Elevated demand for synthetic intelligence (AI) companies created steep competitors amongst tech corporations, significantly within the chip market. {Hardware} like graphics processing models (GPUs) are essential to coaching AI fashions, making a profitable alternative for the businesses growing these chips.

Nvidia took the lead in AI GPUs, which led its inventory worth and earnings to skyrocket over the past yr. Nonetheless, eyes have additionally been on chipmakers Intel (NASDAQ: INTC) and Superior Micro Units (NASDAQ: AMD), which launched competing chips and will provide vital positive factors because the business expands.

Intel launched new AI accelerators this yr and is increasing its manufacturing division with hopes of turning into a number one AI chip fabricator. In the meantime, AMD’s second-largest market share in GPUs might grant it a profitable position with AI in the long run, permitting it to fill within the provide gaps that Nvidia won’t be capable of meet.

These corporations are at earlier levels of their AI journeys than Nvidia, however that might imply they’ve extra room to run within the coming years. So let’s evaluate these chipmakers and decide whether or not Intel or AMD is the higher AI inventory proper now.

Intel

Shares in Intel trickled up 3% over the past month as Wall Avenue seems to be getting behind its long-term potential. The expansion is a welcome change after a yr of declines, which had seen its share worth tumble 7% since final July. The corporate involved traders with a number of quarters of disappointing outcomes because it navigated elevated competitors and modifications within the chip market.

Nonetheless, essential modifications to Intel’s enterprise mannequin over the past yr present the corporate taking part in the lengthy sport, making vital investments in its future now to doubtlessly see main positive factors over the subsequent decade.

First, the tech large is in search of a much bigger position in AI by launching its Gaudi 2 and Gaudi 3 accelerators, that are able to operating AI workloads for information facilities. Intel is setting itself aside from rivals like AMD and Nvidia by providing aggressive pricing, with its chips costing roughly a 3rd of the worth of comparable merchandise in the marketplace.

Nonetheless, probably the most promising growth is Intel’s huge wager on turning into a number one participant within the foundry market. In response to Allied Analysis, the semiconductor foundry market was value about $107 billion in 2022 and is increasing at a charge that can see it greater than double to $232 billion by 2032. In the meantime, Intel plans to open chip fabs all through the U.S. as it really works to grow to be the nation’s main chipmaker, simply as GPU demand is hovering.

Getting began in chip manufacturing is expensive, and Intel would not count on to interrupt even on the enterprise till 2027. Nonetheless, the transfer might considerably repay over the long run, as Intel advantages from elevated chip demand throughout tech.

Superior Micro Units

AMD has grow to be an organization to observe over the past yr, because it restructured its enterprise to prioritize AI. The corporate made promising headway within the business, launching its personal AI GPUs and signing purchasers like Microsoft and Meta Platforms.

Moreover, Tom’s {Hardware} reported final month that AMD had severe inquiries about constructing an AI cluster that may home not less than 1.2 million GPUs. For reference, the perfect supercomputers on the planet are run with lower than 50,000 GPUs. Consequently, touchdown this sort of deal might present a significant enhance to AMD’s earnings.

The chipmaker has thrilling prospects within the business. Nonetheless, it was let down by current earnings. Within the first quarter of 2024, income rose 2% yr over yr to simply over $5 billion. AMD posted income positive factors of over 80% in its information middle and shopper segments. That mentioned, it suffered greater than 40% in declines in its shopper and gaming segments.

So regardless of an increasing place in AI, AMD nonetheless has a number of work forward to rally traders with monetary progress.

Is Intel or AMD the higher AI inventory this July?

Intel and AMD have taken totally different approaches to AI. Intel is attempting to distinguish itself within the business by providing a variety of chips and investing closely in manufacturing. In the meantime, AMD goals to grow to be an equal to Nvidia.

Nonetheless, Nvidia’s estimated 90% market share in AI GPUs will probably be difficult to beat, suggesting Intel might need a greater time increasing within the business than AMD.

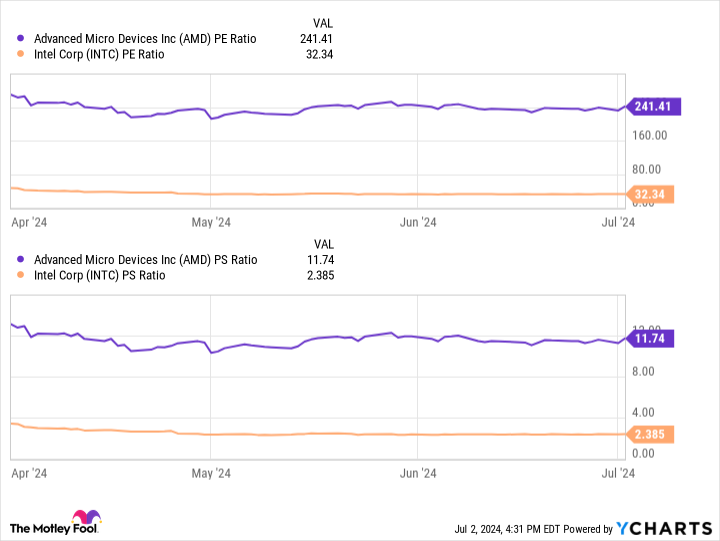

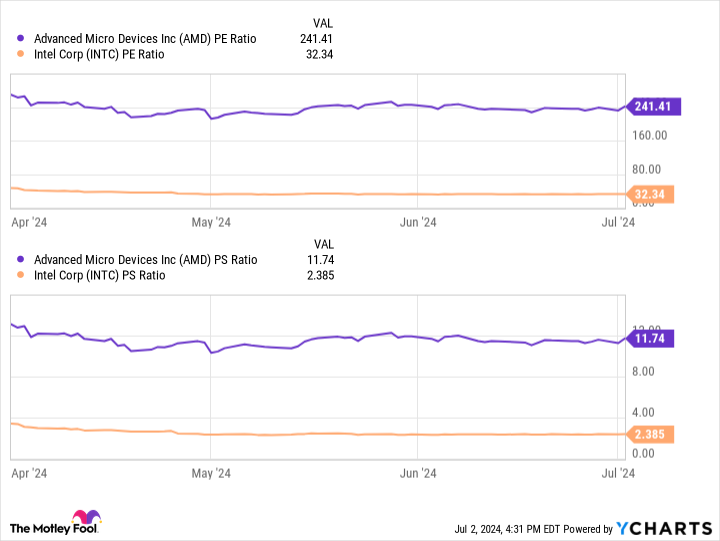

Furthermore, this chart compares the valuations of Intel and AMD utilizing two key metrics: price-to-earnings and price-to-sales ratios. For each metrics, the decrease determine alerts a greater worth. Consequently, the info signifies Intel is doubtlessly buying and selling at a cut price in comparison with AMD.

Along with a promising enterprise into the foundry market, Intel is a no brainer this July and a greater AI inventory than AMD.

Must you make investments $1,000 in Intel proper now?

Before you purchase inventory in Intel, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Intel wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel, lengthy January 2026 $395 calls on Microsoft, quick August 2024 $35 calls on Intel, and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Higher Synthetic Intelligence (AI) Inventory: Intel vs. AMD was initially revealed by The Motley Idiot