Carl Icahn is likely one of the most well-known buyers in historical past. All through the Nineteen Eighties and Nineties, he grew to become often called a company raider, shopping for up massive stakes in corporations in an try to power change. Over the a long time, he has amassed a multibillion-dollar fortune.

Icahn has by no means shied away from making massive bets. Proper now, he has practically his whole fortune — some $6.3 billion — tied up in a single inventory. Shares are at the moment priced at historic lows, presumably making this a profitable method to wager alongside a legendary billionaire investor.

Billionaire Carl Icahn is betting on himself

It ought to come as no shock that Carl Icahn has nearly all of his cash tied up in an organization named after himself: Icahn Enterprises (NASDAQ: IEP). Included in 1987, Carl Icahn has lengthy used Icahn Enterprises as his foremost funding automobile. He at the moment owns greater than 80% of the corporate, a stake value roughly $6.3 billion. In essence, Carl Icahn is totally in command of Icahn Enterprises, and the corporate’s inventory worth is a direct results of his long-term decision-making skills.

Icahn Enterprises is a conglomerate enterprise. Which means it is a conglomeration of disparate companies, a lot of which don’t have anything to do with one another. As of final quarter, the web asset worth of those companies totaled round $4.8 billion. A few of that web asset worth is comprised of assorted actual property belongings, in addition to a handful of business and automotive companies. Round two-thirds of the worth, nonetheless, is tied up in simply two issues: a stake in CVR Power, an oil refiner, and a holding curiosity in Carl Icahn’s funding funds, which function individually from the corporate. So, whereas Carl Icahn has diversified the operation considerably, it’s closely reliant on the efficiency of each CVR Power and his funding funds.

Carl Icahn is probably going nicely conscious that Icahn Enterprises has concentrated its bets. These bets appear to signify the 2 areas by which he has the best conviction. With a long-term observe file of manufacturing multibillion-dollar fortunes, buyers can immediately wager alongside Carl Icahn just by buying shares of Icahn Enterprises.

One downside that does not make very a lot sense

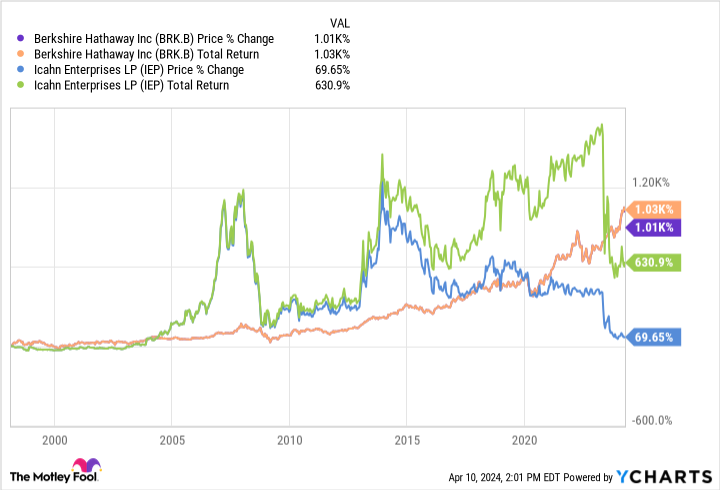

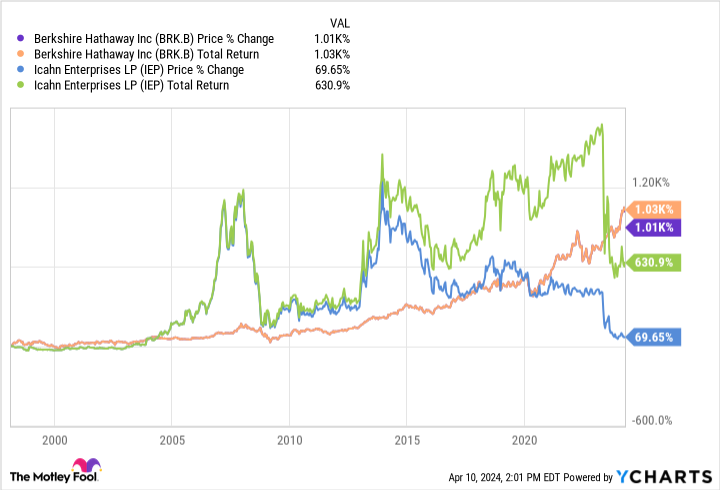

It is a cheap technique to speculate alongside legendary billionaire buyers. Simply have a look at Berkshire Hathaway. Affected person buyers who trusted Warren Buffett have compounded double-digit annual returns for many years. However Icahn Enterprises is not Berkshire Hathaway. Not even shut. Since 1998, Berkshire Hathaway inventory has risen greater than 1,000% in worth. Icahn Enterprises inventory, in the meantime, has added simply 69% in worth. The corporate, nonetheless, has paid a daily stream of massive dividends. These dividends shut the hole considerably, with Icahn Enterprises delivering a 630% complete return over that interval. However there’s nonetheless no denying that Berkshire Hathaway has confirmed a superior long-term funding with far much less volatility. Plus, when you had reinvested your Icahn Enterprises dividends again into Icahn Enterprises inventory, your complete returns would have been nicely under 630%.

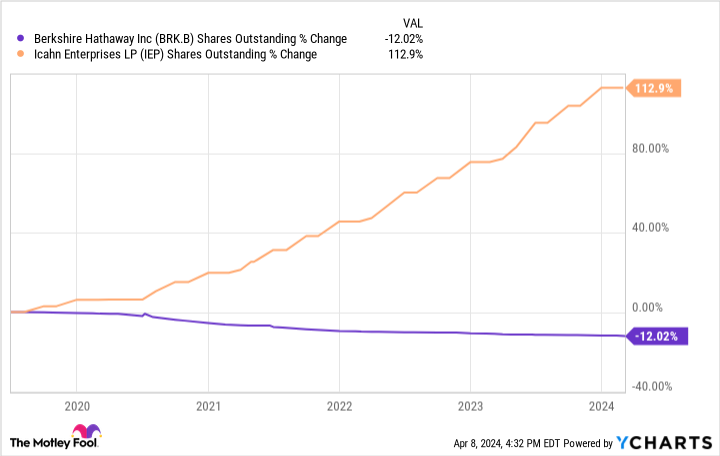

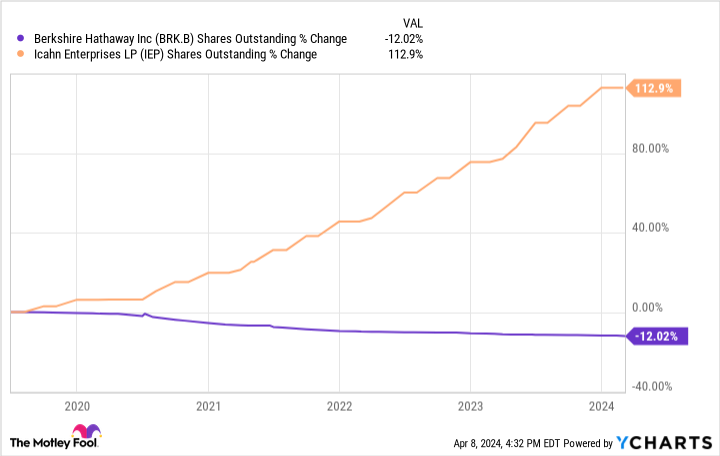

Why, then, does Icahn Enterprises inventory appear to commerce at a premium to Berkshire Hathaway? On a price-to-book foundation — a quite simple metric that gauges how a lot the market is keen to pay for a corporation’s belongings — Icahn Enterprises at the moment trades at 2.3 occasions e-book worth. Berkshire, in the meantime, trades at simply 1.6 occasions e-book worth. There’s even cause to imagine that Berkshire’s price-to-book a number of is overinflated, provided that the corporate has repurchased tens of billions of {dollars} in shares through the years. These repurchases created a whole lot of shareholder worth, however attributable to accounting guidelines, they’ve suppressed the corporate’s true e-book worth. Icahn Enterprises, in the meantime, has been issuing new shares hand over fist. Over the past 5 years, its share rely has exploded by 112%.

It is arduous to justify shopping for Icahn Enterprises over Berkshire Hathaway, particularly given the premium valuation. Taking a look at Icahn Enterprises’ portfolio of companies, it is arduous to argue that something must be valued above e-book worth. The worth of the corporate’s curiosity in Carl Icahn’s funding funds, for instance, went from $4.2 billion final yr to only $3.2 billion at present. Its stake in CVR Power, in the meantime, which must be valued close to e-book worth since it is a publicly traded asset, has fallen in worth from $2.2 billion to solely $2 billion over the identical time interval. The remainder of Icahn Enterprises’ belongings aren’t faring a lot better. One in all its automotive companies, for instance, entered chapter final summer time.

Carl Icahn is betting enormous sums of cash on Icahn Enterprises, however that is possible as a result of he has to. The corporate’s worth would possible collapse if he all of a sudden tried to promote all his shares. As a result of shares commerce at an inexplicable premium to Warren Buffett’s Berkshire Hathaway, buyers are possible higher off betting with that billionaire than this one.

Do you have to make investments $1,000 in Icahn Enterprises proper now?

Before you purchase inventory in Icahn Enterprises, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Icahn Enterprises wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of April 8, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Billionaire Investor Carl Icahn Is Betting $6.3 Billion on This 1 Inventory was initially revealed by The Motley Idiot