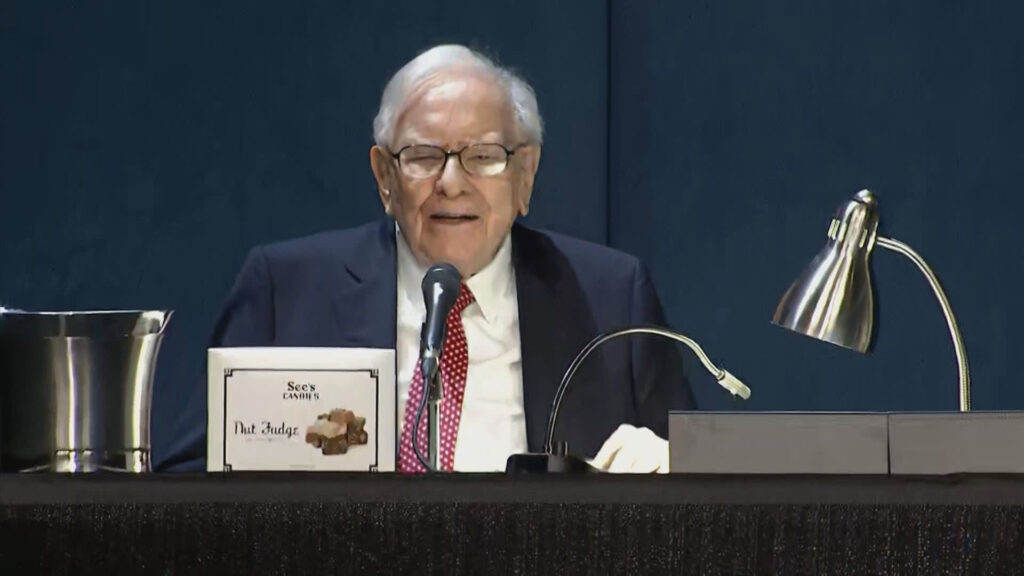

Warren Buffett speaks in the course of the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Might 4, 2024.

CNBC

Warren Buffett’s Berkshire Hathaway offloaded one other chunk of Financial institution of America shares, bringing its complete gross sales to greater than $7 billion since mid-July and lowering its stake to 11%.

The Omaha-based conglomerate shed a complete of 5.8 million BofA shares in separate gross sales on Friday, Monday and Tuesday for nearly $228.7 million at a median promoting value of $39.45 per share, in accordance with a brand new regulatory submitting.

The newest motion prolonged Berkshire’s promoting streak to 12 consecutive periods, matching the 12 consecutive periods from July 17 to Aug. 1.

Berkshire has bought greater than 174.7 million shares of the Charlotte-based financial institution for $7.2 billion, with 858.2 million shares remaining, or 11.1% of shares excellent. BofA has fallen to the No.3 spot on Berkshire’s record of prime holdings, trailing behind Apple and American Specific. Earlier than the promoting spree, BofA had lengthy been Berkshire’s second greatest holding.

Moynihan on Buffett

Buffett famously purchased $5 billion price of BofA’s most popular inventory and warrants in 2011 within the aftermath of the monetary disaster. He transformed these warrants in 2017, making Berkshire the most important shareholder in BofA. The “Oracle of Omaha” then added 300 million extra shares to his wager round 2018 and 2019.

BofA CEO Brian Moynihan made a uncommon remark about Berkshire’s gross sales Tuesday, saying he has no data of Buffett’s motivation for promoting.

“I do not know what precisely he is doing, as a result of frankly, we won’t ask him. We would not ask,” he mentioned throughout Barclays International Monetary Providers Convention, in accordance with a transcript on FactSet. “However then again, the market’s absorbing the inventory …. we’re shopping for a portion of the inventory, and so life will go on.”

Financial institution of America

Shares of BofA have dipped nearly 1% because the begin of July, and the inventory is up 16.7% this yr, barely outperforming the S&P 500.

Moynihan, who has been main the financial institution since 2010, praised the 94-year-old’s shrewd funding in his financial institution in 2011, which helped shore up confidence within the embattled lender fighting losses tied to subprime mortgages.

“He is been an important investor for our firm, and stabilized our firm once we wanted on the time,” he mentioned.

For example how profitable Buffett’s funding has been, Moynihan mentioned if traders have been to purchase his financial institution inventory the identical day Buffett did, they’d have been capable of seize the low value of $5.50 per share. The inventory final traded just below $40 apiece.

“He simply had the center to do it in a giant method. And he did it. And it has been a superb return for him. We’re pleased that he will get it,” Moynihan mentioned.

— CNBC’s Alex Crippen contributed reporting.