Uber (NYSE: UBER) achieved spectacular monetary outcomes for the previous few quarters, however a number of billionaire traders have been unloading shares of the ride-hailing service. That group of high-profile sellers contains Larry Robbins, Lee Ainslie, Roberto Mignone, Steven Tananbaum, Daniel Loeb, and George Soros.

Excessive-profile shares usually have billionaires shopping for and promoting in massive portions over any given quarter, however current transitions may level to main considerations about Uber’s {industry} shifting ahead.

Monetary outcomes have usually been robust

Uber’s most up-to-date quarterly report was a combined bag. The corporate exceeded analysts’ forecasts, with 15% income development over the prior 12 months.

The corporate’s quarterly earnings per share fell in need of analyst estimates, although this was largely attributable to a non-operating, non-recurring expense associated to a change in valuation of a number of the corporate’s fairness investments in different firms.

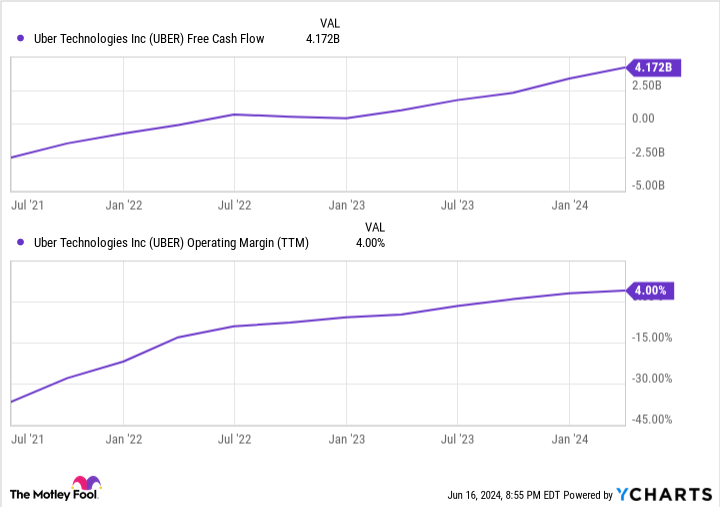

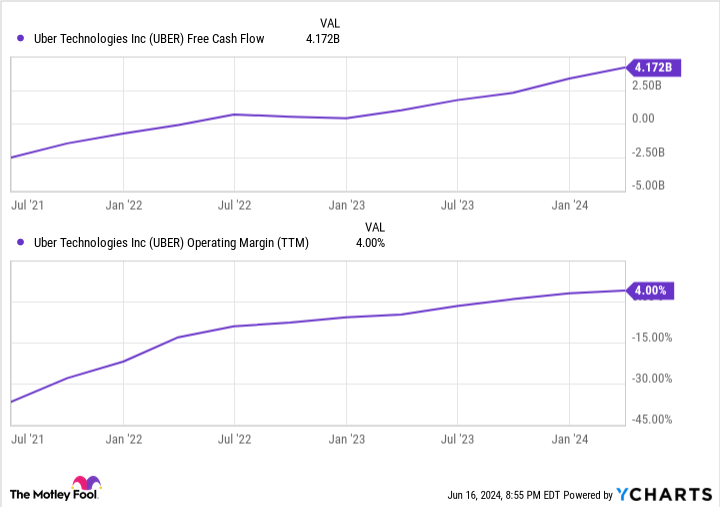

Its adjusted working income elevated greater than 80% over the prior 12 months, whereas free money move elevated practically 150%.

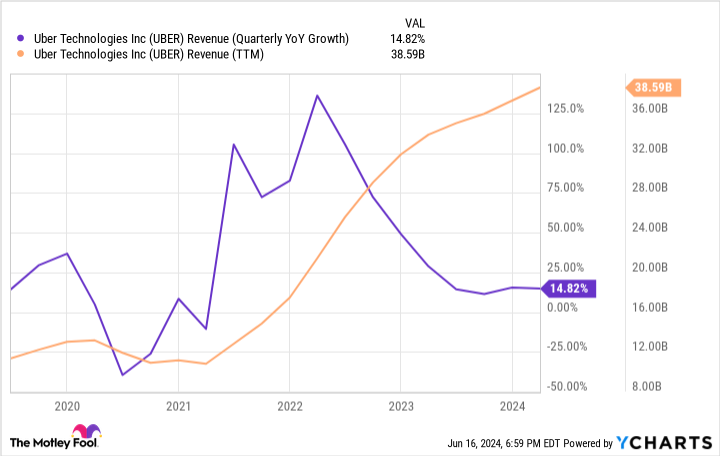

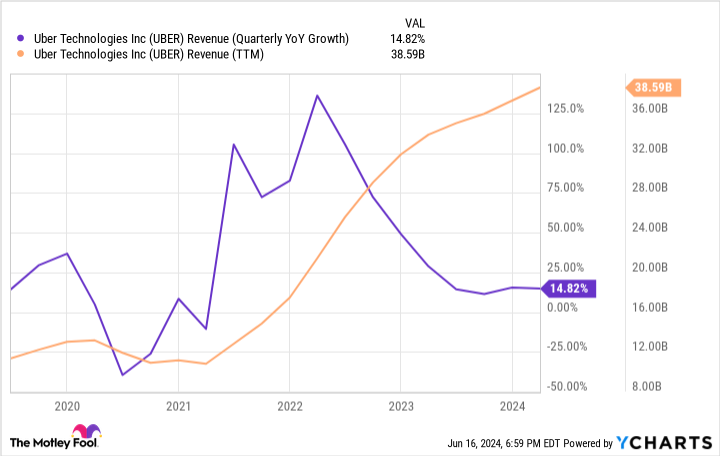

Uber’s income development price spiked in 2021 and 2022 as its operations normalized following disruptions associated to the COVID-19 pandemic. Since then, the corporate’s annual gross sales have steadily expanded between 10% to fifteen% per 12 months.

Uber’s gross revenue margin has been constant over the previous 12 months, hovering round 40%. Its working bills have grown at a slower price over that interval, permitting the corporate to realize constructive working income. The current swing to profitability signifies that Uber’s EPS and free money move development are set to outpace the highest line. That is an awesome development for shareholders.

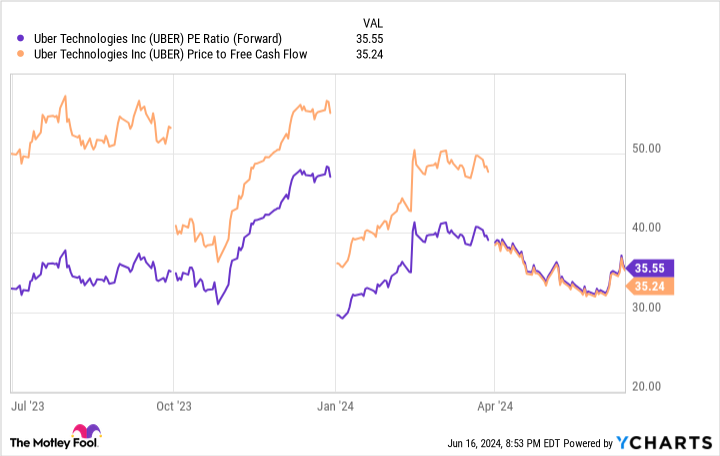

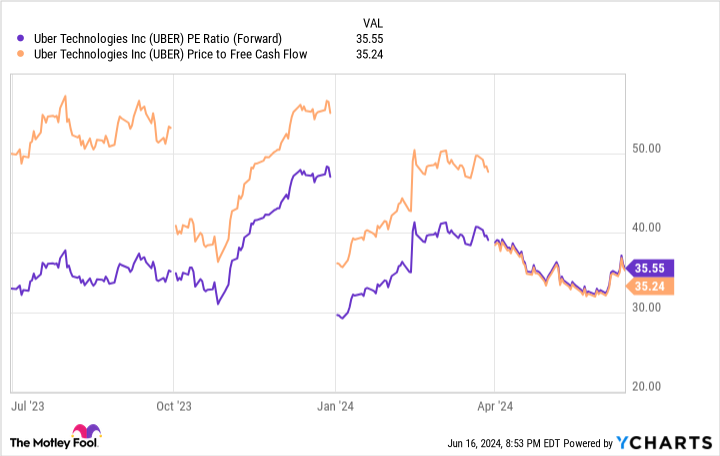

Uber’s valuation is not an issue

Typically, billionaires and hedge fund managers shrewdly exit or cut back positions after attaining their anticipated funding objectives. If a inventory’s valuation will get too excessive relative to anticipated income or money flows, skilled traders usually take into account promoting. It may signify a chance to comprehend good points and take threat off the desk by deploying that capital elsewhere.

That dynamic may very well be at play with Uber. The inventory has strongly outperformed the S&P 500 and Nasdaq Composite over the previous 12 months — its 61% return over that interval greater than doubles the favored indexes. Nonetheless, Uber has lagged the S&P and the Nasdaq 12 months so far, and its valuation ratios have not ballooned to an unreasonable stage.

The inventory’s ahead P/E and price-to-free money move ratios are each round 35. These are greater than you’d count on to see from a mature worth inventory, however each are cheap relative to Uber’s development price.

Maybe the billionaire shareholders are merely taking some good points after a powerful 12 months.

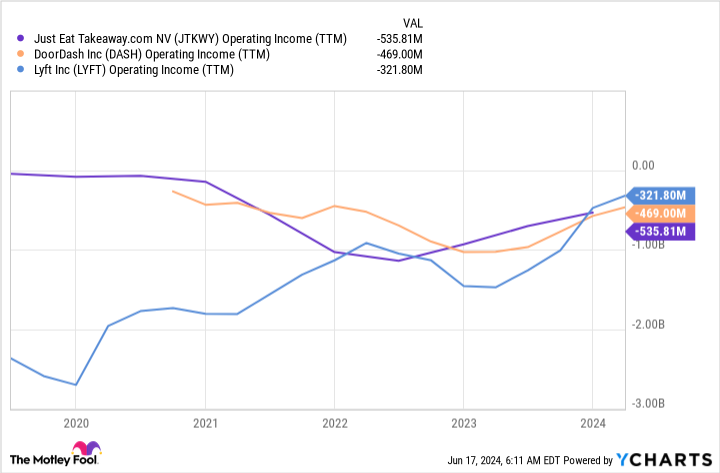

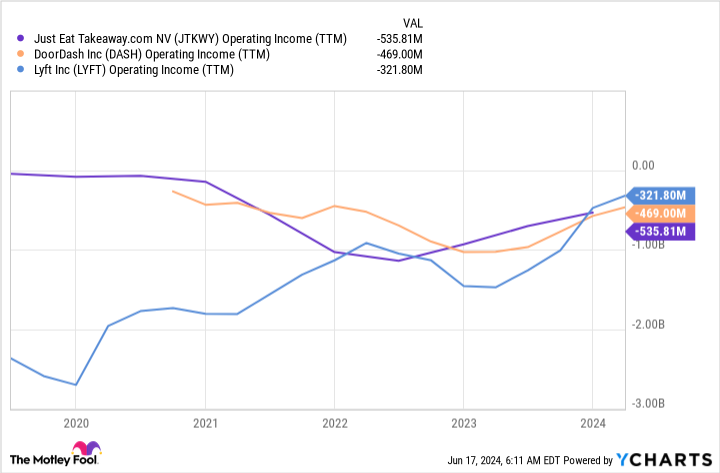

Considerations a few sustainable enterprise mannequin

There are considerations swirling in some investor circles concerning the sustainability of Uber’s enterprise mannequin. DoorDash and Grubhub’s mum or dad firm, Simply Eat Takeaway.com are Uber’s largest rivals within the meals supply {industry}, and each firms wrestle with profitability. Uber’s rideshare foe, Lyft, equally experiences internet losses each quarter.

That clearly hasn’t prevented Uber from attaining profitability with scale, but it surely highlights the challenges of the enterprise mannequin in a aggressive market. Sadly for Uber and its friends, issues may get extra difficult over the subsequent few years.

There are mounting considerations concerning the compensation for drivers. New research recommend that drivers usually earn considerably beneath minimal wage. That is hasn’t been Uber’s downside, as a result of its drivers’ standing as contractors reasonably than workers, however which may change quickly.

The corporate has been battling regulators on the subject of driver compensation and advantages for a number of years, and people points appear more likely to get much more troublesome. A driver-friendly legislation in California just lately obtained help from a federal ruling, opening the door to comparable laws in different states.

Labor prices may enhance materially if Uber has to deal with its drivers as workers or meet minimal wage necessities. That will drastically alter the corporate’s economics, and shoppers could also be unwilling to pay greater costs to offset these elevated bills.

Billionaires may very well be promoting their shares with the intention to keep forward of a market that is been justifiably happy with Uber’s monetary outcomes. There’s an opportunity that upcoming laws may very well be an enormous problem for rideshare and meals supply companies of their present format.

Of observe, Lee Ainslie, Paul Tudor Jones, and Ken Fisher all just lately offered massive portions of Lyft shares. Jones’ and Ainslie’s funds additionally unloaded a big portion of their DoorDash holdings, too. That lends help to the speculation that that is an industry-wide transfer, reasonably than an Uber-specific one.

Considerations about additional regulatory points are purely hypothesis at this level, however lively traders usually attempt to make selections forward of the information. Quite a few skilled traders appear to be acknowledging threat by promoting Uber shares after the inventory delivered spectacular returns over the previous 12 months.

Must you make investments $1,000 in Uber Applied sciences proper now?

Before you purchase inventory in Uber Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Uber Applied sciences wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $830,777!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Ryan Downie has no place in any of the shares talked about. The Motley Idiot has positions in and recommends DoorDash and Uber Applied sciences. The Motley Idiot recommends Simply Eat Takeaway.com. The Motley Idiot has a disclosure coverage.

Billionaires Are Deciding to Promote Shares of This Nicely-Recognized Inventory was initially printed by The Motley Idiot