The generative synthetic intelligence (AI) increase has launched a golden age for chip designer Nvidia (NASDAQ: NVDA) and its buyers. Software program and companies veteran IBM (NYSE: IBM) additionally advantages from the identical pattern, however in a really completely different means.

Which considered one of these tech titans is the higher AI inventory in the summertime of 2024? Let’s have a look.

Nvidia’s generative AI bonanza

Nvidia wasn’t a really thrilling story earlier than the generative AI surge. Two years in the past, the corporate tried its greatest to distance itself from cryptocurrency mining and the lockdown-boosted client curiosity in video gaming gear was fading out. Nvidia was already transport tons of AI accelerator chips behind the scenes, however to restricted fanfare as a result of no one had seen ChatGPT but. If something, Nvidia’s involvement in self-driving car methods regarded like a promising development catalyst again then.

Oh my, how occasions have modified.

It’s normal data that ChatGPT’s synthetic mind was constructed round Nvidia chips, and the corporate shortly emerged because the go-to provider of AI accelerator {hardware}. One Nvidia A100, H100, or L40S accelerator card prices between $8,000 and $30,000. You want tens of hundreds of those merchandise to coach a contemporary massive language mannequin (LLM). These chip gross sales are available massive, profitable batches.

So Nvidia’s gross sales soared 262% year-over-year in Might’s first-quarter report. Knowledge middle gross sales, together with the aforementioned AI accelerators, accounted for 87% of those revenues. That is up from 60% within the year-ago interval and 45% the 12 months earlier than that.

Because of this, Nvidia’s earnings and money flows are skyrocketing. So is the inventory value. Nvidia buyers have loved a tenfold multiplication of their stakes from the two-year lows in October 2022.

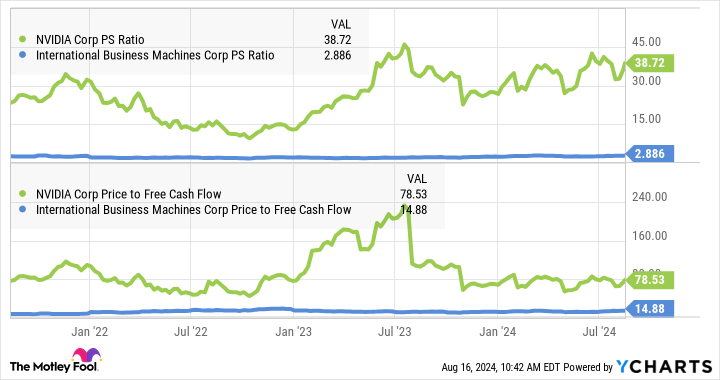

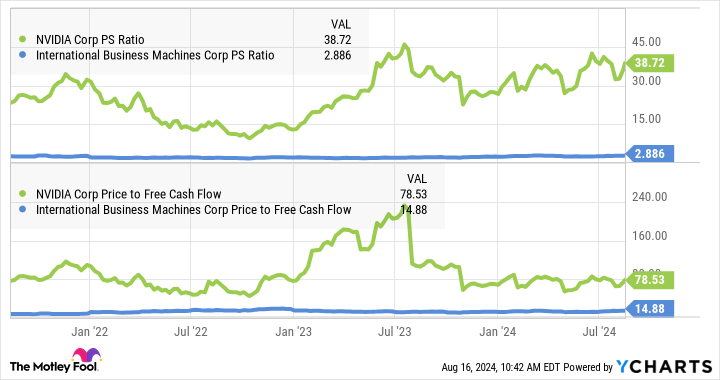

The inventory is clearly up for good cause, however the AI enthusiasm feels a bit overheated. Whether or not you have a look at value to gross sales, value to earnings, or value to free money flows, Nvidia is buying and selling nicely above its long-term valuation ratio averages.

Lengthy story brief, Nvidia appears overvalued regardless of its hovering financials. I might be a purchaser once more if the inventory took a dramatic dip, however I cashed in a few of my Nvidia income within the spring and it is not more than a “maintain” thought proper now.

How IBM’s drastic technique shift is paying off

In contrast to Nvidia, Huge Blue is not a {hardware} supplier nowadays. I imply, its distinctive mainframe methods nonetheless present some publicity to the {hardware} facet of the tech world, however the firm as an entire has refocused on software program and companies.

Because of its unique concentrate on business-class clients, the market was a bit gradual to present IBM credit score for its AI prospects. Enterprise-scale shoppers should put new software program instruments by way of the wringer of efficiency, safety, and integration assessments whereas additionally searching for finances approvals from a number of layers of administration. It takes time, however the ensuing contracts are usually strong and long-lived.

That is the place the corporate stands in the present day. Many testing processes and approvals have run their course and IBM is beginning to generate critical gross sales from its AI options beneath the Watson banner.

In July’s second-quarter report, IBM reported $2 billion in generative AI orders, up from zero a 12 months in the past because the underlying watsonx service was launched in the summertime of 2023. Administration raised their full-year software program development steering from mid-single-digits to high-single-digits — a formidable increase since greater than 80% of IBM’s software program gross sales are tied to multi-year contracts. And CEO Arvind Krishna expects that development fee to climb into double-digit territory in 2025 and past.

Huge Blue’s AI development is extra mellow than Nvidia’s, however I additionally anticipate it to have extra endurance. Sudden bursts of chip gross sales are one factor. A rising tide of long-term software program contracts is one other animal. I might a lot somewhat put money into the slower burn with longer-lasting penalties.

After which there’s the valuation angle. Subsequent to Nvidia’s lofty multiples, IBM’s valuation ratios appear to be a hearth sale:

Why IBM is a greater AI inventory to purchase in the present day than Nvidia

I am nonetheless holding a few of my outdated Nvidia shares however I am not seeking to purchase extra any time quickly. New cash is more likely to enter my IBM place as an alternative, as that tech titan nonetheless appears undervalued.

Wall Avenue is gradual to forgive IBM for a decade-long technique shift, although I might argue that it was precisely the proper transfer on the proper time. The following few years ought to present buyers how nicely the brand new concentrate on software program, companies, cloud computing, and AI will work out in the long term. This can be a nice AI inventory to purchase now and maintain for many years.

And on the identical time, Nvidia appears headed for a pointy value correction. Name me again when that inventory has dropped at the least 30% decrease and ideally much more.

Whereas Nvidia’s speedy development is spectacular, its valuation is just too excessive. In the meantime, IBM provides a extra secure development story as its radical technique shift begins to pay dividends, making it a sexy possibility for brand spanking new investments.

You heard it right here first.

Do you have to make investments $1,000 in Worldwide Enterprise Machines proper now?

Before you purchase inventory in Worldwide Enterprise Machines, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Worldwide Enterprise Machines wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $752,835!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

Anders Bylund has positions in Worldwide Enterprise Machines and Nvidia. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot recommends Worldwide Enterprise Machines. The Motley Idiot has a disclosure coverage.

Higher Synthetic Intelligence (AI) Inventory: Nvidia vs. IBM was initially revealed by The Motley Idiot