Crucial information launch of the quarter occurred earlier this week — and I am not speaking in regards to the much-anticipated July inflation report.

No later than 45 calendar days following the top to 1 / 4, institutional traders with at the least $100 million in belongings beneath administration are required to file Kind 13F with the Securities and Alternate Fee. A 13F gives an under-the-hood glimpse of which shares Wall Avenue’s smartest, most-successful, and richest traders have been shopping for and promoting.

Regardless of the restrictions of 13Fs — e.g., they are often 45 days outdated when filed, that means the info you are seeing is perhaps stale for energetic fund managers — they supply invaluable clues as to what shares, industries, sectors, and traits are piquing the curiosity of Wall Avenue’s brightest asset managers.

Whereas there’s been loads of shopping for and promoting exercise for corporations concerned in what’s presently the buzziest funding alternative, synthetic intelligence (AI), the theme for the most recent spherical of 13Fs is that Wall Avenue’s billionaire traders are persevering with to pare down their stakes in AI darling Nvidia (NASDAQ: NVDA).

Nvidia has change into the {hardware} spine of the synthetic intelligence motion

For the reason that web page was turned to 2023, shares of Nvidia have catapulted larger by 709%, as of the closing bell on Aug. 14, which interprets into a rise in market cap of greater than $2.5 trillion. Fairly just a few billionaire traders and their funds have benefited immensely from this transfer larger.

The catalyst behind this historic acquire for a market-leading enterprise is the corporate’s data-center {hardware}. Extra particularly, Nvidia’s H100 graphics processing unit (GPU) has change into the brains powering the split-second decision-making wanted in enterprise information facilities working generative AI options and coaching massive language fashions. In 2023, Nvidia’s chips had a near-monopoly (98% share) of the GPUs shipped to information facilities, per TechInsights.

The great thing about having an in-demand product is the distinctive pricing energy that normally comes with it. With demand for the H100 outstripping provide, Nvidia has been capable of improve the promoting value of its AI-GPU to between $30,000 and $40,000. The top outcome being a giant uptick within the firm’s adjusted gross margin.

However not all cash managers consider Wall Avenue’s AI chief has sufficient fuel left within the proverbial tank to ship for traders.

Billionaire cash managers offered shares of Nvidia for a 3rd consecutive quarter

In accordance with newly filed 13Fs on Aug. 14, seven distinguished billionaire asset managers had been sellers of Nvidia’s inventory through the June-ended quarter (whole shares offered in parenthesis):

-

Ken Griffin of Citadel Advisors (9,282,018 shares)

-

David Tepper of Appaloosa (3,730,000 shares)

-

Stanley Druckenmiller of Duquesne Household Workplace (1,545,370 shares)

-

Cliff Asness of AQR Capital Administration (1,360,215 shares)

-

Israel Englander of Millennium Administration (676,242 shares)

-

Steven Cohen of Point72 Asset Administration (409,042 shares)

-

Philippe Laffont of Coatue Administration (96,963 shares)

In the course of the March quarter, eight billionaire traders — 9, if you happen to embrace Jim Simons of Renaissance Applied sciences, who handed away in Could — despatched shares of Nvidia to the chopping block, whereas eight choose billionaires had been additionally sellers within the December-ended quarter.

Though profit-taking following a monstrous run larger is a logical rationalization behind this billionaire investor exodus, there are near a half-dozen different elements that will shed extra mild on why cash managers hold heading for the exit.

5 causes billionaires cannot cease promoting shares of Nvidia

Historical past may simply be the clearest motive billionaires are steadily heading to the sideline. Each next-big-thing know-how and development over the past 30 years has navigated its manner by an early stage bubble.

Put one other manner, investor expectations with regard to adoption and utility have far exceeded actuality for each buzzy innovation or development over the past three a long time. With most companies missing a well-defined blueprint as to how they will generate a optimistic return on their AI investments, it is trying probably that AI is the following in an extended line of next-big-thing bubbles. If the AI bubble bursts, no inventory would, arguably, be hit tougher than Nvidia.

The expectation for a significant improve in competitors is another excuse billionaires could also be exhibiting shares of Nvidia to the door. Given AI’s large addressable market, plenty of exterior opponents are getting into the image with AI-GPUs of their very own.

Moreover, Nvidia’s 4 largest prospects by web gross sales are internally creating AI chips for his or her information facilities. These complementary chips will decrease the “actual property” in high-compute information facilities for Nvidia’s {hardware}.

Thirdly, billionaires are properly not overlooking the ceiling that regulators have put in place. In 2022, and once more in 2023, U.S. regulators imposed export restrictions to China for Nvidia’s high-powered AI chips. Following the primary spherical of restrictions in 2022, Nvidia developed the toned-down H800 and A800 chips for the world’s No. 2 economic system. Sadly, these GPUs had been added to the export restriction record final yr. These restrictions might value Nvidia billions of {dollars} in quarterly gross sales.

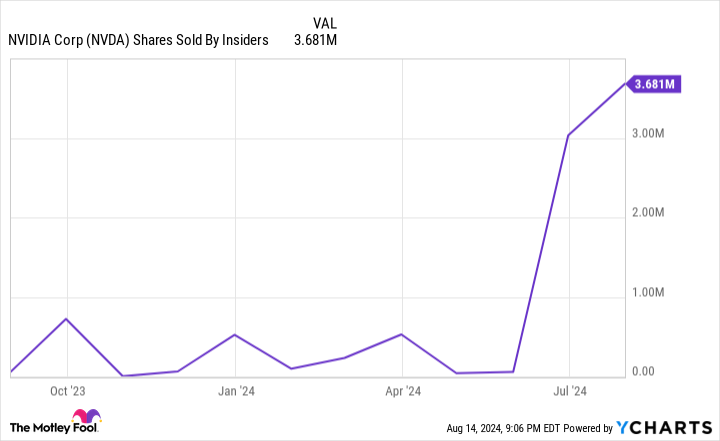

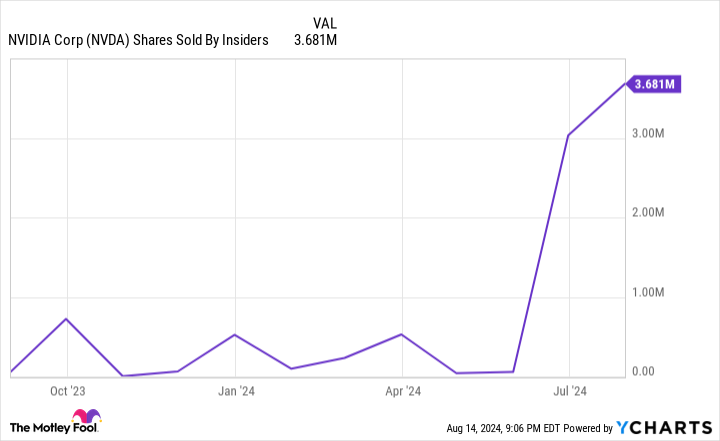

A fourth catalyst behind this ongoing promoting by billionaires may need to do with the shortage of shopping for we have witnessed from firm insiders. There hasn’t been an open-market buy of Nvidia inventory from an govt or board member since December 2020. In the meantime, CEO Jensen Huang has been promoting his firm’s inventory hand over fist since mid-June.

Whereas not all insider promoting is dangerous information — some gross sales could also be accomplished for tax functions — a whole lack of shopping for exercise suggests none of Nvidia’s higher-ups consider shares are a very good worth.

Lastly, Nvidia’s valuation is an eyesore. Though its ahead price-to-earnings (P/E) ratio suggests shares may truly be cheap, its trailing-12-month (TTM) price-to-sales (P/S) ratio reached ranges in June thar rivaled the TTM P/S peaks noticed from the likes of Cisco Techniques and Amazon previous to the dot-com bubble bursting.

Regardless of the euphoria surrounding synthetic intelligence, the actions of a few of Wall Avenue’s brightest funding minds seem to counsel that hassle lies forward.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $723,545!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 12, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Sean Williams has positions in Amazon. The Motley Idiot has positions in and recommends Amazon, Cisco Techniques, and Nvidia. The Motley Idiot has a disclosure coverage.

Billionaires Are Dumping Shares of Synthetic Intelligence (AI) Inventory Nvidia for a Third Straight Quarter — This is Why was initially revealed by The Motley Idiot