From sifting via investor displays and company filings to listening to earnings calls and watching interviews, getting a agency gauge on an funding usually requires quite a lot of work.

One factor that I love to do is analyze 13F filings. These are kinds filed by funding corporations managing over $100 million in shares. One of many extra high-profile hedge funds is Ken Griffin’s Citadel. Final quarter, Citadel lowered its stake in Nvidia (NASDAQ: NVDA) by 79% — dumping 9,282,018 shares. As well as, the agency elevated its place by 1,140% in Palantir Applied sciences (NYSE: PLTR), scooping up 5,222,682 shares.

Let’s dig into what could have compelled Griffin and his portfolio managers to promote Nvidia and purchase Palantir. Furthermore, I will discover what catalysts may assist gas much more development for Palantir — and why now may very well be a good time to observe Griffin’s lead.

Why promote Nvidia proper now?

On the floor, promoting Nvidia inventory would possibly appear to be a questionable transfer. In any case, is not synthetic intelligence (AI) the following large factor?

Effectively, even when AI finally ends up being the generational alternative it is being touted to be, that does not imply an entire lot at face worth. There are various elements to the foundations of AI, and Nvidia’s experience within the growth of superior chipsets referred to as graphics processing models (GPU) is only one of many constructing blocks supporting synthetic intelligence.

The most important bear narrative surrounding Nvidia stems from rising competitors. At current, merchandise developed by Superior Micro Units and Intel are the obvious options to Nvidia. Nevertheless, I see a much bigger danger within the aggressive panorama.

Particularly, Nvidia’s large tech cohorts together with Tesla, Meta Platforms, Microsoft, and Amazon are all investing closely into their very own {hardware} growth. Contemplating that many of those firms are Nvidia’s personal prospects, I am cautious that the corporate’s present development trajectory is sustainable in the long term.

When extra GPUs come to market, there’s a good likelihood this expertise can be considered as considerably commoditized. Such a dynamic will possible result in decrease costs for Nvidia, which can subsequently deliver decelerating income, margins, and income.

All instructed, I do not actually blame Griffin for promoting such a big portion of his Nvidia place. Regardless of the corporate’s success thus far, its future prospects look probably questionable.

Why purchase Palantir proper now?

In a distinct space of the AI panorama sits enterprise software program firm Palantir. It affords 4 information analytics platforms referred to as Foundry, Gotham, Apollo, and AIP. The corporate’s software program is used throughout a number of use circumstances all through the U.S. navy and personal sector.

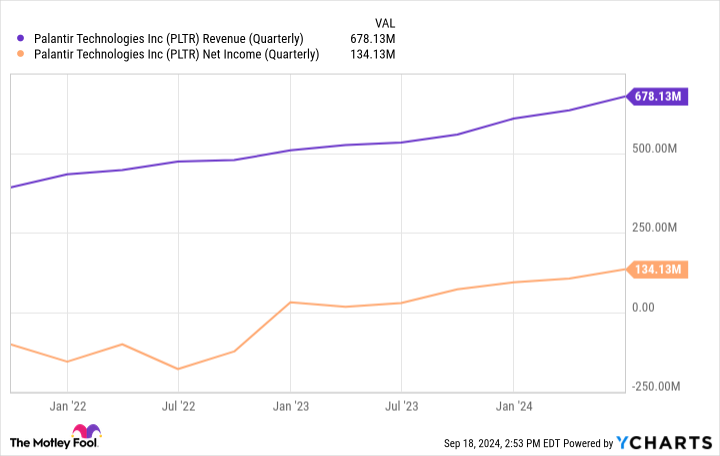

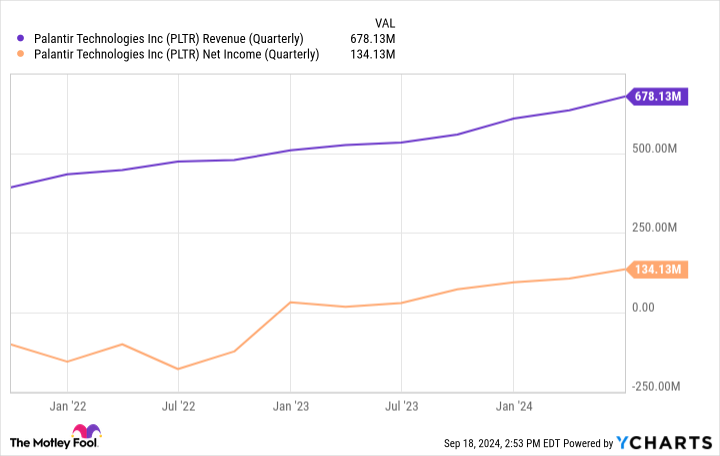

Traders can see that during the last couple of years, Palantir’s income accelerated on the backdrop of a bullish AI narrative. Extra importantly, the corporate’s working leverage has improved dramatically within the type of margin growth and constant profitability.

Earlier this month, Palantir additionally achieved the notable milestone of inclusion within the S&P 500.

Do you have to purchase Palantir inventory proper now?

I am unable to say for sure why Griffin elevated his stake in Palantir a lot final quarter, however I do discover the timing fascinating for one specific cause. Palantir has been eligible for the S&P 500 earlier than however was not initially chosen. Maybe some thought Palantir’s newfound development was purely an extension of demand for AI software program and wouldn’t be sustainable in the long term.

Regardless of the case, I believe those that have adopted Palantir for a very long time understood that the corporate’s long-run prospects appeared stable — whatever the present AI narrative. Bearing that in thoughts, it was affordable to suppose that the corporate can be included within the S&P 500 finally.

This leads me to a broader level. Now that Palantir is within the S&P 500, there’s a good likelihood extra funding banks and analysis analysts will start following the corporate extra carefully. In flip, this might result in a rise in institutional traders shopping for the inventory. Over time, this might strengthen Palantir’s model and notion within the funding group and produce the inventory to even increased costs.

I believe there’s a good likelihood Palantir will witness an increase in institutional possession. The corporate is rapidly rising as a drive within the AI software program area, and has even attracted the likes of Microsoft and Oracle — two relationships that I believe will deliver even additional development to the corporate.

I very a lot see even higher days forward for Palantir, and suppose now is a superb time to purchase shares. With so many catalysts fueling the corporate’s upside, I see Griffin swapping Nvidia for Palantir as a very savvy transfer.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 finest shares for traders to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Amazon, Meta Platforms, Microsoft, Nvidia, Palantir Applied sciences, and Tesla. The Motley Idiot has positions in and recommends Superior Micro Units, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, Palantir Applied sciences, and Tesla. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2026 $395 calls on Microsoft, quick January 2026 $405 calls on Microsoft, and quick November 2024 $24 calls on Intel. The Motley Idiot has a disclosure coverage.

Billionaire Ken Griffin Simply Bought 9.3 Million Shares of Nvidia and Purchased This Different Synthetic Intelligence (AI) Inventory That is Headed to the S&P 500 As a substitute was initially printed by The Motley Idiot