Constructing wealth can take a long time, or in case you personal Nvidia (NASDAQ: NVDA), it will probably take a couple of 12 months. Over the previous 12 months, the inventory has risen a exceptional 165% as a consequence of accelerated development associated to heavy investing in synthetic intelligence (AI) throughout the know-how area.

However it’s not alone in creating large funding returns. Arm Holdings (NASDAQ: ARM) is not any slouch, both; its shares are up greater than 120%. That leaves traders with a superb dilemma: Which is the higher AI inventory to personal?

It seems that one is much extra more likely to proceed its run than the opposite. Which one? Here’s what that you must know.

Each firms play essential roles in AI

The robust momentum behind each shares underlines every firm’s key position in AI. It is unclear what that know-how would possibly appear like 5 or 10 years from now, however there is a robust probability that Nvidia and Arm Holdings might be within the thick of it.

Nvidia’s AI chips have turn out to be, kind of, the constructing blocks of AI know-how. AI language fashions like ChatGPT prepare on large knowledge facilities with 1000’s of chips.

Chips from Nvidia specialise in demanding, high-compute purposes. These traits are good for AI, and the corporate has completed an incredible job optimizing its chips and software program for it.

Firms investing to construct these AI fashions have all gravitated to Nvidia, giving the corporate an estimated 90% market share for AI chips. It is unclear when (or if) it should lose its stranglehold on the chip market.

Arm Holdings is arguably the gold customary for laptop chip design. Its central processing unit (CPU) structure is the inspiration for roughly half the world’s laptop chips. That footprint consists of smartphones, automobiles, computer systems, and extra.

Arm makes cash by charging royalties and licensing charges on every chip that makes use of its mental property. That features Nvidia’s next-generation Grace collection of knowledge middle CPUs.

Each Nvidia and Arm Holdings will seemingly have a giant say in the way forward for AI.

AI is already benefiting each companies

Each firms are already seeing the influence of AI on their enterprise. Nvidia and Arm are extremely worthwhile, and the accelerated gross sales development is lining every firm’s coffers:

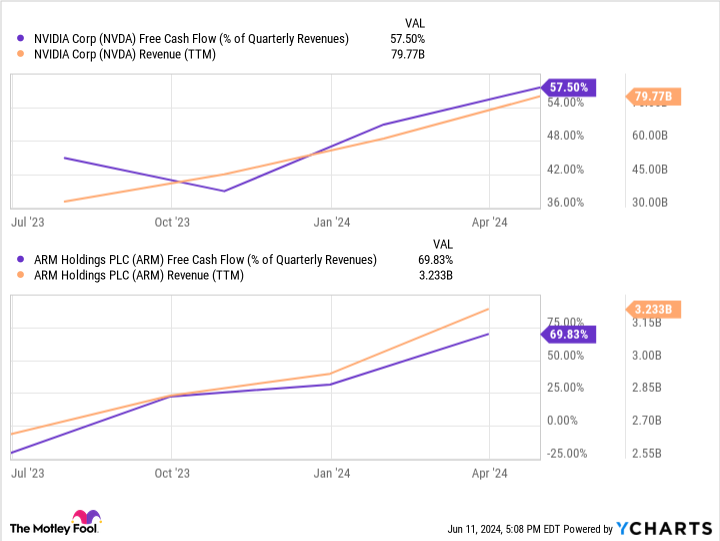

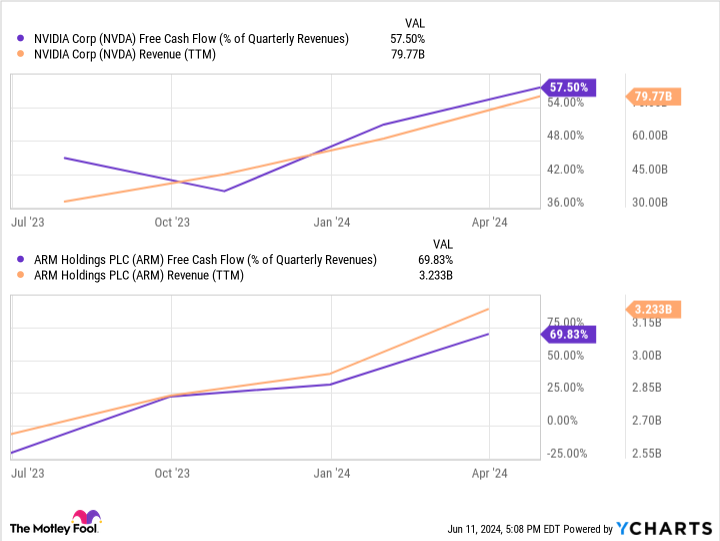

Arm’s enterprise has proved to be extra worthwhile; the corporate’s main expense is analysis and growth. Roughly $0.70 of each income greenback winds up as free money circulate. However Arm is a a lot smaller firm than Nvidia. Its trailing-12-month gross sales are simply over $3.2 billion.

In the meantime, Nvidia is not fairly as environment friendly as Arm in changing gross sales to money circulate, however it’s bringing in much more income: almost $80 billion over the previous 12 months.

Nvidia’s capability to promote a bodily product at such excessive margins is spectacular, and that’s the reason it should generate far more money circulate than Arm over the long run. Additional cash circulate offers an organization extra choices. Nvidia even got here shut to purchasing Arm Holdings earlier than the corporate went public, however the merger fell by way of. Give Nvidia the sting right here for its comparable profitability at a a lot bigger measurement.

The hole widens when speaking about valuation

Analysts are equally optimistic about each firms’ earnings development over the approaching years. Consensus long-term estimates name for roughly 31% annualized earnings development for each Nvidia and Arm. Nonetheless, you possibly can see under that the beginning valuation for every is dramatically completely different:

At a ahead price-to-earnings (P/E) ratio that’s half as costly as Arm Holdings’, Nvidia inventory has a built-in margin of security. Assuming development estimates show correct, Nvidia is much extra more likely to carry out higher.

As they are saying, the upper they go, the additional they will fall. Excessive valuations depart much less room for issues to go unsuitable. Arm Holdings may carry out exceptionally effectively as a enterprise, and one thing — even one thing exterior to the corporate, like broader market volatility — may ship shares decrease.

Nvidia and Arm Holdings are blue chip know-how shares with a vibrant future in AI as a consequence of their distinctive aggressive footing. Nonetheless, given the dramatic distinction in valuation, Nvidia looks as if the higher AI inventory to purchase at this time.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $794,196!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia. The Motley Idiot has a disclosure coverage.

Higher Synthetic Intelligence Inventory: Nvidia vs. Arm Holdings was initially printed by The Motley Idiot