-

Bitcoin slipped 5% under $65,000 Thursday, with the U.S. greenback resurging amid the Swiss central financial institution’s rate of interest reduce.

-

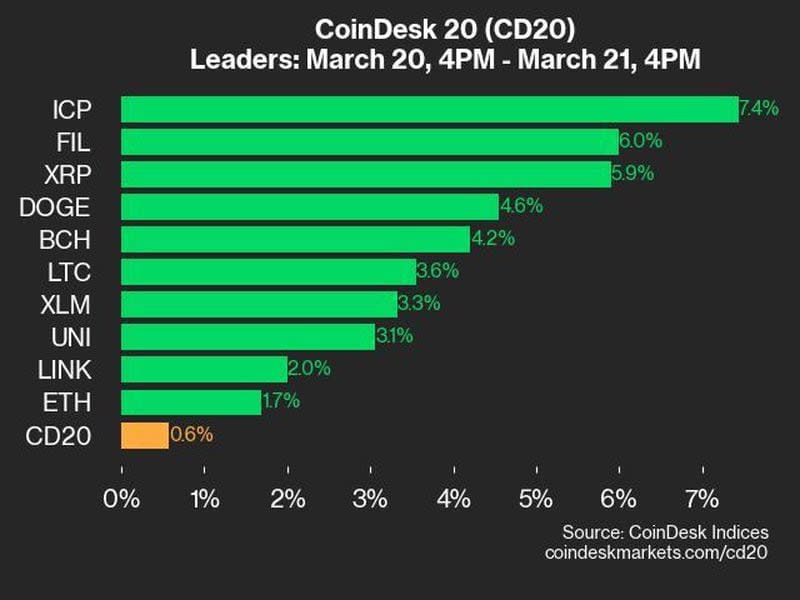

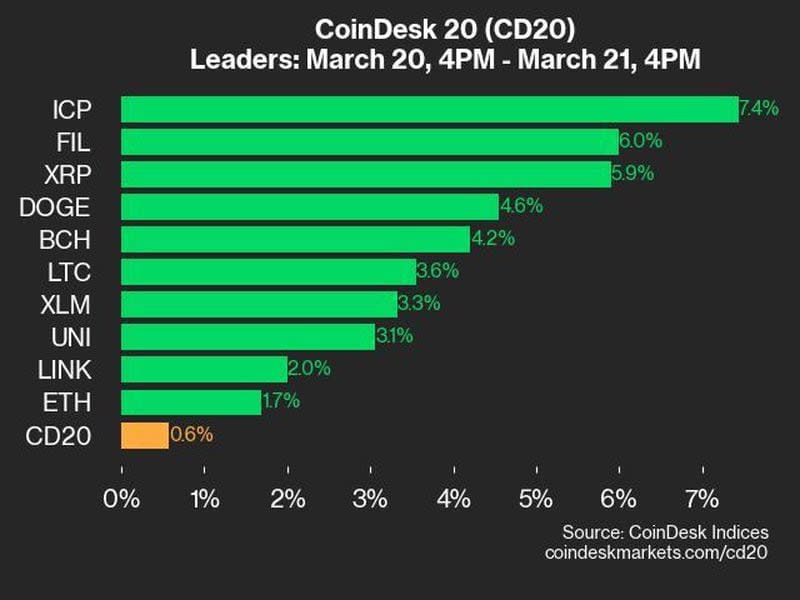

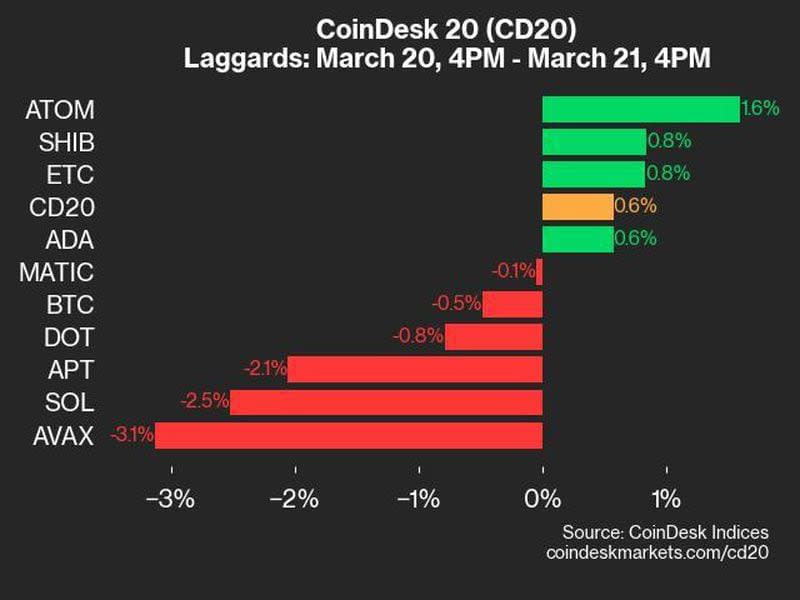

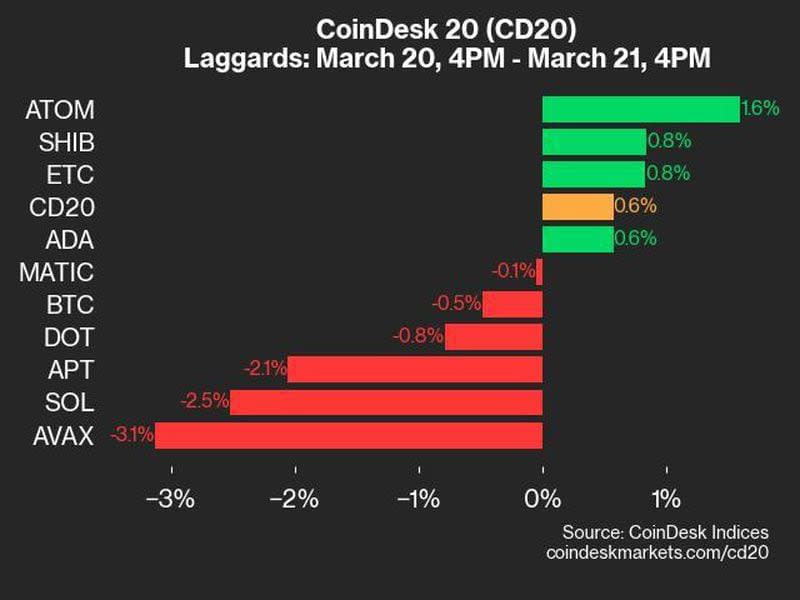

XRP, FIL and ICP defied the stoop, whereas SOL and AVAX declined.

-

Bitcoin accomplished its correction by rebounding from $60,000 Wednesday and focusing on “a lot larger ranges” within the subsequent part of the uptrend, Swissblock analyst mentioned.

Bitcoin {{BTC}} slid decrease Thursday amid a stronger U.S. greenback, giving up among the advances from Wednesday’s spectacular bounce spurred by a dovish tone from the Federal Reserve.

BTC dropped some 5% to as little as $64,600 by late afternoon UTC hours from above $68,000 in the beginning of the day. The broad-market CoinDesk 20 Index (CD20) declined 3.5% from its every day excessive, as altcoins typically outperformed bitcoin throughout the day.

Fee community Ripple’s native asset {{XRP}}, decentralized information storage platform Filecoin’s crypto {{FIL}} and the Web Laptop’s token {{ICP}} superior 6%-7% over the previous 24 hours.

Native tokens of layer 1 networks Solana {{SOL}}, Avalanche {{AVAX}} and Aptos {{APT}} misplaced 2%-3% throughout the identical interval.

Bitcoin’s weak value motion was maybe as a result of resurging U.S. greenback after the Swiss central financial institution, in a shock transfer, reduce rates of interest by 25 foundation factors, erasing all of Wednesday’s steep drop when Fed Chair Jerome Powell hit a dovish tone regardless of higher-than-expected inflation readings.

The U.S. greenback index (DXY), which measures the U.S. greenback’s energy in opposition to different main currencies and a stronger greenback often weighs on asset costs.

The transfer was maybe resulting from market contributors anticipating that another key central banks might begin decreasing rates of interest earlier than the Federal Reserve, macro analyst Michael Kao famous on a social media put up.

Musings of the Day, 3/21/24:

Regardless of JPOW’s Rhetorical Pivot, the information in coming weeks/months current a superb probability that he punts once more in June.

Maybe USD resurgence right this moment following shock SNB reduce is a touch that RoW will nonetheless Out-Dove the Fed. pic.twitter.com/uREhsB2jhL

— Michael Kao (@UrbanKaoboy) March 21, 2024

Market analytics agency Swissblock mentioned that bitcoin accomplished its pullback earlier than Wednesday’s bounce, reaching virtually their goal value of $58,000-$59,000 once they referred to as for an imminent cool-off part final week.

“Now a lot larger ranges (are) coming,” Swissblock analyst Henrik Zeberg mentioned in a Thursday market replace. He added that altcoins and bitcoin miners will carry out “tremendously nicely” within the subsequent part of the uptrend.

Crypto dealer Jelle famous that the underside for the correction is in till BTC holds the $65,000 stage. He added that it might consolidate for some time within the present value vary and desires to interrupt above the $69,000 value stage – the market cycle peak in 2021 – to reignite its rally to larger costs.