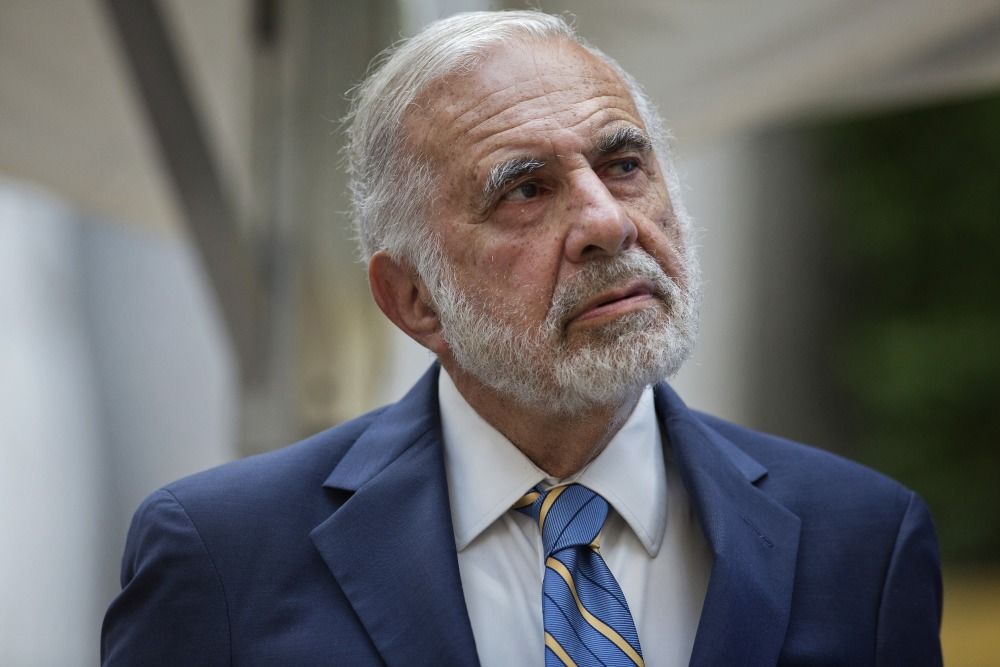

(Bloomberg) — Billionaire investor Carl Icahn started shorting GameStop Corp. throughout the peak of the meme-stock frenzy round January 2021 and nonetheless holds a big place within the video-game retailer, in keeping with individuals conversant in the matter.

Most Learn from Bloomberg

Icahn began constructing the brief when GameStop was buying and selling close to its peak of $483 per share and nonetheless holds a big guess in opposition to the retailer’s shares, stated the individuals, asking to not be recognized as a result of the matter is personal. The investor, who has added to his place once in a while, is betting that GameStop’s inventory isn’t buying and selling on its fundamentals and can proceed to fall, the individuals stated.

The scale of his place isn’t clear.

GameStop fell 8.8% Monday to shut at $25.16, giving the retailer a market worth of $7.7 billion. The retailer executed a four-for-one inventory break up this 12 months and has misplaced 71% of its worth from a January 2021 closing excessive.

Representatives for Icahn and GameStop declined to remark.

The early response to Icahn’s brief on social media was comparatively measured. Information of the wager was shared on Reddit in no less than two threads, together with within the widespread WallStreetBets discussion board, garnering greater than 250 feedback as of 9:54 a.m. in Singapore. That pales compared to the hundreds of responses to GameStop posts throughout the peak of meme mania.

The inventory wasn’t trending on social media platforms because it did in early September, when information emerged of its partnership with Sam Bankman-Fried’s now bankrupt FTX US cryptocurrency trade.

GameStop grew to become a poster youngster for so-called meme shares when retail buying and selling took off throughout the coronavirus pandemic, aided by no-fee buying and selling apps and financial stimulus. Particular person buyers, egging one another on in Reddit boards, plowed cash into GameStop in a push to burn cash managers who guess in opposition to the retailer.

The hassle, referred to as a brief squeeze, led to a number of buyers who held comparable shorts to really feel the pinch. That included Melvin Capital, the hedge fund run by Gabe Plotkin, which stated in Could it was folding because of heavy losses from its guess in opposition to GameStop.

Brief Bets

It marks a uncommon occasion of Icahn betting in opposition to meme shares. Though the legendary investor has taken sizable shorts elsewhere, together with a guess on the downfall of malls by means of derivatives referred to as CMBX.

A couple of-fifth of GameStop’s shares accessible for buying and selling are at the moment bought brief, in keeping with information compiled by S3 Companions, greater than double the extent seen this time final 12 months. That compares to a peak of greater than 140% in January 2021 when the retail buying and selling crowd flooded chatrooms on Stocktwits and used memes and GIFs to pump bets on boards like Reddit’s WallStreetBets.

That mania triggered parabolic inventory rallies regardless of avid gamers opting to obtain new titles as a substitute of visiting shops, with the retailer saddled with greater than $1 billion in debt and lease liabilities at one level. For the reason that craze, the corporate has been in a position to promote thousands and thousands of shares within the open market, to assist practically wipe out its debt.

A big portion of buyers that debate their positions on social media platforms tout Ryan Cohen, the corporate’s chairman and largest investor and founding father of pet retailer Chewy Inc., as the important thing driver of their funding.

–With help from Abhishek Vishnoi.

(Provides retail merchants’ response on social media over Icahn’s place)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.