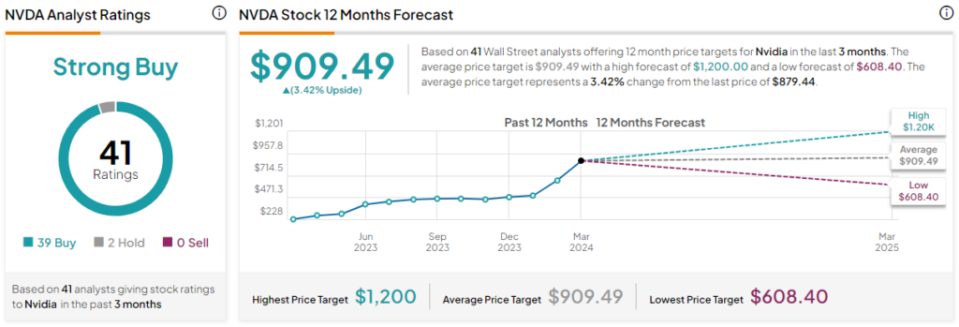

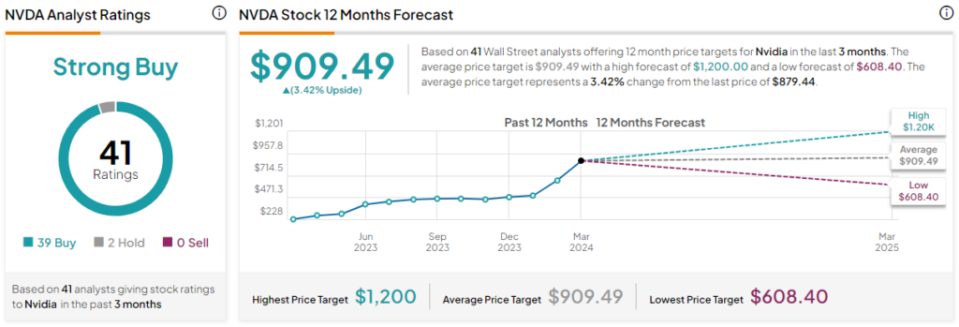

NVDA stands as an invincible drive, a inventory that garners widespread consideration. With 39 Buys and two Maintain rankings from analysts within the final three months, the consensus score is unmistakably a Robust Purchase. Nonetheless, the typical Nvidia inventory goal value of $909.49 means that the shares will return 3.4% over the following 12 months.

Apparently, the typical goal value has been rising extremely as analysts try to match NVDA’s steady record-breaking highs month after month. It has elevated from $661 simply three months in the past to $909.

Conclusion: Take into account Shopping for NVDA for Its Lengthy-Time period AI Potential

NVDA inventory is poised to soar to unprecedented heights, propelled by the extraordinary progress expectations inside the AI house. As an {industry} frontrunner, NVDA maintains a considerable lead over its rivals, boasting an nearly monopolistic place with an roughly 80% market share in AI chips. This dominant place ensures a strong moat and solidifies its grip on the flourishing AI panorama.

The insatiable demand for all issues AI far outpaces the obtainable provide, underscoring the potential for accelerated computing and generative AI adoption throughout varied industries and areas. This pattern is anticipated to be a major driver of income and earnings progress for NVDA within the years forward.

With NVDA’s extremely anticipated stay GTC convention scheduled for March 18-21, my bullish outlook on the corporate stays steadfast, prompting me to buy shares at their present ranges.

Disclosure