Software program firm Palantir Applied sciences (NYSE: PLTR) and chip firm Nvidia (NASDAQ: NVDA) are two of the most well liked shares on Wall Road. Each shares are up over 240% over the previous 12 months and have fierce loyalty amongst buyers.

Is one synthetic intelligence (AI) inventory higher than the opposite? To seek out out, I in contrast them head-to-head to see why they’re thriving and whether or not they can proceed. It was a really shut race, however one stood out simply forward of the opposite.

Here’s what it’s essential to know.

Assembly these two very totally different firms

Each shares soared as a result of incredible efficiency of their underlying companies. Nevertheless, these two AI firms are very totally different. Nvidia spent years specializing in high-performance GPUs, which turned ideally suited for knowledge facilities and AI. Nvidia’s high-quality merchandise and CUDA software program, which helps clients effectively use their GPUs energy, have led to Nvidia grabbing an early stranglehold on the AI chip market — an estimated 80% to 90%.

Alternatively, Palantir builds customized software program purposes for each authorities and industrial purposes. It runs three software program platforms: Gotham, Foundry, and AIP for AI purposes. You possibly can consider Palantir as an working system that helps organizations use their knowledge. The corporate’s intent is that it augments human intelligence; it would not substitute it.

A better take a look at every firm’s development

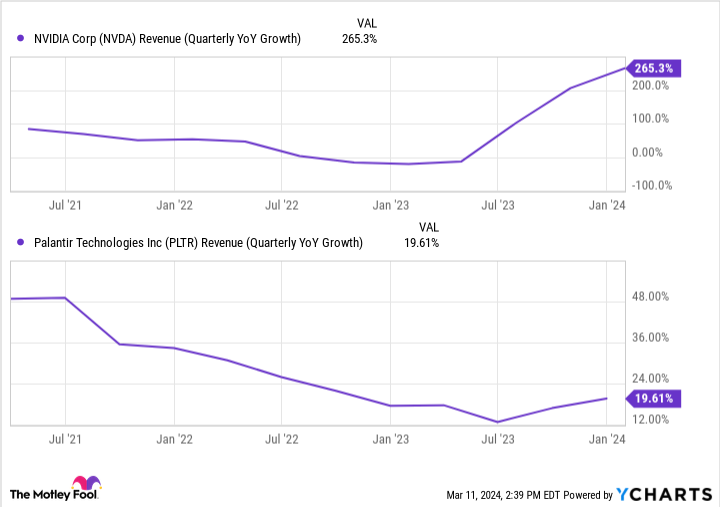

From a pure numbers standpoint, Nvidia is rising leaps and bounds sooner than Palantir. You possibly can see beneath how each firms started accelerating income development in mid-2023, however Nvidia soared on large knowledge middle spending from huge expertise clients, primarily within the “Magnificent Seven.” It could possibly be honest to surprise how lengthy this monumental enhance in knowledge middle spending from huge tech will proceed.

One chance is that these firms begin producing customized chips in-house, weaning themselves off of Nvidia’s. That would damage long-term development for an organization at present getting most of its income from a small handful of shoppers.

Talking of Palantir, the corporate just isn’t as explosive as Nvidia. However what impresses me is the corporate’s increasing buyer base. Palantir’s U.S. buyer depend grew 55% 12 months over 12 months within the fourth quarter and 22% quarter over quarter. Clients are available in all sizes and shapes, so it is not a exact translation. Such buyer development bodes nicely for long-term income development.

Perhaps Nvidia’s buyer focus will not matter, and Nvidia’s chips will preserve their market share. Nonetheless, I would wish to see buyer enlargement like Palantir’s.

What is the higher bang in your buck?

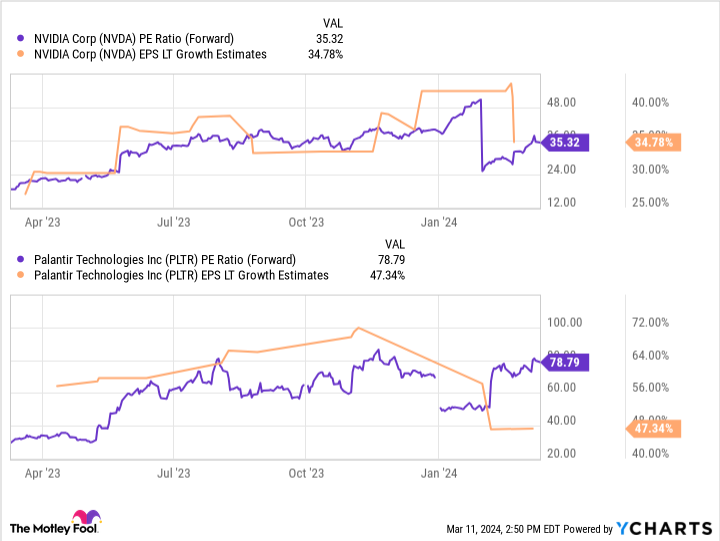

Analysts count on vital earnings development from each firms shifting ahead. On a ahead foundation, that makes each shares cheaper than you’d guess after each of their 200% runs. I like utilizing the PEG ratio to check how a lot I pay for an organization’s earnings development. The decrease the PEG ratio, the higher, and I wish to spend underneath 1.5 if I can.

Nvidia suits that standards with a PEG ratio of simply over 1. Palantir would not fairly match, with its PEG ratio of 1.6.

Nvidia is handily the higher worth right this moment, primarily based on every firm’s anticipated long-term earnings development. After all, the caveat is whether or not every firm will carry out as much as expectations.

The decision is…

Each firms are wonderful AI shares and leaders of their respective areas. Each are accelerating their income development. Naturally, analysts are very optimistic about every firm’s earnings development shifting ahead. Whichever firm you imagine is extra prone to meet development expectations over the following three to 5 years might be your winner.

This Idiot is giving Palantir a slight edge. Why?

Palantir will get roughly half its income from authorities contracts. The corporate’s lengthy historical past with the federal government may put a little bit of a flooring into Palantir’s enterprise, plus the upside from increasing its buyer base. In the meantime, Nvidia’s buyer focus could possibly be problematic if a big buyer opts for an additional chip.

Whereas the numbers say Nvidia is the higher purchase, there’s an argument that buyers can belief Palantir’s long-term development barely extra, particularly when the long run.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 11, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a disclosure coverage.

Higher Synthetic Intelligence (AI) Inventory: Palantir vs. Nvidia was initially revealed by The Motley Idiot