There are two sides to each coin. For penny shares, or tickers that commerce for lower than $5 per share, this rings very true. As a number of the most divisive names on the Avenue, they’re both met with resounding reward or forceful discontent.

Going past the argument that you simply get extra to your cash, even minor value appreciation may end up in large share features. Nevertheless, some traders favor to keep away from these shares completely, as the truth that shares are buying and selling at such depressed ranges might sign insurmountable headwinds or weak fundamentals.

So, how are traders supposed to find out which penny shares are poised to make it huge? Following the exercise of the investing titans is one technique.

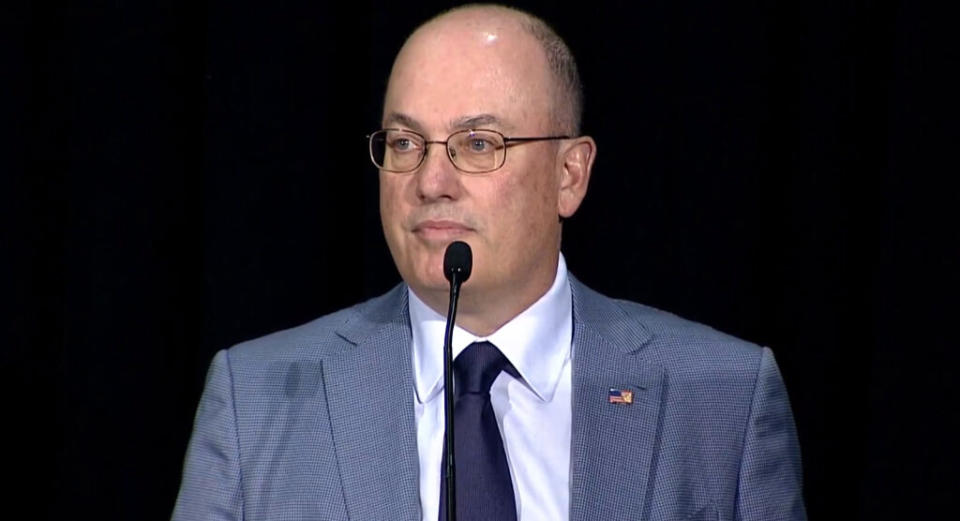

Billionaire Steve Cohen is amongst these Wall Avenue greats. Serving as Point72’s Chairman, CEO and President, Cohen has constructed his fortune – round $17.5 billion – utilizing a high-risk/high-reward technique. All through his profession, Cohen has persistently delivered large returns to purchasers, giving him guru-like standing on the Avenue.

Turning to Cohen for inspiration, we took a better take a look at two penny shares Cohen’s Point72 made strikes on lately. In actual fact, it’s not solely Cohen who favors these names. Utilizing the TipRanks database, we discovered that each are additionally rated as ‘Sturdy Buys’ by the analyst consensus. To not point out colossal upside potential is on the desk. We’re speaking about over 500% right here.

Praxis Precision Medicines (PRAX)

We’ll begin with Praxis Precision Medicines, a biopharmaceutical firm centered on illnesses of the central nervous system, or CNS. Particularly, the corporate is engaged on new remedies for motion problems and epileptic seizure problems, two units of CNS circumstances linked by neuronal imbalances. The corporate is following a dual-track analysis pipeline, utilizing two proprietary platforms to develop new drug candidates: Cerebrum, a small molecule platform, and Solidus, an ASO (antisense oligonucleotide) platform.

The corporate’s analysis relies on the applying of genetic insights and an understanding of the organic targets and circuits within the mind. Between the 2 platforms, Praxis has 4 energetic pipeline applications within the clinic.

The standout drug candidate right here is ulixacaltamide. Earlier this month, Praxis introduced optimistic knowledge from the randomized withdrawal sub-study and long-term extension of the Essential1 examine for this candidate within the remedy of important tremors. The examine confirmed that sufferers switched from ulixacaltanide to placebo skilled a worsening of signs. The sub-study execution additionally confirmed design options of the deliberate Section 3 examine, scheduled to start throughout 4Q23. The corporate has already had a positive end-of-phase-2 assembly with the FDA, in preparation for Section 3 initiation.

Additionally of word is the corporate’s drug candidate PRAX-628, a possible remedy for focal epilepsy. This program has accomplished Section 1 testing, and Praxis lately launched optimistic outcomes from the EEG evaluation following that trial. PRAX-628 is at present present process Section 2 testing, and the preliminary knowledge readout from that examine is anticipated in 2H23.

In one other upcoming catalyst, Praxis expects to launch knowledge from the Section 2 EMBOLD examine of PRAX-562 within the remedy of pediatric sufferers with developmental and epileptic encephalopathies (DEEs) through the fourth quarter of this 12 months.

These analysis tracks have caught the attention of Steve Cohen throughout Q2. In that quarter, Cohen purchased 10,500,000 shares of PRAX, an enormous improve from his earlier holding of fifty,000 – and a robust vote of confidence within the firm. Cohen’s holding right here is price $11.39 million at present costs.

The billionaire investor is way from Praxis’ solely bullish fan. Piper Sandler analyst Yasmeen Rahimi covers this inventory and is impressed with what she sees – particularly on the ulixacaltamide monitor.

“We’re happy to report that PRAX has been making important progress throughout their 4 pipeline applications, particularly highlighting that the Ph3 program in ET with ulixacaltamide is on monitor to start out enrollment as quickly as October 1 (4Q23) with topline in 2H24. We proceed to have excessive conviction on a optimistic readout of the first endpoint of mADL11, on condition that Essential1 confirmed a big -1.81 delta distinction (-2.69 vs -0.88 placebo; p=0.042), regardless of not being powered on that measure… Total we stay bullish on the inventory and see a shopping for alternative for PRAX with ~1 12 months out from topline Ph3 knowledge,” Rahimi wrote.

These feedback underpin Rahimi’s Purchase ranking whereas her $18 value goal makes room for 12-month returns of a whopping 1,598% from the present share value of $1.07. (To observe Rahimi’s monitor file, click on right here)

Total, Wall Avenue tends to agree with the bull. The 4 current analyst critiques embrace 3 Buys and 1 Maintain, for a Sturdy Purchase consensus ranking. The $7.75 common value goal is much less aggressive than Rahimi’s, nevertheless it nonetheless leaves room for 624% upside potential. (See PRAX inventory forecast)

Agenus, Inc. (AGEN)

The subsequent penny inventory we’re is Agenus, a biotech firm engaged on new immunotherapy medicine for the remedy of most cancers. Immuno-oncology is an increasing subject, based mostly on utilizing the affected person’s personal immune system to struggle the most cancers, aiming to manage or treatment the illness.

Agenus has a wide-ranging analysis pipeline of immuno-oncology applications, together with antibody therapeutics, adoptive cell therapies, and adjuvants and vaccines. The corporate’s allogeneic cell therapies and adjuvant and vaccine applications are being undertaken by subsidiaries. In complete, Agenus is engaged on greater than a dozen clinical-stage applications and estimates that its main program has a possible affected person base of 200,000+ within the US.

Agenus’ pipeline contains fully-owned drug candidates, partner-directed applications, and scientific collaborations with different biotech firms. The corporate’s analysis is focusing on numerous cancers, together with pancreatic most cancers, cervical most cancers, colorectal most cancers, melanoma, and common stable tumors. A number of of the drug candidates are present process a number of research, as each monotherapies and mixture remedies. Agenus’ companions embrace such huge names as Merck, Briston Myers Squibb, and GSK.

In its most up-to-date enterprise replace, for 2Q23, Agenus reported persevering with progress on a number of analysis tracks. Probably the most superior of those relies on the drug candidate botensilimab, which is being clinically examined towards a number of cancers. The first trials are the 2 Section 2 ACTIVATE research. Certainly one of these research assesses the drug as a monotherapy towards melanoma, whereas the opposite examines it as a mix remedy with balstilimab towards colorectal most cancers. Each of those research are anticipated to achieve full enrollment by the top of this 12 months, with knowledge updates deliberate for 2024.

Standing firmly within the bullish nook, Cohen’s actions spoke volumes through the second quarter. Boosting its holding by 125%, his agency snapped up 9,776,083 shares within the firm. This introduced Point72’s complete holding within the agency to 17,616,983 shares, a stake price $22.2 million at present valuations.

The corporate’s energetic, wide-ranging, and catalyst-rich pipeline has additionally caught the attention of Baird analyst Colleen Kusy, who says of the corporate and its inventory, “We count on a number of significant catalysts for Agenus over the approaching 6-18 months, together with extra lung most cancers knowledge (YE23, not at present within the inventory), Section 2 melanoma knowledge in 2024, and Section 2 knowledge in MSS CRC with out energetic liver mets, that are anticipated to help Agenus’ first BLA submitting in 2024 (lately employed Chief Business Officer). Total, we stay bullish on the profile of botensilimab throughout a number of tumor varieties.”

Kusy follows up her feedback with an Outperform (i.e. Purchase) ranking, and a value goal of $8 that signifies her confidence in a sturdy 537% one-year upside potential. (To observe Kusy’s monitor file, click on right here)

Total, this inventory holds a unanimous Sturdy Purchase consensus ranking, based mostly on 5 optimistic critiques set in current weeks. The shares are at present buying and selling at $1.25 and have a mean value goal of $7.66, pointing towards a 510% achieve on the one-year horizon. (See AGEN inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your individual evaluation earlier than making any funding.