For particular person buyers, it could pay to comply with what the professionals are doing. Particularly, in case you are a buy-and-hold investor you could find concepts from like-minded investing legends. One investor to comply with carefully is Invoice Ackman of Pershing Sq. Capital Administration. The billionaire investor runs a $10 billion portfolio for out of doors buyers, proudly owning positions in simply seven shares that he and the crew have held for a few years.

Listed here are 4 shares that make up a whopping 70% of Ackman’s concentrated inventory portfolio.

1. Efficiently betting on a Chipotle rebound

Ackman’s second-largest place is Chipotle Mexican Grill (NYSE: CMG). Pershing Sq. purchased the inventory after the restaurant chain started to wrestle in 2016 after an outbreak of food-borne sickness at a few of its places. It helped the corporate steer a turnaround by bringing in new administration and fixing its high quality management points.

Because the center of 2016, Chipotle’s inventory has returned some 632% for shareholders. Working earnings has grown even quicker, up 963% over this time interval as the corporate regained retailer visitors and considerably improved its margins. On the finish of 2023, it had slightly below 3,500 shops in North America. Whereas the corporate is kind of giant at the moment, administration thinks there’s room to double its retailer depend to 7,000 places in North America alone, as a right for any worldwide growth.

Add on strong same-store gross sales progress, and Chipotle seems to be primed to proceed rising earnings for a few years into the longer term. At simply over 18% of his portfolio, this has been an enormous winner for Ackman and will proceed to be sooner or later.

2. Extra restaurant publicity

At 17.6% of the portfolio, one other giant place for Pershing Sq. is Restaurant Manufacturers Worldwide (NYSE: QSR). Like Chipotle, it is a guess on quick-service restaurant chains, with the corporate proudly owning 4 manufacturers: Firehouse Subs, Popeyes, Burger King, and Tim Hortons. It has additionally been one of many longer-term holdings for Pershing Sq., with the primary buy of the inventory coming all the best way again in 2014.

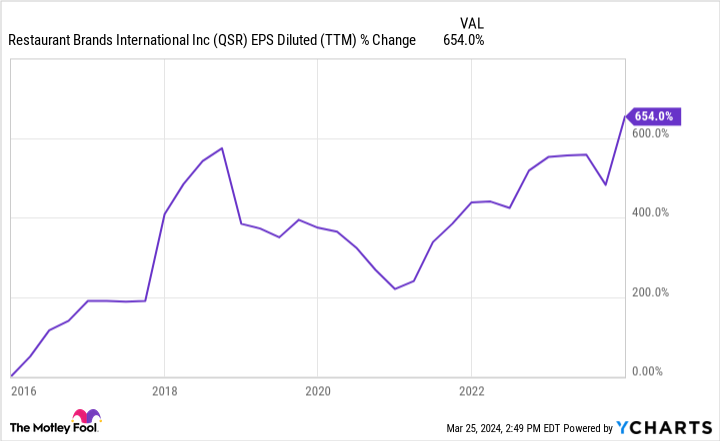

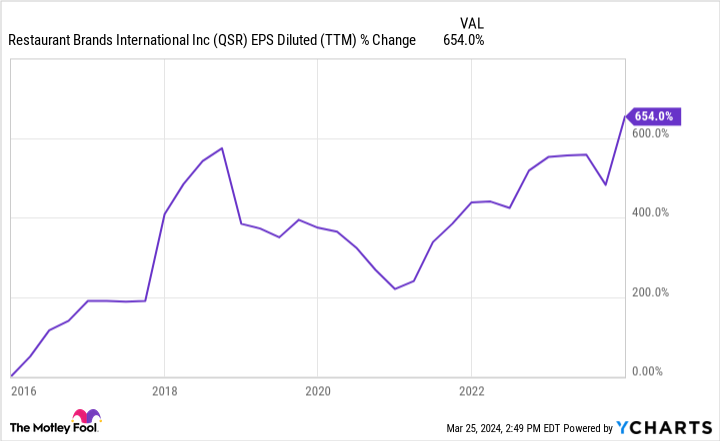

Restaurant Manufacturers’ inventory efficiency has not been as robust as Chipotle’s, nevertheless it has nonetheless accomplished effectively for Pershing Sq.. Shares are up 194% since 2014, with earnings per share (EPS) up 654% as effectively. It owns 4 distinct manufacturers that give it diversified publicity to all the restaurant sector with over 30,000 eating places unfold across the globe. For buyers in search of sturdy shares with low draw back over the long run, Restaurant Manufacturers Worldwide seems to be like an ideal selection. It’s laborious to think about there not being Burger King and Tim Hortons places 10 or 20 years from now.

3. A take price on international journey

At 16.2% of the Pershing Sq. inventory portfolio, Ackman has made one other play on a shopper model with Hilton Worldwide Holdings (NYSE: HLT). The funding firm purchased the inventory again in 2018, having a bet on the expansion of world journey. Hilton Worldwide owns its namesake Hilton model but in addition quite a lot of different resort manufacturers just like the Waldorf Astoria, Embassy Suites, and DoubleTree.

Importantly, Hilton Worldwide does not really personal the resort actual property, however licenses its manufacturers to resort operators. In change, Hilton receives a reduce of all gross sales, which resort homeowners are keen to do as a result of the Hilton model permits them to supply greater room charges in comparison with in the event that they have been an impartial operator.

Hilton’s earnings have not grown a lot since 2018 as a result of pandemic, with working earnings up 77% and income solely up 20%. However it seems to be like a restoration could also be on the best way, with spending on journey absolutely rebounding in most markets. With its publicity to international journey, Hilton is poised to learn from this restoration, and its enterprise mannequin is hedged to inflation. It’s unsurprising then to see the inventory make up a big portion of Ackman’s portfolio in early 2024. This can be a nice enterprise with a long-standing international model.

4. Do not forget the biggest holding: Alphabet

Ackman’s largest holding, and his most up-to-date buy, is Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). Pershing Sq. purchased shares of the guardian firm of Google Search and YouTube in early 2023. It’s now near 19% of the inventory portfolio.

Ackman doubtless bought Alphabet due to its falling valuation originally of final yr on account of fears it was shedding the brand new race in synthetic intelligence (AI) to rivals like Microsoft. These fears proved to be unwarranted, with Alphabet persevering with its earnings progress by means of 2023. The corporate’s working earnings hit an all-time excessive of $84.3 billion in 2023, main the inventory to soar 71% for the reason that starting of final yr.

Alphabet seems to be like a quintessential Pershing Sq. guess. It’s a diversified holding firm with long-standing international manufacturers, and the hedge fund supervisor determined to strike and make it a big place when its price-to-earnings ratio (P/E) got here all the way down to round 15 early final yr.

Buyers can be taught quite a bit from Pershing Sq. and Ackman. He makes concentrated bets on shares with robust manufacturers buying and selling at affordable valuations. Then, he holds his positions for a few years and lets his winners run.

Do you have to make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of March 25, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Brett Schafer has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Chipotle Mexican Grill, and Microsoft. The Motley Idiot recommends Restaurant Manufacturers Worldwide and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Billionaire Invoice Ackman Has 70% of His $10 Billion Portfolio in Simply 4 Shares was initially revealed by The Motley Idiot