Binance, the world’s largest crypto trade by buying and selling quantity, endured a wave of withdrawals on Monday amid considerations about its proof of reserve report.

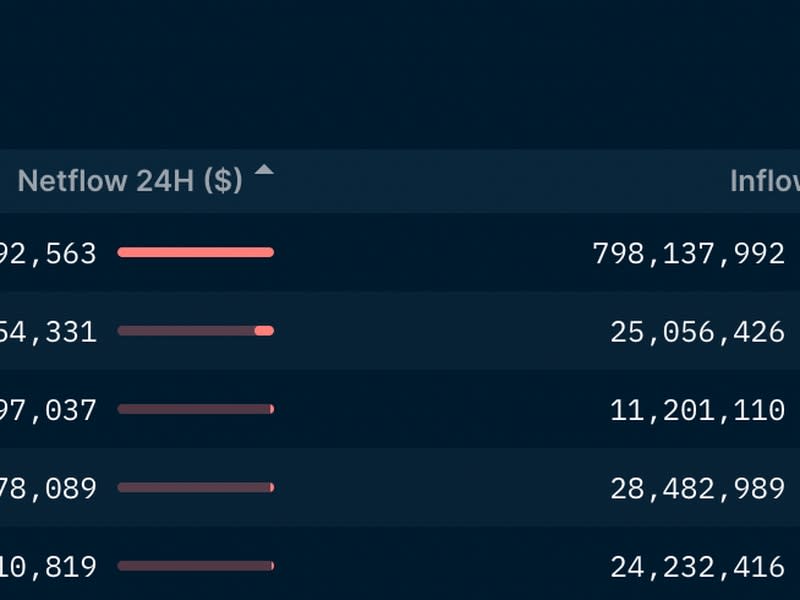

Web outflows, the distinction between the worth of belongings arriving and leaving the trade, hit $902 million up to now 24 hours, in keeping with knowledge by blockchain intelligence platform Nansen.

Binance’s web outflow has surpassed these of all different centralized exchanges’ within the final 24 hours, and is sort of 9 instances bigger than the second largest outflow.

The outflow was the best for Binance since Nov. 13, two days after FTX filed for chapter safety, in keeping with knowledge supplied by blockchain knowledge platform Arkham Intelligence.

Nonetheless, the outflow “doesn’t appear notably anomalous,” Henry Fisher, an Arkham analyst, wrote in a Telegram chat, on condition that there are ostensibly $64 billions of belongings on Binance.

Withdrawals rose following a string of regarding information experiences about Binance, and as buyers have change into more and more cautious about their funds on centralized trade. The swift collapse of rival trade FTX, piled on different trade debacles, has prompted different exchanges to show that they’re safeguarding clients’ belongings.

Prison expenses towards Binance?

Binance launched a report by auditing agency Mazars final week claiming that its bitcoin (BTC) reserves are overcollateralized. Industry experts and up to date experiences flayed the doc for its slim scope, and on Monday, Reuters reported that U.S. prosecutors are mulling prison expenses for potential cash laundering towards Binance and its executives, together with Zhao.

Binance didn’t reply to a request for remark. Changpeng Zhao, founder and CEO, urged his followers to “ignore the FUD” – crypto slang for spreading worry, uncertainty and doubt – in a tweet.

Learn extra: Binance Suspends Account of Buyer for Being ‘Unreasonable’

Blockchain knowledge exhibits that giant crypto market makers Leap Buying and selling and Wintermute have been amongst these transferring sizable funds from Binance up to now seven days.

Leap Buying and selling seems to be the most important withdrawer from Binance, Nansen analyst Andrew Thurman wrote in a tweet.

Web withdrawals from the trade by crypto wallets related to Leap reached $146 million of digital belongings by the previous seven days, knowledge compiled by Nansen exhibits.

Leap’s web withdrawals embrace $102 million in Binance USD (BUSD), the trade’s stablecoin issued by Paxos; $14 million of Tether’s USDT; and $10 million of ether (ETH).

Leap redeemed some $30 million of Binance USD (BUSD) from Paxos a number of hours in the past, per blockchain knowledge from Arkham.

Wintermute, one other important crypto market maker, withdrew $8.5 million of wrapped bitcoin (wBTC) and $5.5 million of Circle’s USDC stablecoin.

On the time of publication, Leap Buying and selling and Wintermute had not responded to CoinDesk requests for remark.

Wintermute acknowledged in a tweet on Nov. 9 that some funds remained on Sam Bankman-Fried’s crypto trade FTX, which imploded final month in spectacular trend. Leap Buying and selling tweeted on Nov 12. that the agency remained well-capitalized, however didn’t specify losses or capital publicity to FTX.