Synthetic intelligence (AI) was a scorching investing theme in 2023 and billions of investing {dollars} discovered their approach into this know-how this yr, resulting in windfall features for sure firms that had been savvy sufficient to profit from the early adoption of AI.

In accordance with Goldman Sachs, non-public investments in AI might hit $110 billion this yr globally and improve to a formidable $200 billion by 2025. Nvidia, Microsoft, and Alphabet are a few of the apparent names that buyers have been piling into to reap the benefits of this enormous alternative. On the identical time, some smaller firms could possibly be large beneficiaries of AI adoption because of the markets they serve.

Palantir Applied sciences (NYSE: PLTR) and SentinelOne (NYSE: S) are two firms for whom AI is prone to be a giant catalyst. Whereas Palantir is a number one participant available in the market for AI software program platforms, SentinelOne is setting itself as much as capitalize on the rising deployment of AI throughout the cybersecurity area of interest.

However in case you had been to decide on one among these two shares to learn from AI’s progress, which one do you have to purchase? Let’s discover out.

The case for Palantir Applied sciences

Palantir Applied sciences is understood for constructing and deploying software program platforms for each authorities and business prospects, and the corporate is now utilizing its experience within the AI market as nicely. It’s estimated that Palantir’s alternative within the AI software program platform market could possibly be as enormous as $1 trillion in the long term, and the nice half is that the corporate is well-placed to capitalize on this chance.

That is as a result of Palantir was ranked as the highest vendor of AI, machine studying (ML), and knowledge science options per a third-party analysis report, forward of the likes of Alphabet and Microsoft. Extra importantly, Palantir has already began touchdown AI-related contracts. In September, Palantir was awarded a $250 million contract by the U.S. Military to hold out AI/ML-related analysis work. This was adopted by a one-year extension value $115 million to an present U.S. Military contract for offering new AI capabilities.

On the identical time, Palantir noticed a pleasant leap within the variety of business prospects it serves because of the rising adoption of its AI platform. In simply 5 months, the corporate’s AI platform has been utilized by virtually 300 organizations throughout a number of industries. Not surprisingly, Palantir’s general buyer depend was up 34% yr over yr final quarter, pushed primarily by a forty five% year-over-year leap within the business buyer base.

What’s extra, Palantir is working aggressively to broaden its AI gross sales funnel amongst business prospects. That is why the corporate performed 140 boot camps, or coaching packages, final month to assist potential prospects perceive the best way to deploy AI for his or her use circumstances. These strikes appear to be the explanation why Palantir elevated its full-year income and working earnings steerage regardless of seeing softness within the authorities spending surroundings.

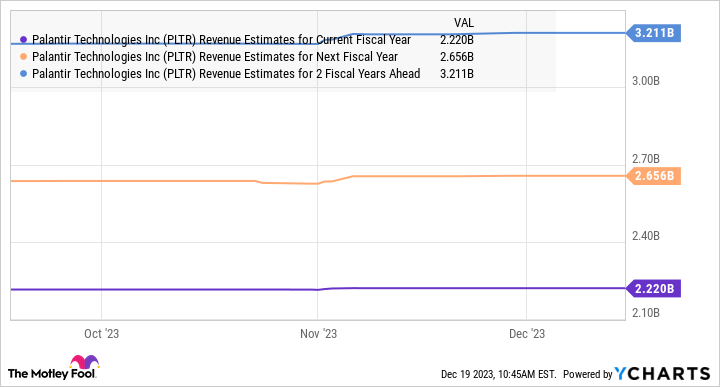

Palantir expects to complete 2023 with a 16.5% year-over-year improve in income to $2.22 billion. Even higher, the corporate’s progress price is predicted to get higher from 2024.

So, rising catalysts resembling AI might assist Palantir inventory maintain its excellent momentum in the marketplace following 178% features in 2023.

The case for SentinelOne

Cybersecurity firms focus extra now on integrating generative AI inside their choices. That is as a result of generative AI-fueled cybersecurity spending is anticipated to leap from simply $9 million in 2022 to $3.2 billion in 2027. This is a chance for SentinelOne to shortly ramp up its enterprise and appeal to extra cybersecurity prospects.

SentinelOne already supplies an autonomous, AI-enabled risk prevention, detection, and response platform referred to as Singularity. The corporate can goal the prolonged detection and response (XDR) cybersecurity market with this platform, which is forecast to develop 38% yearly by way of 2028. On the identical time, SentinelOne began promoting its Purple AI generative AI cybersecurity analyst to prospects and has built-in the performance into the Singularity platform.

In accordance with SentinelOne, this generative AI-powered safety answer will permit a company’s cybersecurity analysts to turn into faster and extra environment friendly by enabling them to make use of text-based prompts to search for threats, analyze them, and ultimately reply to the threats. Market analysis agency Canalys estimates that over 70% of companies are prone to undertake generative AI-based cybersecurity instruments by 2028.

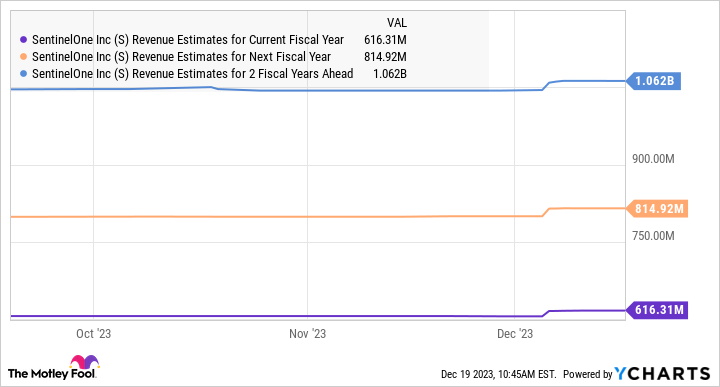

Because of this, it will not be stunning to see SentinelOne maintain its spectacular progress. The corporate’s fiscal 2024 income steerage of $616 million could be a 46% leap over its fiscal 2023 income of $422 million. Administration thinks SentinelOne can maintain a 30% income progress price for the subsequent two fiscal years as nicely.

However do not be stunned to see the rising adoption of generative AI within the cybersecurity area of interest driving stronger progress at SentinelOne, which might permit this cybersecurity inventory to leap increased following 83% features in 2023.

The decision

Each Palantir and SentinelOne might witness a stable leap of their companies because of AI. Nevertheless, buyers wanting to decide on one among these AI shares over the opposite have a straightforward determination to make.

Whereas Palantir inventory trades at virtually 19 occasions gross sales, SentinelOne is cheaper, with a price-to-sales ratio of 13.5. SentinelOne can also be rising at a a lot quicker tempo than Palantir. What’s extra, because the charts within the article point out, SentinelOne might preserve outperforming Palantir over the subsequent couple of years as nicely.

As such, buyers trying to purchase an AI inventory proper now that is rising at a pleasant clip and is not very costly could also be tempted to purchase SentinelOne, because it seems to be the higher selection when in comparison with Palantir, based mostly on its quicker progress and comparatively engaging valuation.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Palantir Applied sciences wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Goldman Sachs Group, Microsoft, Nvidia, and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

Higher AI Inventory: Palantir Applied sciences vs. SentinelOne was initially printed by The Motley Idiot